3DS 2.1 – A Game Changer For E-Commerce Payments

The pandemic put the eCommerce business in the spotlight enhancing the need for digital payments.

The convenience and on-the-spot payments made the eCommerce business surge in India.

The Indian digital payment scenario has soared to new heights as people began t understand the importance of digital payments.

Being one of the biggest eCommerce markets in the world, India’s digital payments sector is thriving and giving a boost to the economy.

But while Indian businesses are exploring the digital payment ecosystem, the ecosystem itself still needs advanced and secured ways to simplify online payment acceptance.

Online payment ecosystem

Today, there are a plethora of payment options available for customers to choose from. Cards, wallets, UPI, and net banking, are some of the popular online payment methods.

Some tie ago, card payments dominated online payments, but with card payments, customers started to become aware of wanting more simplified and secure payment options and merchants were worried about cart abandonment and transaction drop-offs.

The more convenient, simplified, and secure payment mode comes in the form of a great initiative by the government of India, i.e. UPI. Unified Payments Interface, a real-time payment system become immensely popular among merchants as well as customers, and today India has recorded over 3800 crores valued at 73 lakh crore alone in the year 2021.

And with RBI mandated 2FA, digital payments are soaring with a reduced number of frauds.

Nowadays most online payments are based on the 3DS protocol.

This XML-based technical specification includes requirements and specifications for participants involved in the online transaction.

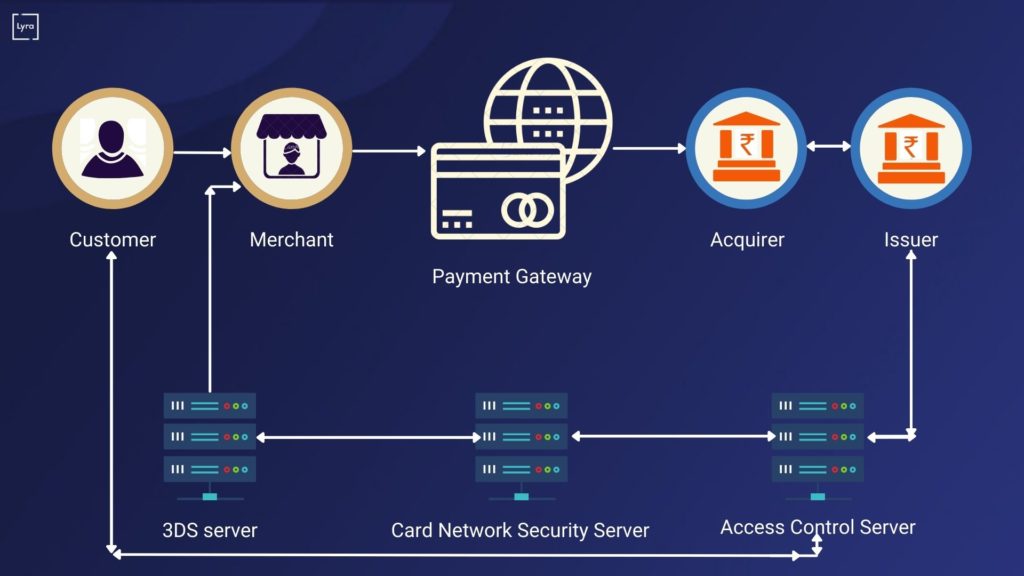

As the name suggests, 3 Domain Security divides the authentication process into 3 domains.

These three domains are based on the entities involved. They are,

Issuer domain – With participants involved, viz. Issuers, ACS, cardholders, issuer domain comprises of the following:

-

Cardholder browser and related software: Sends and receives messages between the MPI and ACS.

-

Enrollment server: Facilitates cardholder’s initial authentication as well as administrative activities

-

Access control server: It checks the authenticity of a card in the card schemes and assists in the authentication of the cardholder

-

Validation server: Performs a validation of cardholder’s authentication.

Acquirer domain – The acquirer domain involves acquirers, merchants, and gateway as participants. The acquirer domain comprises the following:

-

Merchant Plug-In: It creates and processes cardholder authentication messages.

-

Signature Validation Server: It validates the digital signature on an already authenticated order/purchase request.

Interoperability domain: With the systems that connect issuer and acquirer, this domain decides which network will be used. The interoperability domain comprises the following:

-

Directory Server: This server provides centralized decision-making capabilities The directory validates if the given account number is associated with the card and is part of a card scheme and forwards the request to the ACS for further processing.

-

Certificate Authority: It generates and distributes all needed certificates across all domains. These certificates are card scheme certificates, SSL server certificates, public root hierarchy certificates, and digitally signed certificates of the issuer.

So, what exactly is the 3DS protocol?

3DS or 3 domain secure is a technical standard that added an additional security layer for the online transaction.

Similarly, With 3DS, every cardholder making online payments gets authenticated through OTP sent to the cardholder’s registered mobile number.

Known for risk-based authentication, 3DS is a next-gen security protocol based on multiple form factors and use cases.

How does 3DS work?

3Ds reduce misuse of cards, reduce fraud risks, and offer more customer and merchant protection.

It also secures international transactions.

With the reduction in fraud cases, customers get more satisfaction and they get comfortable with online payments, which in turn help merchants with an increase in sales and decrease in disputed transactions.

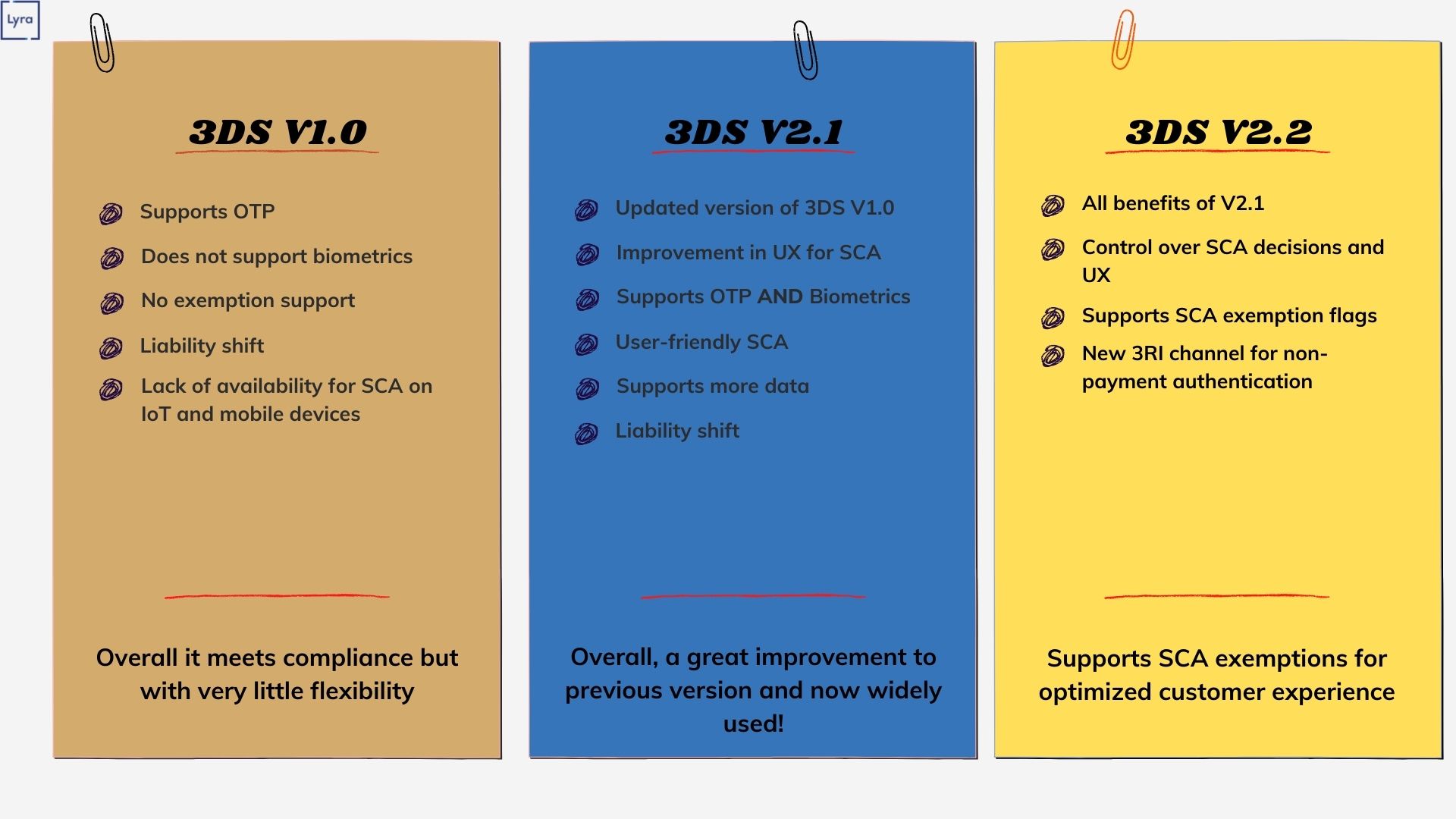

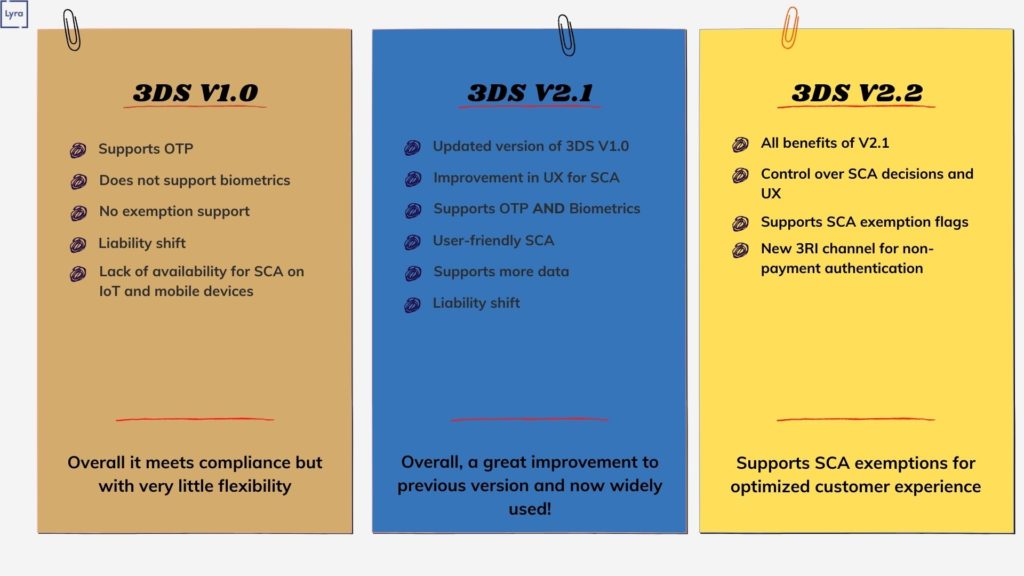

3DS has evolved with time offering more updated and secure versions with each update.

Here is a quick summary of 3DS versions,

Lyra’s 3DS-powered solutions

Lyra provides a payment gateway that offers 3DS authenticated payment processing along with PCI compliance (PCI DSS V3.2.1) providing complete data security for merchants as well as customers.

Lyra also offers MPI which provides the most robust 3DS plugin enabling secure online payments.

For a higher success rate, fraud and chargeback minimization, multi-currency support and maximum secure online transactions contact us today!

In conclusion, Get your own 3DS MPI to maintain your transaction integrity, and keep your customers happy and your transactions secure!

Follow Lyra India for more updates