That us 5 Features of Lyra Payment Switch you should know!

One of the most terrible issues for banks, fintech, and merchants is payment service providers’ downtime and/or outage.

Aggregators need a constant connection to multiple new endpoints.

Banks, PSPs, and facilitators are implementing and opting for 24-by-7 payment options.

A number of service providers are implementing multiple online payment options.

But having more providers makes the transaction process fragile to acquirer failures.

And prone to transaction failures with connectivity and security issues.

This issue will not only irritate customers but ultimately can lead to revenue loss.

Lyra’s payment switch is a robust and secure platform.

That offers authorization and switching solutions for banks, fintech, and payment facilitators.

It not only saves them from connectivity and security issues.

But dynamically routes payment transactions between the acquirer and payment service provider upgrading the transaction success rate.

How does Payment Switch work?

Here are the top 5 features of Lyra’s Payment Switch you should know:

Dynamic Routing: Acceptance rates of different acquirers differ based on multiple variables. Lyra’s Payment Switch considers these variables as rules and uses them to dynamically route the transactions, maximizing payment acceptance performance and minimizing transaction failures.

With the advantages like in-house hosting, direct connectivity with card schemes, and BIN sponsorship, Lyra’s payment switch offers a smooth and strong platform.

Security: Lyra Payment Switch offers a scalable, trustworthy, and highly-available platform that complies with the most recent security and data protection regulations.

It controls the online transaction acquisition, authentication, capture, and authorisation.

In addition to handling authorization transactions in ISO-8583 standard, it complies with PCI DSS and has received certification from VISA, MasterCard, and NPCI.

Lyra’s Payment Switch features a robust architecture and flexibility because of its use of high-end ISO infrastructure and rules-driven architecture.

With its active-active high ability, it prevents unscheduled disruptions. This architecture allows the fast rollout of new features and functions and a reliable interface renders dynamic transaction routing.

The payment Switch can connect to any and all types of network devices, eg. PSTN, 3G, 4G, LAN, WiFi, and IP devices.

The 3DS MPI, ECOM platform, Lyra Payment Gateway, POS platform, and LUMA are all completely connected with it.

Transaction support: Lyra Switch supports a wide range of transactions for both issuers and acquirers including, mobile payments, online payments, transfers, refunds, etc.

As stated above it is a comprehensive payment platform certified by Visa, Mastercard, and NPCI.

It can manage both online and offline transactions because it is connected with a production-grade platform.

It handles card network exceptions and acts as a One-stop-shop for POS/ECOM/MOTO card acquisition.

Card scheme management: Lyra Payment Switch acquires, processes, clears, and settles credit and debit card transactions in real-time.

It can also be connected to various systems for the purpose of transaction processing.

And it can acquire, authenticate, authorize and switch transactions for,

1. banks

2. facilitators

3. card schemes

4. POS

5.EWallets

6. fintech

7.eCommerce

8. businesses

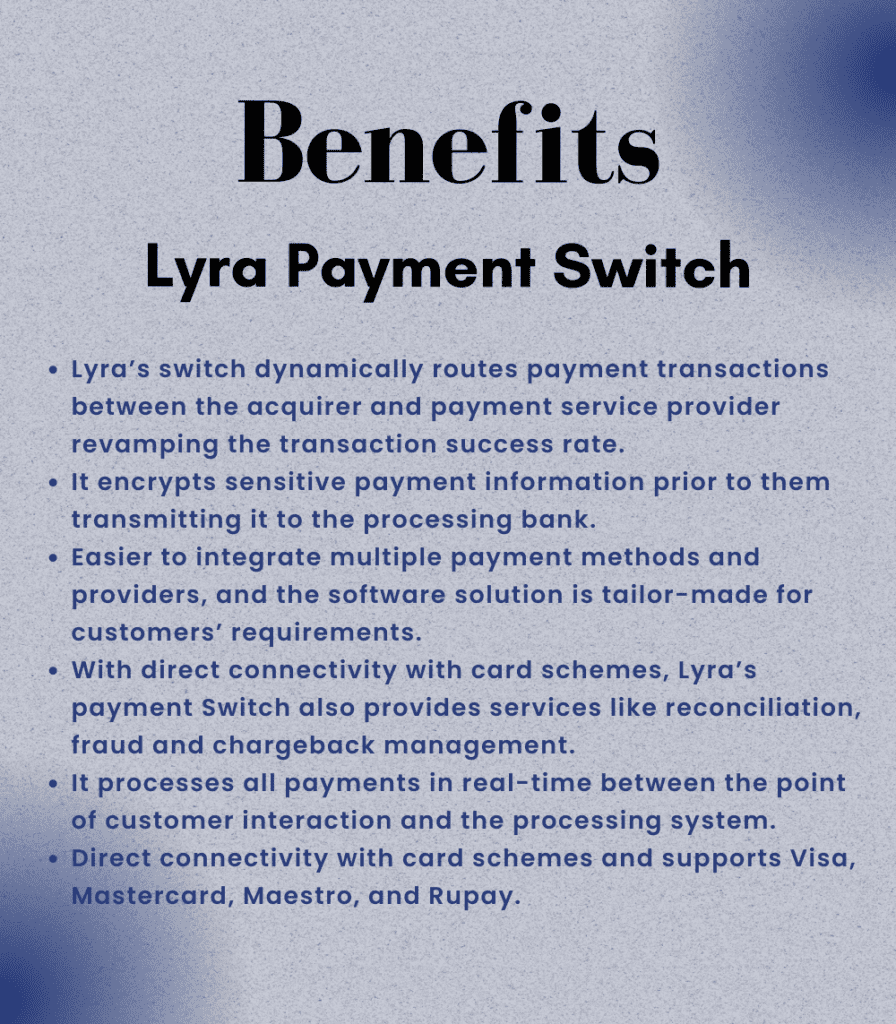

Lyra’s Switch: Benefits