All About Recurring Payments

Today we live in the age of subscriptions, be it NETFLIX, Hotstar, SalesFore, or WordPress, once remembered for only magazines or newspapers, these subscribed services are making appearances in our lives more than often.

And at the center of these subscriptions resides recurring payments.

What are recurring payment?

In simplest of terms recurring means repetitive. Recurring payments are the payments done repetitively weekly, monthly, yearly, or on a defined period of time.

In other words, recurring payments are payments done by customers to any business for their services or product on a repeating basis set over a regular time interval.

These payments happen remotely over a payment processor. When a customer needs to purchase the same service/product repeatedly out of loyalty or need, recurring payments come in handy.

Many payment solution providers provide online recurring payment services, but it is always important to find a service that will suit your business model and infrastructure. Here are some pointers for choosing the automated recurring payment service-

Security standards compliance: For recurring payments, the customer trusts your business with their credentials.

So, in order to accept recurring payments, you have to make sure that customers will feel safe to share the credentials and trust your business completely.

In order to achieve this, you have to make sure to select a service provider that is compliant with industry and government security standards.

Global presence: When your business is accepting recurring payments you have to keep in mind that your customer can be anywhere on the back of the earth.

You will need to subscribe to a service provider that allows you to accept international payments. Also, additional charges for accepting international transactions are a thing to keep in mind.

Platform charges: Accepting online recurring payments seems like a simple and easy process, but in reality, it gets quite complex on the developing and integration side.

A payment solution provider is responsible for offering uninterrupted payment collection services and the retry implementation if the payment fails.

You have to research the platform charges offered by different service providers and compare them against your advantages.

How recurring payments work-

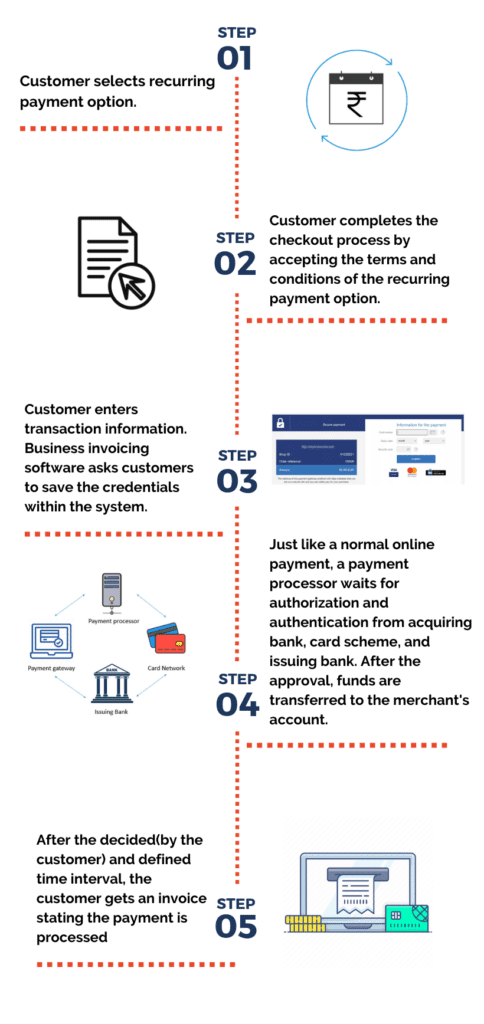

Customer selects recurring payment option.

The customer completes the checkout process by accepting the terms and conditions of the recurring payment option.

The customer enters transaction information. Business invoicing software asks customers to save the credentials within the system

Just like a normal online payment, a payment processor waits for authorization and authentication from acquiring bank, card scheme, and issuing bank. After the approval, funds are transferred to the merchant’s account.

After the decided(by the customer) and defined time interval, the customer gets an invoice stating the payment is processed

Benefits of recurring payment –

Easy setup – recurring payment services come with an easy setup for merchants. Nearly all service providers offer an extremely user-friendly interface to set up a recurring payment system. With just a few clicks, merchants can set or remove the subscription

Easy management – As easy as it is to set up the subscriptions, merchants can also easily manage the subscribed accounts.

Merchants need not worry about manually handling everything,

As nearly everything including processing bills and generating invoices is set to happen automatically, a recurring payment platform is also easy to maintain.

Convenient for customers – recurring payments help customers to avoid late payments. Once the customer shares credit card details and opts for the subscription, it is set to deduct the amount directly from the customer’s account (most of the platforms are set this way unless instructed otherwise).

Customers don’t need to worry about the due dates, late fees, etc., and can enjoy the services to the fullest.

A perfect solution for periodic services- Be it a subscription, membership, or any other automated periodic payments, a recurring payment platform works as a perfect solution.

Recurring payments are time-saving. They can increase customer loyalty, boost customer relationships and improve conversion rates leading to improvement in business performance.

Get started with recurring payment

With Lyra Payment Gateway, your business can easily accept online recurring payments. With Lyra, you can manage your payment schedule and issue payment orders manually.

Lyra payment gateway allows you to track expiration dates of cards registered for recurring payments.

Backed up with a rich and powerful back-office system and with + 100 available payment methods, Lyra offers a secure, user-friendly, and quick online payment platform for online payment collection.

Get onboard with Lyra and start collecting online recurring payments.