Can digital-payments fuel the rebound of the travel and tourism business?

Compulsory restrictions and emerging virus containment strategies have hit a few industries in India in the worst way possible, and travel is one of them.

Amidst all the chaos, concerns, high volume of customer data, and battling the surge in requests for refunds, travel companies switch to digital means by introducing vouchers, rewards, and digital means enabling customers to cancel and book flights.

But despite all the mayhem, fraudulent transactions remain the problem increasing the number of chargebacks and headaches for travel agents and companies.

The travel and tourism companies need to make sure that these online transactions get processed through a payment processor that is compliant with the government’s security guidelines and government-issued security and regulatory modules along with a strong authentication tool.

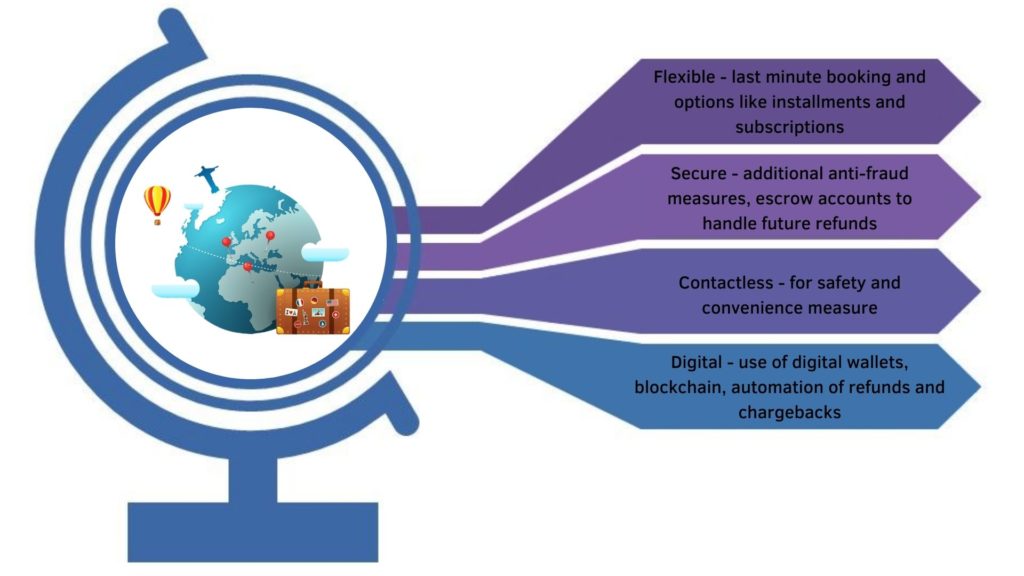

The behavior of customers is changing as they have started to accept digital payments. Encouraging the shift in behavior, travel companies, agents and merchants are also leveraging new payment features. COVID19 has redefined travel payments with the trends like,

How digital-payments can be leveraged?

Many travel and tourism businesses/ companies have their online websites, apps, or social media channels.

They showcase their travel packages, plans, and other amenities on their online platforms. Customers can take their time with browsing, comparing, and deciding the packages and if it is combined with the online payment functionality, it could bring great convenience for the customer.

They need not carry or look for cash while making payments.

The largest and most important asset for any travel company is the customer database. This huge volume of data can be leveraged if used efficiently.

Understanding, analyzing, and processing customer behavior, their payment behavior, and preferences, Moder technology like AI or ML can generate numerous opportunities to attract new customers, retain old ones and increase revenue.

How Lyra can help?

Accept secure online payments with Lyra

Lyra is established as a leader in securing e-commerce and proximity payments. It is one of the most preferred partners for financial establishments.

All of Lyra’s service and products are PCI DSS compliant and follows the government’s guidelines on security and online payments.

Lyra’s Payment gateway is 3D secure, SSL layered and offers fraud and risk management modules. Lyra EPOS and WhatsApp Payment Collection Solution are also 3D secure and equipped with a secure Lyra Payment Gateway.

When you are accepting online payments, you might have noticed that customers prefer the payment mode and method that they are comfortable with.

Lyra offers 100+ payment methods including the most popular ones, like, UPI, net banking, card payments, etc.

Lyra also enables different payment modes like payments in installments, EMIs, recurring payments, etc.

With quick onboarding and zero setup fee, Lyra can be the one thing your business is missing.

Lyra can help you foster your local and international transactions by managing your everyday transactions, so you can concentrate on other important business aspects without any worry.

Here are Lyra’s offerings,