Merchant QR code, how do they work?

Thanks to smartphone penetration and access to high-speed internet, the digital payment scenario has seen various new technologies and QR code is one of them.

from product packaging to payment acceptance, the marketplace has welcomed and adopted QR codes pretty quickly.

QR code payments are one of the low-cost options. Merchants can easily create and display customized QR codes eliminating the need for expensive POS infrastructure.

QR or Quick Response codes are similar to the bar codes but unlike the bar codes, QR codes can store a huge amount of data.

This information is kept as black pattern bits arranged horizontally and vertically on a white backdrop.

When the QR code scanner scans the code, the information might be encrypted.

Nowadays almost all mobile devices come with an inbuilt QR scanner.

One of the advantages of using QR codes is that they have inbuilt integrity checks.

the scanner can retrieve information even if the QR code is broken,

In the case of digital payments, the QR codes contain commands related to the transactions.

Merchants can easily create static or dynamic QR code that supports POS scanning, mobile scanning, app-to-app payments, etc.

QR codes can be Static or Dynamic. QR codes displayed at checkout or printed on the stickers or bills are static codes.

They have unchangeable special information in them.

Static codes, on the other hand, are generated during transactions and need the customer’s or merchant’s device screen to be shown.

They are generally valid for a short amount of time and contain some unique information.

There are several ways to process QR codes,

A customer can scan the QR code displayed on the product, at checkout, on the bill, etc. with the QR code scan application on the mobile device.

If the merchant is using a POS system, once the total amount is displayed on the POS, the customer opens the payment app.

However, This app displays the QR code incorporated with the customer’s card details. The merchant then scans this code and concludes the transaction.

Can Conduct App to app payment via QR codes

In this case, both merchant and customer use their applications. customer scans the QR code generated by the merchant’s application.

This QR code incorporates transaction details. After scanning the code, the customer confirms the transaction and completes the payment.

For online transactions using QR codes all you need is a smartphone (one with a QR code scanner).

QR codes enable a simple, easy, and cost-effective setup to accept real-time digital payments.

Merchant won’t need to buy expensive third-party add-ons like POS machines. QR payments facilitate secure and on-the-spot payments.

Because the data carried by QR codes is encrypted, QR code payment solutions reduce security breaches and data loss.

Because no additional data is needed for entry, QR codes have unique data, which lowers the chance of mistake.

Want to adopt QR code payments for your business?

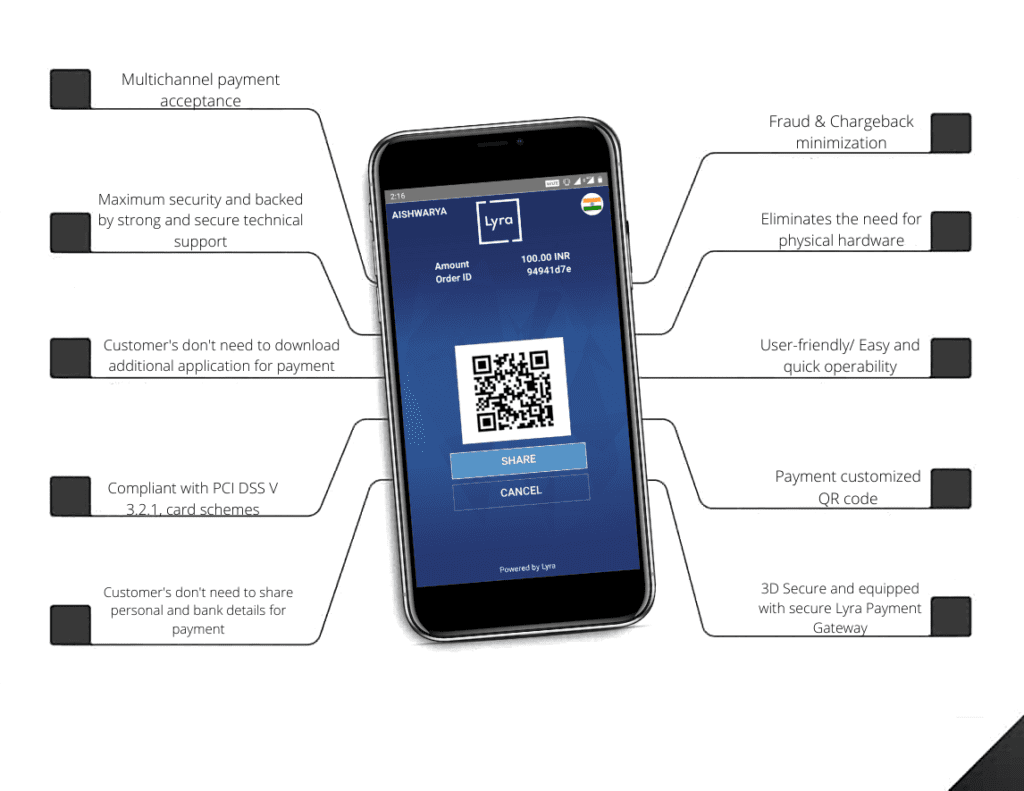

Use Lyra’s EPOS

In conclusion, Lyra’s EPOS or Electronic Point of Sales Application enables secure and on-the-spot payment collections from the mobile device. It eliminates the need for bulky POS hardware and cates the need of the omnichannel business.