How Fintech is building the scope for the next generation!

How did India become digitally inclined for making Payments?

Fintech is an industry that has risen quite a lot in a short span of time due to rapid technological advancements and innovations.

It would not be wrong to call it the “era of digital payments” since in today’s time, the most convenient, quick, and secure method of making payments is via digital platforms.

Some examples of Fintech services are mobile banking, investing services, and cryptocurrency as these are all technology-induced services aimed at easing financial services for the public.

Fintech broadly categorizes existing financial institutions as well as technology companies that fall in its ambit.

There was a time when people in India were hesitant to make payments online as they were entirely dependent on the traditional method, i.e., “cash” for making transactions.

In 2016, India witnessed demonetization, which turned out to be the key factor to have nudged the economy India toward a more developed economy.

This was a wise step for India since the country needed transformation to be on par with the digital world simultaneously.

In making India digitally inclined, the government has played a major role since it has been giving many perks for online transactions in order to encourage people to make payments online.

One of the examples of these perks is incentivizing entry fees at some of the heritage or tourist spots, which has been done by keeping less charge for payments done via debit card.

Besides, technology has been advancing rapidly for making digital payment services better with time. As India is adopting new technology simultaneously, it is able to procure the benefits out of the same.

In 2016, other countries had already become digitally inclined in terms of digital payments.

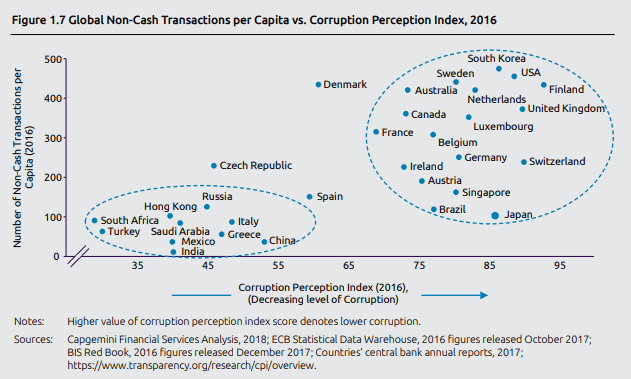

According to World Payments Report, the Global Non-cash transactions per capita vs. Corruption perception Index is as such:

Source: World Payments report

The graph above shows how India, along with some other countries, had an extremely less number of digital (non-cash) transactions and the Decreasing level of corruption was not in favor.

However, India has come a long way as there have been numerous awareness programs and perks for the citizens of the country to be comfortable with adopting digital payments.

This has helped make India a “less-cash” economy to a great extent. Very recently, RBI laid 12 objectives that it seeks to achieve in the next three years for making India “Cash-lite”.

These objectives have targeted everything that the newly formed Digital India requires for deepening its roots in the country.

In India, intense penetration of mobile phones has increased digital/mobile payments, which is very much visible in the data available on Statista.

Hence, according to Statista, mobile phone users have considerably increased from 21% in 2014 to 39% in 2019.

This increase in mobile usage combined with perks by the government as well as an increased faith in digital payments and fintech have all triggered online payments further.

Possibilities/Scope for Current as well as Future Generation

With the techno-geeks having already brought a lot of innovation in the technology and added more useful features to the functions of digital payments, India has added an industry called Fintech.

Such an industry providing all the innovative and technology-infused financial services is a boon not only for the masses and online businesses but also for the young generation that is looking for a successful career for themselves.

Be it the rural sector or the urban, in India, digital payments are gradually becoming a trend among everyone.

The scope of the Digital Payments Industry is quite extensive and it has already managed to encourage India to go toward a cash-less economy gradually from being less cash.

Although digital payments are yet to be adopted by some patches in the country, it has still risen by leaps and bounds.

In the coming future, the digital sector is going to be only more and more widespread covering everyone possible since its rate of dynamism and growth is extremely optimistic.

With the various advantages like one-click checkout and password-protected gadgets, digital payments have the provision of keeping the data secure.

Also, a payment gateway is encoded with the facility to provide a secure flow of transactions each time, which increases the security tangent successfully.

Within a short span of time, the techno-geeks have brought various elevations in the industry that have tremendously simplified the way the world operates.

The penetration of Near –Field Communication (NFC) is a technological advancement that has simplified the use of digital payments furthermore.

NFC is that set of communication protocols that allows two devices to establish communication with each other when brought together within the range of 4 cm.

Another wondrous innovation is the facility of instant bank-to-bank transfer with a single API.

Adding to the advantages, are the features that cater to the needs of students like making the payment for fees online, being able to apply for studying abroad, buying books online or accessing E-learning applications, and so on.

Further on, with various discounts available on the portals every now & then, it is extremely pocket-friendly for young India.

Follow Lyra India for more updates