A Complete Guide to Credit Card Processing for Businesses

irrespective of the type of business, nearly every business reaches the point where processing credit cards for payment acceptance becomes extremely necessary.

It helps build a stronger customer base and sell more solutions and services. Credit cards are easy to use.

So, whether your business accepts online payments or payments via POS or other terminals, credit card processing is the option you had to have!

Now, as a business/ merchant you don’t need to have deep knowledge of the whole process, but it is important to have a general understanding of the process.

Here is your complete guide on Credit Card Processing

What is credit card processing?

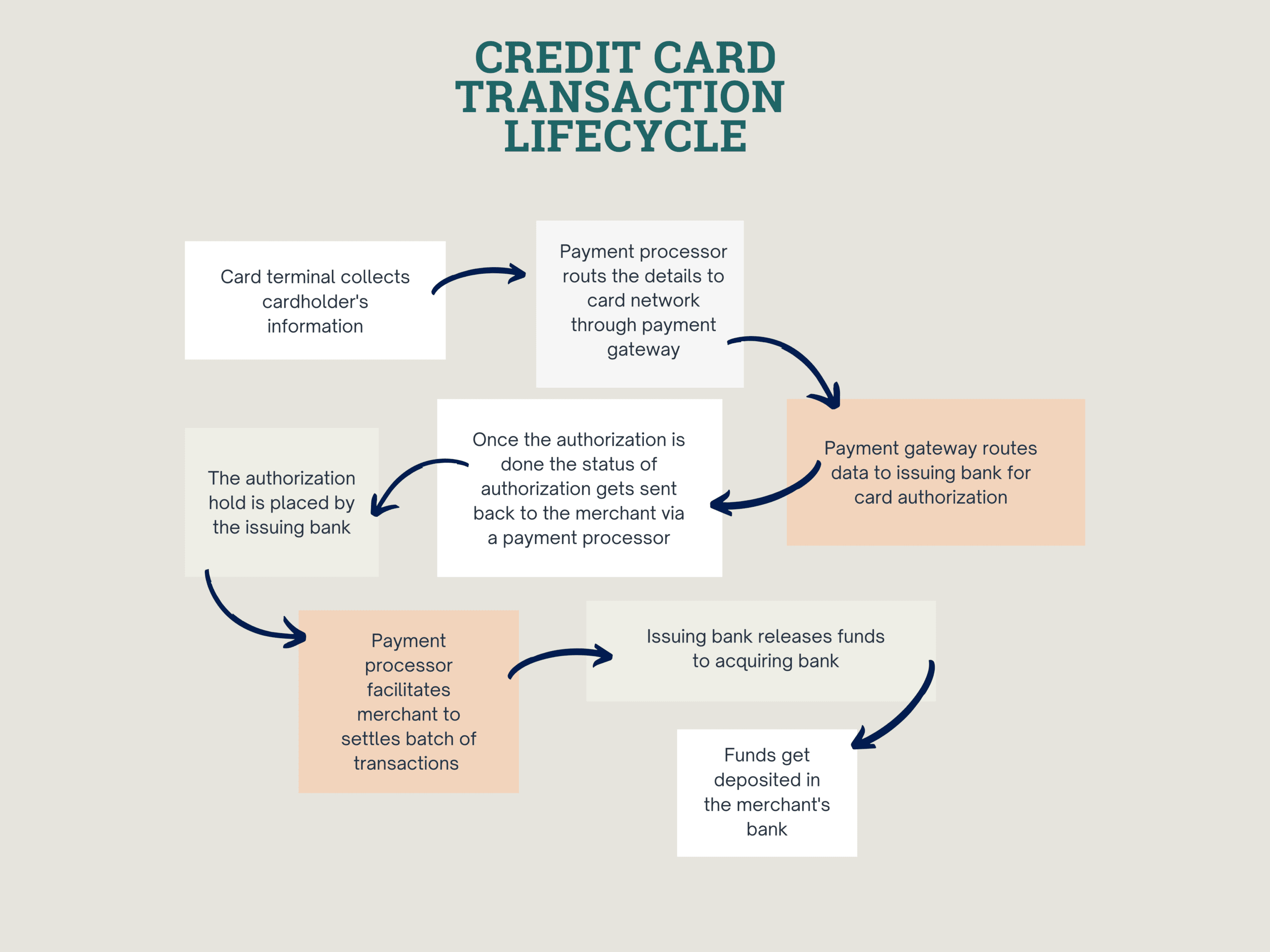

Customers make purchases and choose the credit card option to make payments. When customers initiate the card payment and the merchant enables payment acceptance via card, the whole process to transfer the amount from making the card payment to funds settled in the bank account is called credit card processing.

It is everything and anything happening behind the scenes where the customer uses the credit card to transfer funds to the business/ merchant.

What are the entities involved in credit card processing?

Merchant – Business enabling payment acceptance via credit card.

Customer – a cardholder making a purchase and opting for a credit card payment option to make payments.

Acquiring bank – Merchant’s bank

Issuing bank – Customer’s bank / Cardholder’s bank. These banks issue cards on behalf of credit card networks.

Payment Gateway – offers a secure connection between the shop website and payment processor

Payment processor – Facilitates the payment data to the card network

Card Network – Card operating networks including VISA, MasterCard, RuPay, etc.

It takes a few seconds for card authorization and it can take an average of two to three days to settle the funds in the merchant’s account.

What is credit card authorization – link to the blog

Credit card transaction lifecycle

How to choose a Payment Processor?

Now you know the basics of the credit card process. the next challenge comes in the form of choosing a payment processor.

Choosing a suitable payment processor for your business is a challenge of critical importance. Here are some deciding factors,

-

To enable credit card processing and for funds to get settled a business needs a merchant account. But opening a merchant account can be quite a hassle. It is a lengthy process that can cost you your time as well as money. Instead of going through all the trouble, you can choose a payment processor that offers a merchant account.

-

Today, customers are getting comfortable with digital payments and as a result, we see a plethora of payment methods. So, the availability of other payment methods like UPI, net banking, mobile wallets, etc. Can be considered a plus point for customers hence making it one of the important considerations when choosing a payment processor.

-

Security is one of the main concerns of customers when opting for card payments and with increasing credit card fraud, it is obvious that they will think twice before making payments. As a merchant, you have to ensure them that their transaction is processed in a secure environment and their card details are safe. So, it is important to choose a payment processor that complies with the government’s data security standards and is PCI DSS compliant.

-

When you integrate a payment processor with your business module, you may face some issues be it technical or functional. It is necessary to choose a payment processor that offers great customer service and assistance.

-

Another plus point is the fraud and risk management module. If a payment processor offers a fraud and risk management module, it helps to protect merchant reputation and at the same time, it probably saves merchants from chargebacks.

-

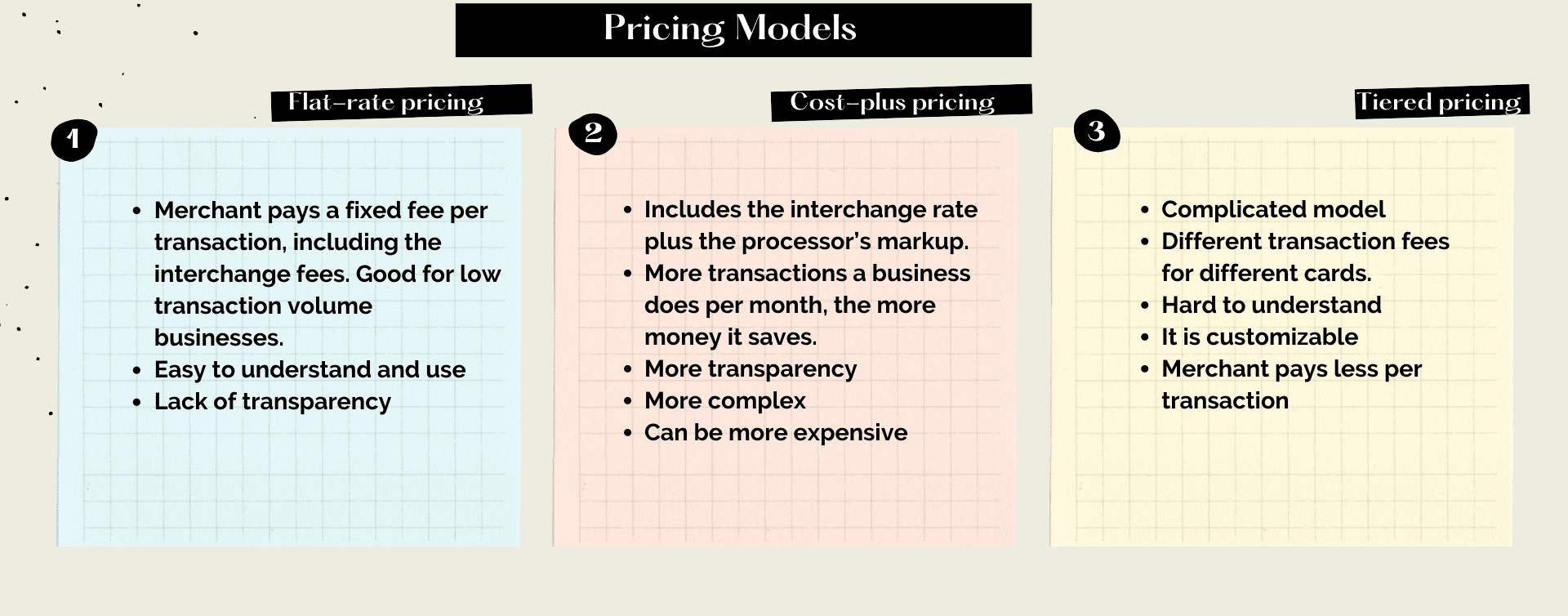

In addition to these fees, there are also pricing models, here is a review of three types of models,

-

Downtime is also one of the important aspects to consider. Often, payment processors face downtime due to technical issues, and outages. This may affect business and can result in loss of trust from customers as well as financial losses.

In conclusion, credit card processing is becoming a necessity for business. And a fast, secure, reliable, and easy-to-integrate processor can help you as well as your customers save time and effort.

Contact Lyra and get started with one of the most secure payment solutions in India. We offer the best services for credit cards and other payment methods.