How to secure online payments

Digital payments are rapidly becoming popular and due to COVID circumstances, there is a sudden surge in digital payments.

But this surge has also increased the risk of cyber theft. Be it the negligence or a lack of proper guidance, users and the merchants accepting online payments are becoming the victims for cybercrime.

Thinking beyond the passwords or any third-party solutions, according to the business needs, merchants need to learn and implement the ways to secure online payments to protect themselves as well as their clients.

Online transactions always carry some risk. Identity theft or online fraud are some of the common examples and they occur pretty often.

Read here all about online payment frauds.

So, here are some ways merchants can make sure to provide for secure online payments.

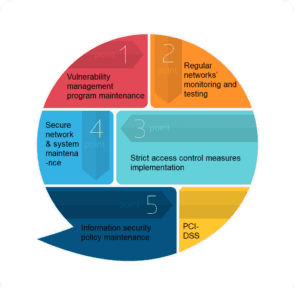

PCI DSS compliance

PCI-DSS stands for Payment Card Industry Data Security Standard is the set of rules and regulations that handle the majority of card schemes and provide security protocols. Main goals of PCI DSS are –

Cardholder data protection.

How to check if the service provider is PCI DSS certified?

When choosing any third-party service provider, it is essential to ensure that the service provider is PCI DSS certified.

A PCI DSS-certified service provider will have an official PCI-DSS mark.

PCI DSS Standards- A Gist about the Emperor That Guards the World of Payment

SSL Protocol

SSL, short for Security Socket Layer is a protocol that encrypts transactions between a web browser and online stores.

It uses encryption algorithms to check that each and every message sent or received passes the integrity test. SSL is visible in the website address bar as-

1. a padlock symbol

2. the prefix https

Why SSL protocol is necessary to accept online payments-

The main goal of SSL protocol is to protect sensitive information with encryption.

SSL certificate verifies the domain and identity of the merchant’s website.

SSL protocol provides confidential transactions and convinces customers that their information is protected increasing their trust.

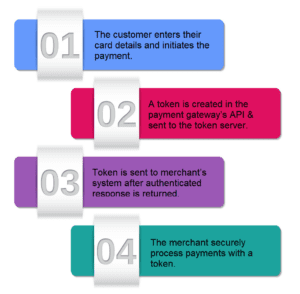

Tokenization

Tokenization replaces sensitive information of cardholders with tokens. The token is a randomly generated string of numbers.

How tokenization works –

After initiating online payment, the acquirer receives the token, acquirer then routs the token to the payment network. From there it goes to the cardholder. The issuer returns the token with authorization to the acquirer completing the transaction.

In short, tokenization works like this-

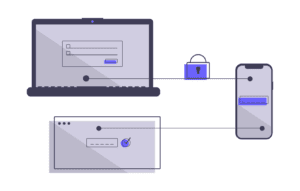

Two-factor authentication

2FA i.e. two-factor authentication is a security measure used to verify the user. As the name suggests, it uses two factors for authenticating users. It adds an extra layer of security for users and minimizes the chances of fraud.

2FA i.e. two-factor authentication is a security measure used to verify the user. As the name suggests, it uses two factors for authenticating users. It adds an extra layer of security for users and minimizes the chances of fraud.

It works in the following way –

The first factor – username or password

The second factor – OTP code

OR

The first factor – Details on the card i.e. cardholder’s name, card number, expiration date, CVV

The second factor – OTP via SMS or email.

Here are some measures for fraud prevention in the eCommerce business.

- Using updated and high-quality software for running online stores.

- Use an improved and reliable third-party payment processor.

- Using Address Verification System (AVS) and Credit code Verification (CVV).

- Make sure that all the websites representing the online store are secured with HTTPS.

- Using fraud detection and management software to detect high-risk transactions.

- Analyzing the risk factors and doing a fraud risk assessment.

- Making the online payment process compliant with rules, applicable laws, and regulations.

- Fraud awareness sessions for employees and customers

Generating awareness amongst your customer is also equally important. Here are some ways your customers can protect their online information-

Using hard to guess passwords.

Changing passwords as often as possible.

Log out of online banking and shopping sites after transactions.

Not allow computers to store usernames and passwords.

Using 2FA and password for mobile, laptop, or computer device.

Shop and transact on authentic websites.

Use a firewall and up to date anti-virus software.

Accept secure online payments

Use Online Payment Solutions by Lyra