Everything you need to know about card authorization

As a business accepting online payments, you are familiar with the online payment process. All it takes are a few seconds and funds get transferred from the customer’s account to yours.

But do you know actually what happens behind the scene when the customer initiates the transactions?

When the customer initiates the card transaction, the card authorization request is sent to the issuer to check the card validity and in this blog, you will find everything you need to know about the card authorization.

Card authorization is approval and permission to conduct transactions.

This permission is granted by the card issuer, i.e. the bank that provides the card to the customer (in simple terms, the customer’s bank).

Usually, the process happens through a credit card processor and validates the card information.

How does card authorization work?

Primarily there are two ways,

-

When merchant contacts bank

-

when permission to operate the POS terminal is required.

When the card transaction is made, the merchant requests an acquirer.

The acquirer then requests the issuer bank to do validity checks on the cardholder’s card like card details or are there enough funds to complete the transaction, etc. Based on these checks, the acquirer gets approval or an error code.

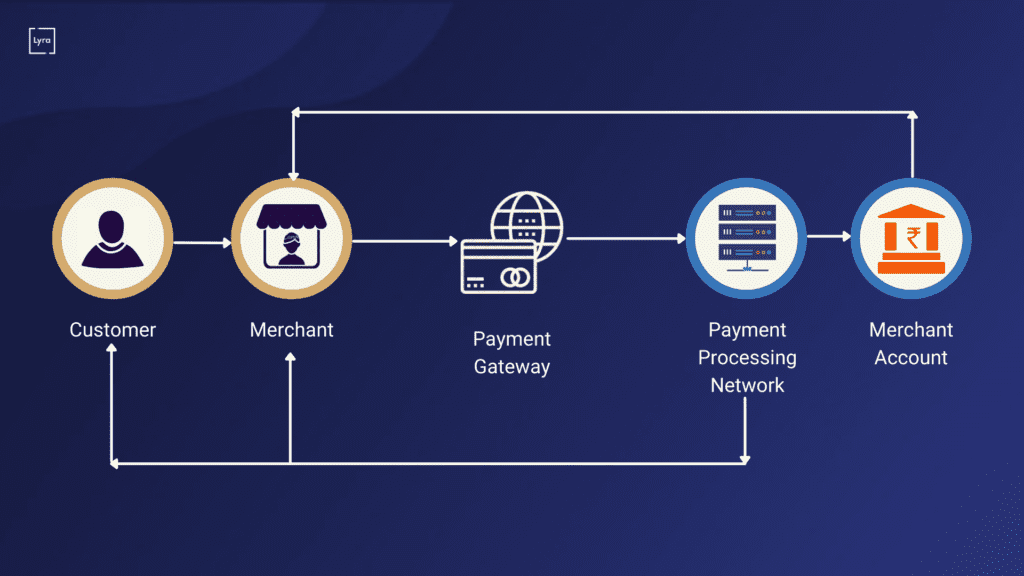

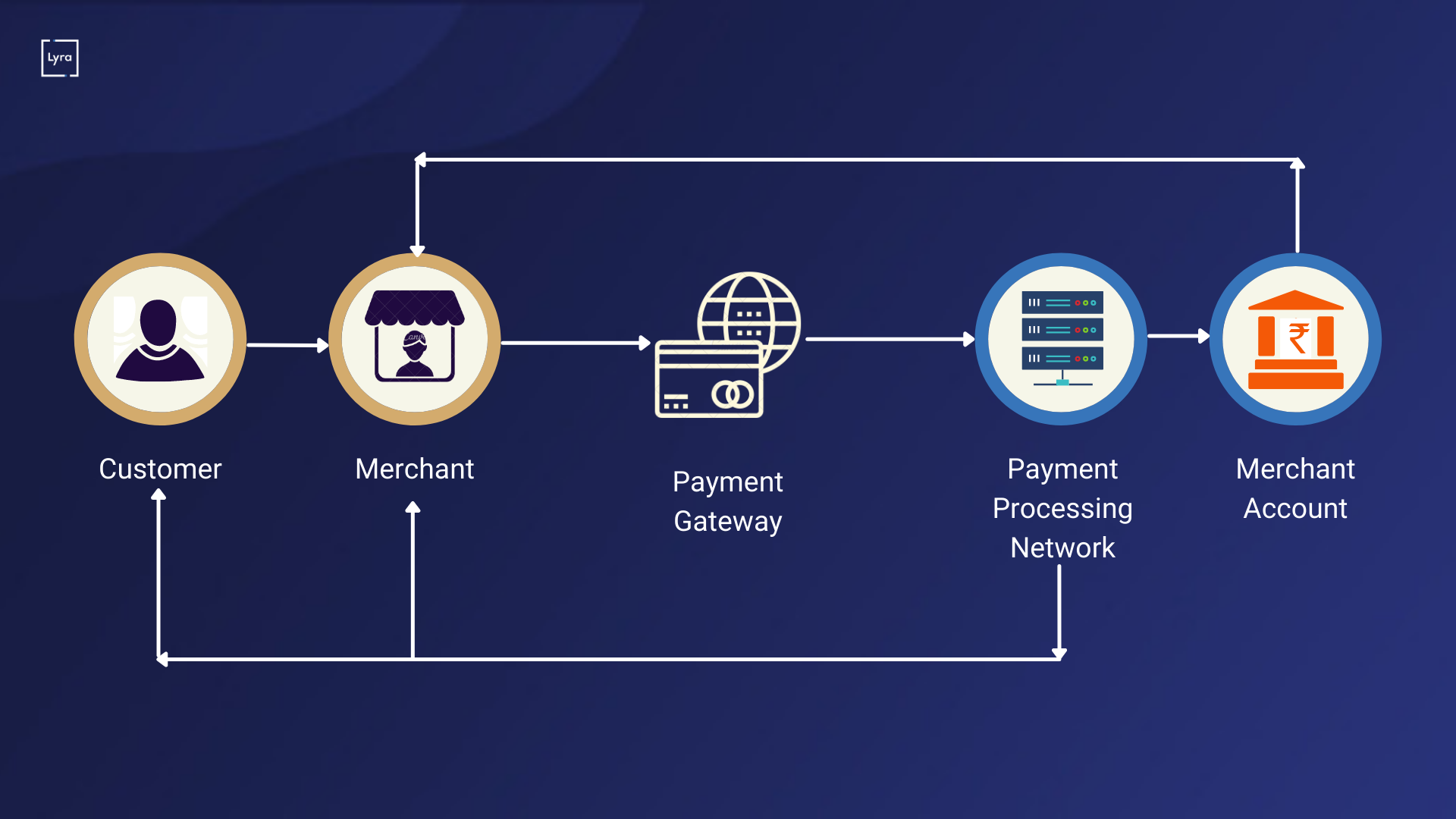

The whole authorization procedure can be divided into the following steps:

-

A customer purchases a product or service from your store.

-

The payment gateway encrypts data and securely sends it through the payment processing network.

-

The transaction is reviewed for authorization or decline, and the results are sent back through the Payflow payment gateway.

-

Your customer receives a confirmation receipt and you fulfill the order.

-

Once the transaction is processed, funds are transferred from the customer’s bank account to your merchant bank account.

Now the question comes of the actual money getting transferred during the authorization process?

The answer is no, authorization is simply the process to acknowledge available funds in the cardholder’s account and place a hold on those funds.

What is an card authorization hold?

When a customer’s account has enough funds for the transaction to take place, an authorization hold is put on the funds to reduce the credit by the transaction amount and the approval or denial signal is sent to the acquirer.

The denial comes in the form of an error code representing different validity checks. The authorization hold is removed when the merchant captures funds (actual fund transfer from the customer to merchant) or the authorization expires.

By blocking funds temporarily, merchants can make sure that the customer is in fact can pay the funds thus it helps merchants to protect their business from fraud and chargebacks.

Why does authorization fail?

Broadly there are two reasons,

-

Financial reasons

-

Technical reasons

As stated above, the error code returned to the acquirer identifies the cause of the transaction failure. If the authorization fails, the purchase cannot be completed.

The financial reason usually means the problem lies within the cardholder’s account, like insufficient funds.

On the other hand, if there is a technical reason, the processor or acquirer may be facing some issues and the transaction can get completed once these issues resolve.