How to Choose a POS Machine for Your Business?

As India is progressing towards a cashless economy rapidly, payments by swiping cards are back in action.

And with the rise of digital culture, It is safe to say that every individual carries at least one card at all times.

So, if you are a merchant and still don’t have a card swiping machine for accepting payments, you are losing big time! If you don’t want to let down your customers by saying ‘sorry, we don’t accept cards’ (and maybe lose a sale), it’s vital that you start accepting card-based payments.

Now once you decide to buy the ‘card swiping device’, the next question arises is, ‘how to choose a card swiping machine that will be the best fit for your business?’

There is a plethora of providers and several devices to choose from, so here is your guide towards choosing the best ‘card swiping machine’.

Card swiping device is also known as POS, i.e. Point Of Sale machine. Card swiping device is also known as POS, i.e. Point Of Sale machine.

It allows customers to pay via their cards for their purchases. With POS you can offer faster checkouts for customers with secure, hassle-free, and convenient card transactions.

How does the card swiping machine / POS works?

Here are 5 simple steps showing how a card swipe machine works:

Step 1: Card Swiped

For any transaction to take place, the card and the card swipe machine should be in physical contact with one another.

A transaction is active only after the magnetic stripe on the debit or credit card is moved or passed through a console at the merchant.

There are some other types of swipe cards that just require tapping them to the card swipe machine.

Step 2: Using Electronic System

Data is transmitted from the card through the EIS or electronic information system. There is a network connection established to verify all the details of the debit or credit card provided.

Most of the methods of establishing a connection require electronic systems with the right programming that reads the information from the card that is swiped. It also needs a network connection with the help of a wireless network of a telephone line.

Step 3: Information Sent

After the swipe card comes in contact with the POS swipe machine, the information in the card is sent to a system to process the key information regarding the transaction.

This step basically confirms if the debit or credit card is active and has enough money to pay for the purchase.

Step 4: Further Verification

Some cards might also ask for other additional verification after swiping. This is done to confirm the identity of the user and their authenticity.

Cardholders may also be asked to put their personal identification numbers while processing their transactions.

Step 5: Transaction Fees

A few of the cards might also deduct some transaction fees after swiping, in case the customer is using their credit card to pay.

This is because a merchant is charged every time you make a transaction with a credit card. Technically, a percentage of 1.6 to 3 is charged to a company.

This is in addition to the amount the company has to pay annually by default for getting into the credit card verification criteria.

The account holder in a bank might also be charged with some additional fees after the card is swiped.

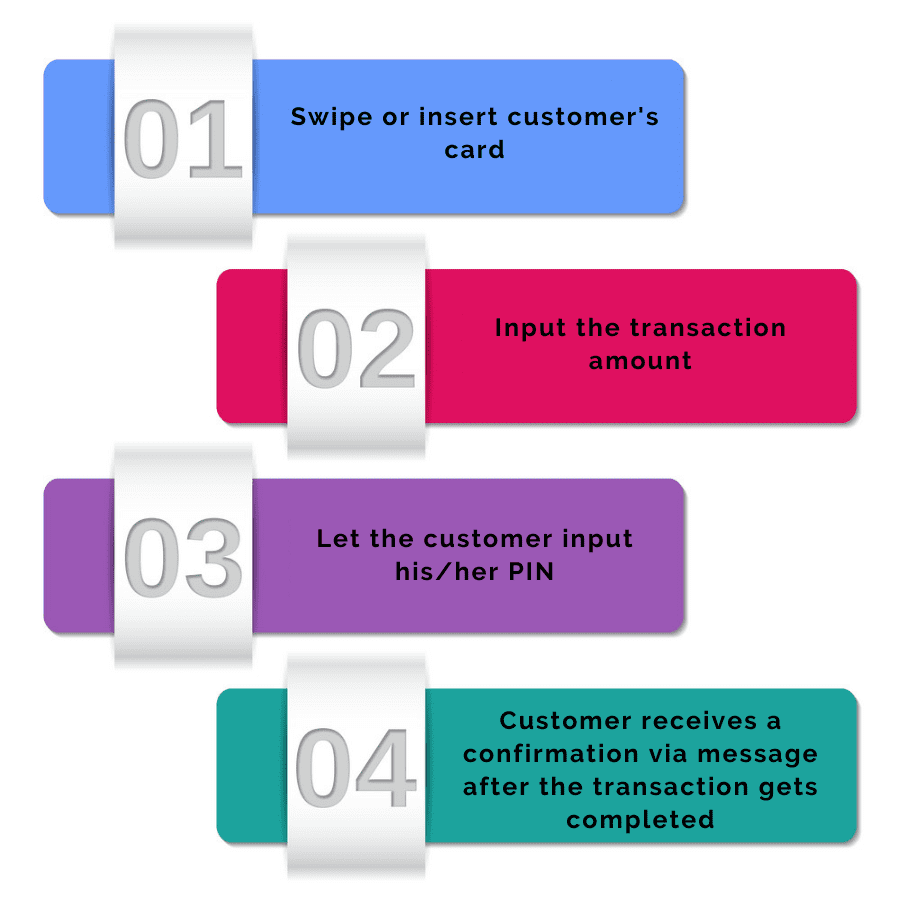

POS working flow

As obvious as it seems, the first step is to swipe the card. The customer initiates the transaction after swiping or inserting the card through the POS terminal.

The information gets passed through the device via the magnetic stripe present on the card.

The magnetic stripe stores information like account number, name, expiration date, service code, country code, card verification code, etc.

Once the in information gets passed to the device and the merchant enters the amount to be paid by the customer, transaction and customer details are passed through an electronic information system.

After the network connection gets established all the card details get verified.

After the authenticity of the cardholder is verified, cardholders are asked to put their PIN (Personal Identification Number).

If the correct PIN is entered, the transaction proceeds and funds from the customer’s account get transferred to the merchant’s account.

Factors to Consider to choose a POS for Your Business

Security – The first and foremost feature to consider is security. As POS machine accept cards, they deal with customer’s sensitive card details.

Choose a device provider that offers PCI DSS compliance, technologies like encryption, tokenization and follows the government’s regulatory standards and guidelines.

Seamless onboarding – Getting a POS device means getting onboarded with the device provider.

You should choose a service provider that needs minimum documentation, less authentication period, and offers a quick onboarding as you need to get started on accepting card-based payments as quickly as possible.

Card acceptance – At this point, there are too many cards available for making payments, there are prepaid cards, postpaid cards, cards offered by different banks, schemes, etc.

It is essential to do your research on the card types and understand what types of cards are popular with your