UPI (Unified Payments Interface)

UPI (Unified Payments Interface) was launched in 2016 and is equipped with the principles of interoperability, consumer choice, and forging partnerships between banks and the fintech domain/community.

UPI was born because of the existence of a lot of payment systems in the market with no seamless connection with each other.

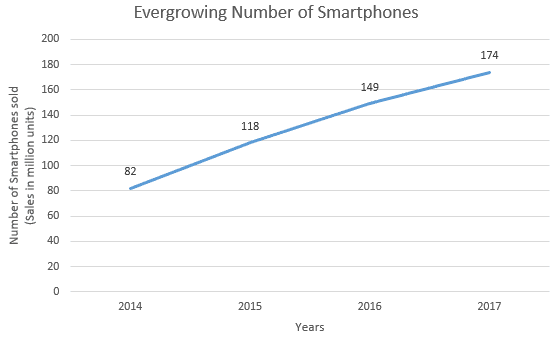

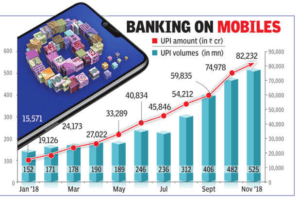

With UPI, the transaction volumes have grown drastically, which is 123 times.

Data reveals that the transactions went from 2 million in December 2016 to 246 million in June 2018 as this platform proved to be a success amongst the citizens.

FUTURE WITH UPI AND MORE APPS

In the years to come, it is expected that the era of mobile-first strategy will come where consumers may use functionality-rich and user-friendly apps for P2P (Person-to-Person) or P2M (Person-to-merchant) payments. Moreover, digital payments from citizens to governments imply a big opportunity.

With more awareness amongst the public about the advantages and features of digital payment apps, it is sure to benefit a large section of society.

It is also anticipated that more people come to be aware of frauds or dos and don’ts while dealing in digital payments in the coming time.

Fintech domain, in collaboration with banks, will build its digital economy much better and faster with time.

IMPACTS AND BENEFITS

BHIM app, which is UPI-based, has made its mark in the country with it receiving or sending money from or to non-UPI-based accounts. It can be done by scanning the QR code instantaneously.

BHIM app allows the money transfers between two bank accounts and that too even on weekends and bank holidays.

Various benefits of this app have provided for ramping up of the ecosystem and an increase in digital payments.

Apart from the provisions of safe, convenient, and everyday access to making transactions, the BHIM app allows for checking the bank balance as well.

These features and such apps help in making the country pro-digitization and are constantly making people inclined toward participating in digital methods of making payments for the goods & services purchased.

Recently, as RBI has openly invited more private firms to enter the payments system space, more such platforms are expected to be available for the public to get involved in digital methods of making/receiving payments.

Source: ET Tech

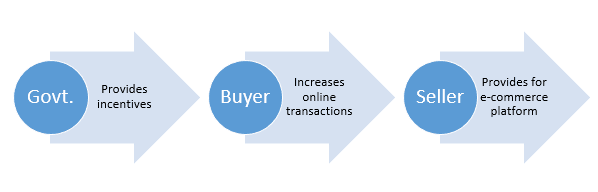

The fintech domain/community is looking forward to many more such opportunities where government nudges forward such advancements in the digital payments system.

With demand and requirement for such technology, there are over 90 BHIM UPI apps having been provided by the banks and third-party providers to the customers of 130 banks.

Having joined the UPI bandwagon in collaboration with banks, the digital payments sector has been able to boost its services and reach to customers accordingly.

UPI AND FINTECH

UPI, by default, is the platform that enables two entities to make transactions happen. This benefit to the masses is readily available, irrespective of the user interface which helps bring a seamless authentication and authorization.

Fintech, along with UPI, extends its services and advantages to the masses effectively and with a huge optimistic impact.

Fintech and UPI together have brought a financial transformation and a revolution that has made the country come a long way in being cashless.

The true digital side of the country is expected to only show up with such advancements in the digital sector in the future. Especially as this also leads to a reduction in the chances of money laundering and tax evasions.

To provide their services, the Fintech domain provides for quick, convenient, and safe transactions to their customers.

Added with the needed infrastructure, UPI & Fintech domain can move much ahead together in a matter of some time.

International best practices that can be adopted and other Speculations for Indian Digital Payments’ Sector:

- India is expected to adopt much better internet coverage as well as connectivity to increase the trust on digital payments. A lost network in the middle of a transaction/withdrawal is an active issue and leads to delays in some areas of the country.

- Need for Cap on cash transactions and instead availability of a quick and easy-to-use mobile app on all mobile phones.

- More awareness of the benefits of having a bank account. The awareness of extracting benefits from bank accounts can lead to more bank accounts and hence, more digital transactions.

- Need for bringing public transport and services under the ambit of cashless transactions.

- Education and awareness of the customers using digital methods for making payments is expected to be increased soon.

- The needed availability of preferred language options in the apps with regard to different regions and states is another speculation.