Payment Switch

Now that covid has set the new rules for following social distancing, customers are becoming more aware and used to digital payments, online banking, and online shopping.

Considering this scenario, the greatest catastrophe for any business that offers online payment collection can face is the payment provider’s downtime and outage.

The outages or the downtime can be the result of various technical difficulties such as software or hardware malfunction or data center downtime, etc.

An outage of a few days can result in millions and billions of financial losses.

And the aftermath won’t be easy as there will be a cycle of refunds, recharges, and backlogged transactions.

Outages come hand in hand with financial losses and with the significant effects on not only merchant reputation but also provider’s reputation resulting in bad publicity and also can attract the eye of a regulator

What steps should be taken in order to avoid outages?

Whenever you are facing such an outage, it should be communicated consistently to your customers explaining the reasons and updates on the outage.

It is always better to have a backup, for example,

- A contract with multiple payment processors.

- A regular backup system for your store website and the webserver.

- Offering multiple payment methods.

For a small business, Implementing multiple payment processors would undoubtedly be an overkill, also, having more providers makes the transaction process vulnerable to acquirer failures and prone to transaction failures with connectivity and security issues.

In such cases what can be their option?

Payment Switch:

A payment switch is a third-party or internally built software system.

By dynamically routing transactions between multiple endpoints like PSPs, and acquirers, the payment switch provides rule-based authorization.

The main function of a payment switch is to acquire, route, switch, authenticate, and authorize payment transactions across multiple payment channels.

Are payment gateway and payment switch the same?

Though a payment gateway also connects a merchant’s website to multiple endpoints, the ability to switch and dynamically route the transactions makes the switch different from a payment gateway.

How does the payment switch help during outages?

During outages or downtime, merchants can easily route transactions to their backup acquirer or other acquirer using a switch.

The routing of the switch is based on merchant driven rules, for example, routing can be done by,

-

processing amount

-

BIN

-

Day and time

-

retry transactions

-

declined transactions, etc.

So, if the transaction is declined from one of the acquirers in case of an outage, the merchant can retry the same transaction by routing it to other acquirers.

Functions of the payment switch:

The Lyra switch performs the following core functions

-

Manages direct integrations into the payment providers

-

Manages merchant configurations with a particular provider.

-

Manages 3D Secure MPIs

-

Facilitates processing of real payments between these providers

How does the payment switch work?

It accepts the request for payment, understands which providers it needs to process with, formats the message for that provider and sends it to them, gets a response, changes the response to a generic format, and sends the response back to the caller.

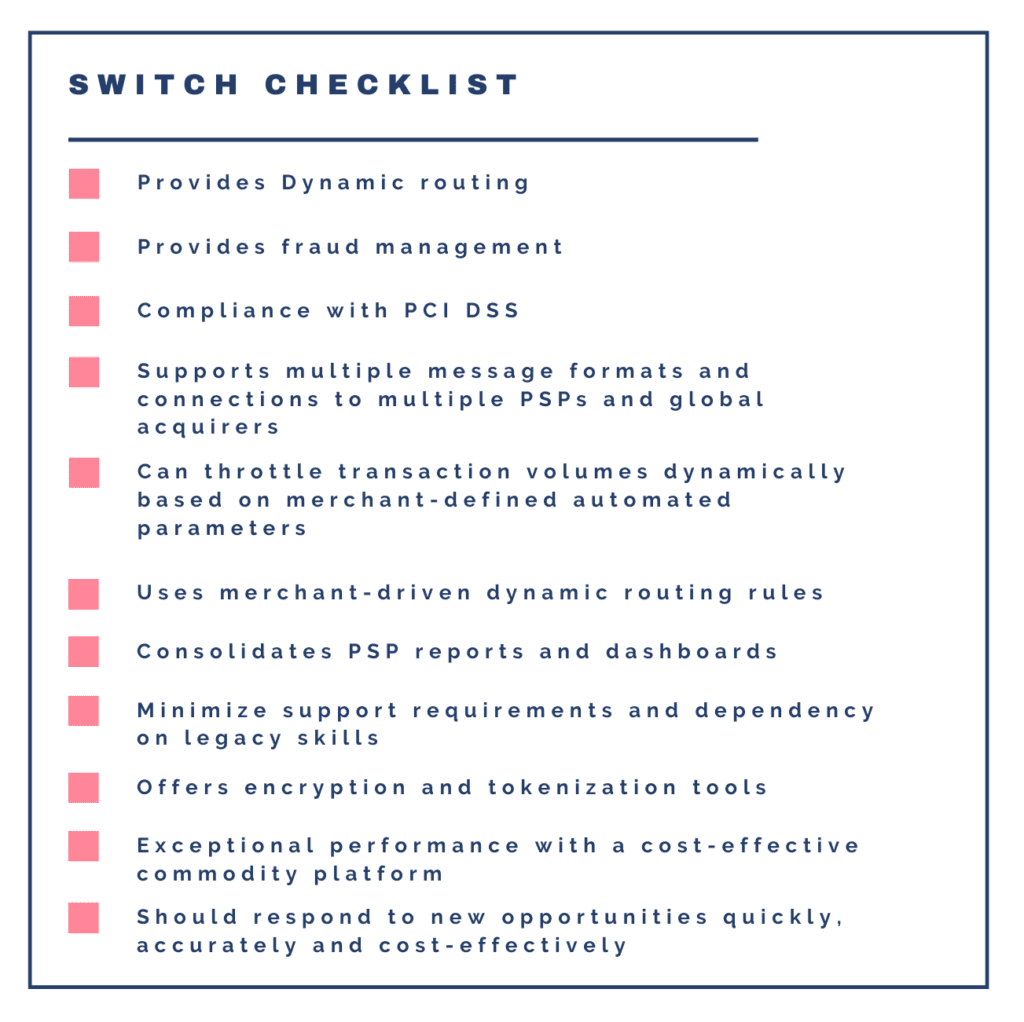

While considering getting an LPS for a business, a merchant must consider the business structure and define the specific requirements.

Here are some of the requirements a merchant should consider while choosing an LPS.

LPS – Efficient solution for a higher success rate and faster processing time for online and offline transactions

LPS solution provides a robust and secure platform for authorization and switching.

It can acquire, authenticate, and switch online and offline transactions for, banks, payment facilitators, card schemes, eCommerce, e-wallets, POS devices, etc.

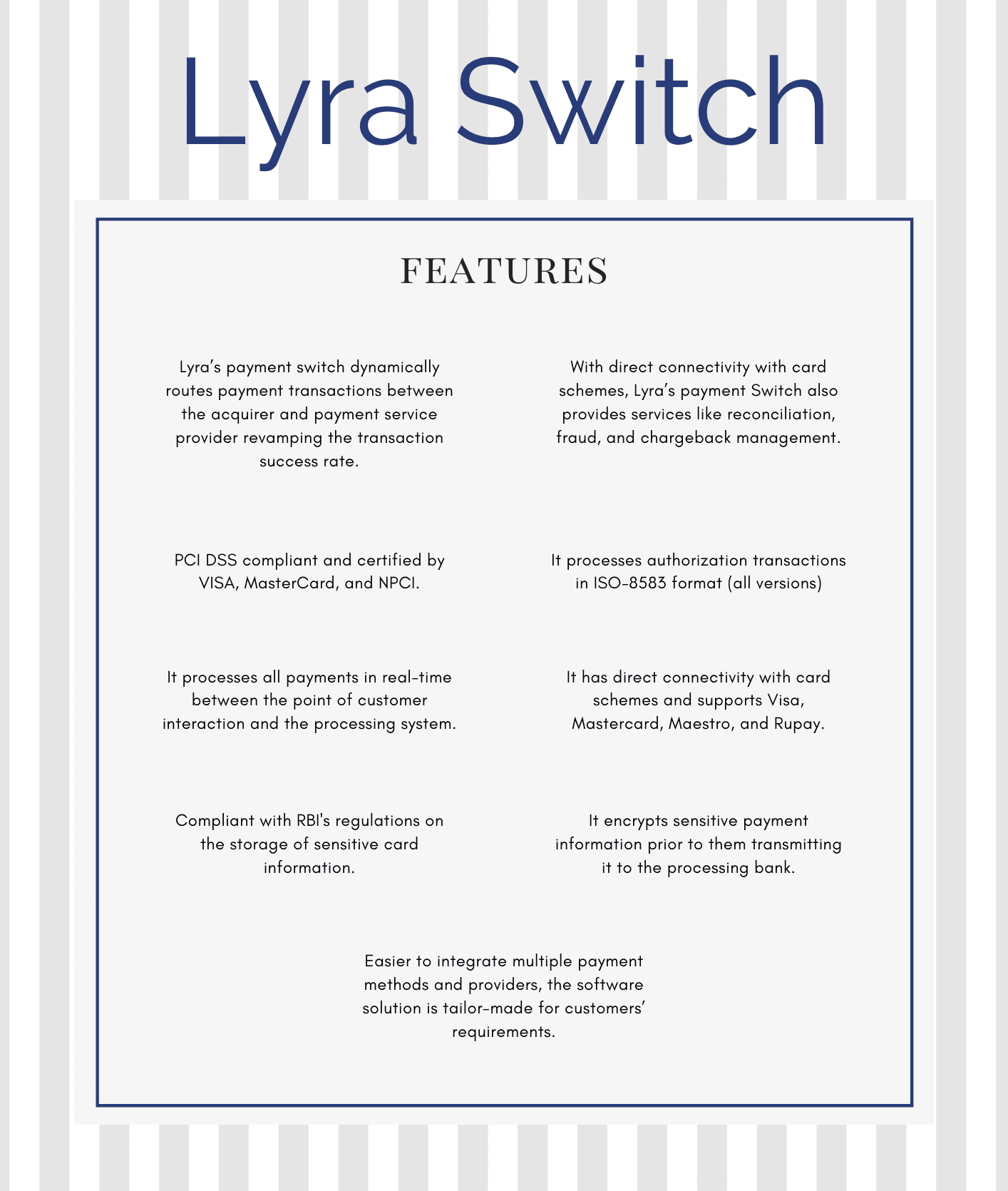

Why Lyra’s Payment Switch?

With the high-end ISO switch infrastructure, Lyra’s switch saves merchants from connectivity, and security issues and helps them to avoid downtime and outages.

Lyra’s payment switch with Lyra’s Payment Gateway provides an independent online payment solution as there are no third parties included.

This results in fewer hops, maximizing transaction approval, and acceptance rates. Lyra maintains multiple data centers and provides active-active high availability to prevent unscheduled outages.

Lyra Switch can be connected to various systems and it comes with a default connectivity platform to connect 3G, 4G, IP, LAN, WiFi, PSTN devices, and a wide variety of services like POS, MPOS, ECOM, SMS, etc.

It also provides the best built-in interface to view and analyze payment transactions.

Follow Lyra India for more updates