How To Choose a Payment Gateway For Freelancers

Freelancing is an upcoming trend that is sitting quite comfortably with this generation. The ability to choose working hours, shifts, working from anywhere you want, no hectic office schedules, and working at your own pace is giving the working force the freedom they want.

India is not an exception to this trend. Many Indians are choosing to do freelancing work while working full-time or part-time.

More than 16 million people are working as freelancers and soon many more will move on to freelancing.

With these statistics, it is clear that India without a doubt has one of the largest freelancing workforces.

Though there are many benefits to going freelancing mode, it is not all rainbows and sunshine.

Freelancers have their fair share of problems and accepting payments is one of them. As a freelancer, you know that you don’t have steady payments.

Based on the project’s deadline or project period you will get paid. In this scenario, it is difficult to collect payments.

Uneven payment cycles can create unpredictable financial scenarios.

There are other concerns like late or negotiable payments or in the worst possible case, no payments.

So, it is inevitable for freelancers to spend more and more time following up with clients for the payments.

One of the easiest ways to collect payments from clients is through online payment acceptance. As a freelancer, you can collect money digitally from your clients, and hence you need a payment gateway.

So, how can you choose a payment gateway that benefits your freelancing business? Here is your checklist:

Security –

Digital transfer involves the risk of cyber threats. It is important for you as well as your client to carry out online transactions in a secure and safe environment.

You have to choose a payment gateway that is PCI DSS compliant and supports all security guidelines.

Transaction fees –

Different payment gateway providers offer different pricing. This pricing often consists of a combination of fees like integration fees, maintenance fees, setup fees, etc.

Considering your business requirements and model, you have to consider the transaction fees before choosing a payment gateway.

Multiple payment modes –

Your clients may prefer a specific payment mode. Some may prefer payment by wallet, some may prefer payment by card.

There are a handful of payment methods that are quite popular among people.

Considering the convenience of your clients, you have to make sure that the payment gateway provides these selected methods.

Integration –

The integration method of the payment gateway differs from provider to provider.

As a freelancer, there is already n number of things you have to work hard on, so, you don’t have to make payment gateway integration one of them.

Chose a payment gateway that can flawlessly integrate and is easy to maintain.

Settlement Time –

Settlement time is a time interval between the client paying you online money and you receiving it.

It differs from payment gateway provider to provider. It can be T+1, 2, or 3 days.

Transaction Limit –

Every payment gateway provider has a specific transaction limit. If the amount paid by the client is greater than this transaction limit, the transaction may end up failing.

So, considering the amount your clients end up paying you, you have to choose the payment gateway.

In case the amount the client wants to pay is greater than the transaction limit, you can request your payment gateway provider to increase the transaction limit.

International payments –

Thanks to the internet, the world is growing closer.

Freelancers are not limited to deliver their work only for the clients in their country but on an international level.

The problem arises when the international clients’ and freelancers’ currency doesn’t match.

But this is a more common problem for all industries and many payment gateway providers offer a solution that supports international payments.

This list aside, when it comes to the online payment gateway the integration should be simple and flawless.

Freelancers prefer simpler, ‘do it yourself’ types of methods that fit with their freedom in their work.

So, to overcome all the complicated payment transaction process jargon what is the best alternative?

Don’t worry, Lyra is here to offer you simple solutions that will go easily with your freelancing routine.

Lyra WhatsApp Payment Solution

As a freelancer, you have to admit the world-renowned messaging app, WhatsApp helps you more than just contacting your clients.

You can share your showcase, ask for feedback from your clients, and whatnot.

What if along with this you can also accept payments from your clients on the WhatsApp platform?

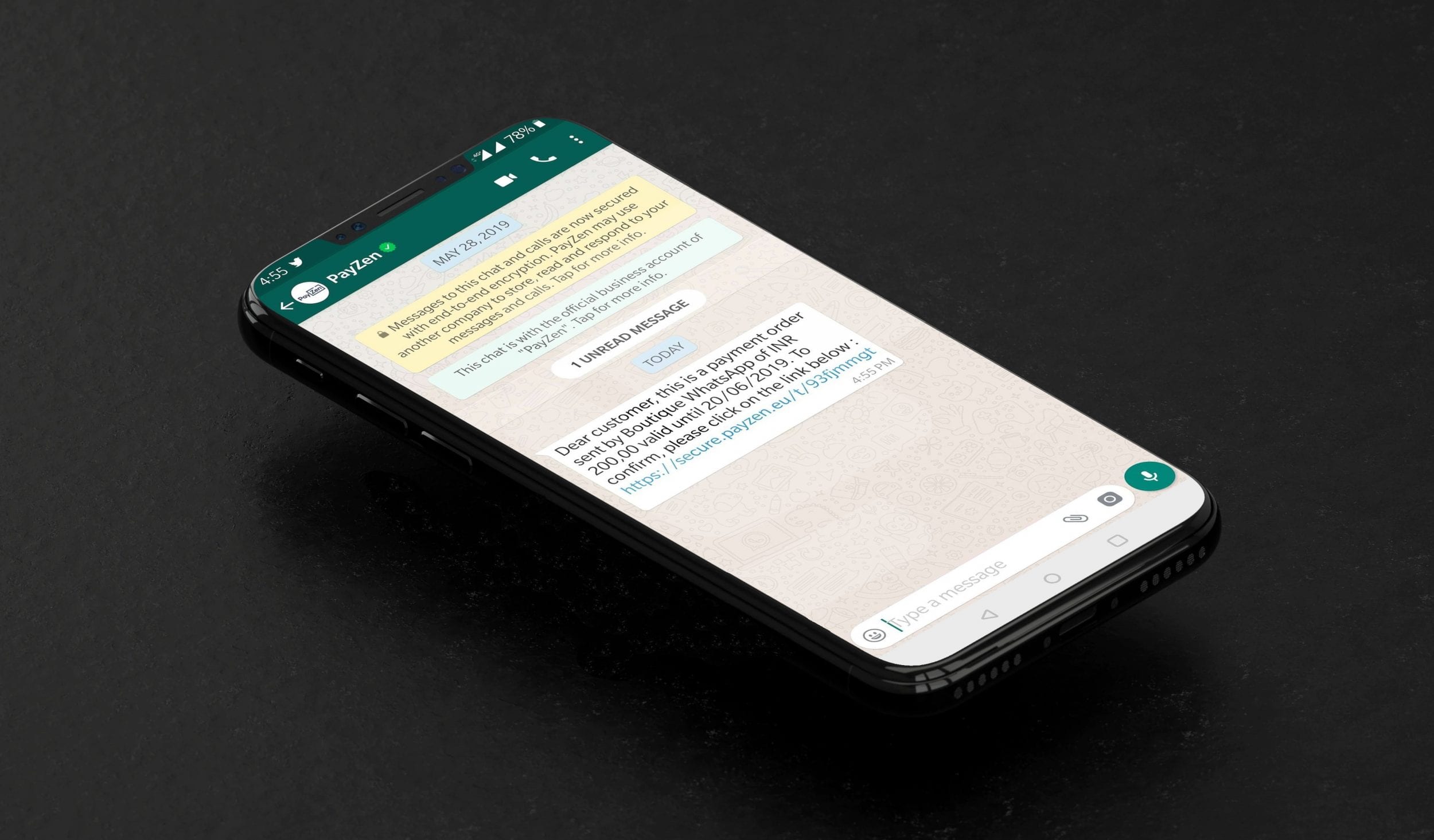

The answer is Lyra’s WhatsApp Payment Solution

Lyra’s WhatsApp Payment Solution provides a simple secure and extremely efficient online payment collection method.

With a simple merchant integration and PCI DSS compliance, WhatsApp payment Solution does not need a third-party application or any external hardware to accept online payments.

What is Whatsapp Payments & its top 9 features

For the first time in India Lyra has introduced an extremely convenient and on-the-spot online payment collection solution – Lyra WhatsApp Payment...

Features of WhatsApp Payment Solution:

Bulk payments – WhatsApp Payment Solution enables bulk payments. A very convenient method for accepting online payments from multiple clients at the same time.

Customization: You can customize the messages along with payment links and send them to your clients. This can be useful for customer loyalty.

WhatsApp Payment Collection comes with a dashboard for a clear overview of all transactions along with day-to-day auto-generated reports for transactions and fraud detection and Chargeback handling.

Follow Lyra India for more updates