Is Your Payment Processing Secure?

As the world is shifting from physical to digital and most merchants and customers are giving preference to online payments over traditional cash payments.

With obvious advantages such as convenience, user friendly, seamlessness, instantaneous, etc, and intervention of the pandemic has increased the popularity of online payments.

But as the transaction volume is increasing the most concerning point is payment security. Be it a merchant or customer, you would need a secure and reliable payment method that you can trust.

But what makes online payment secure? Do you just blindly trust the payment service provider?

Can you confidently input your credit card details on the eCommerce site? The answer obviously is NO!

So, it is important for all of us to be aware of the mandatory security protocols and regulations guidelines by the Government of India.

After all, it is better, in the long run, to prevent something before it happens.

Though it is impossible to eliminate fraud completely, there are many ways to secure your online payments and data.

SSL protocol – SSL or Secure Sockets Layer is an encryption-based internet security protocol.

In other words It uses an encryption algorithm for integrity testing and secures the data transferred between web browser and server.

For enhanced security of online transactions, an SSL certificate for the website domain is integral.

In addition, SSL is visible to users in the website address bar as A lock icon and the website address starting with https:// in the browser bar

TLS protocol

TLS or Transport Layer Security is the successor protocol of SSL, and hence the improved version. It offers privacy and data security for online communications.

Tokenization

Tokenization replaces the sensitive data with the ‘tokens’, a randomly generated character string. These tokens can be substituted for card data and thus minimize the payment fraud risks. It offers improved security and comfort for online transactions.

PCI DSS

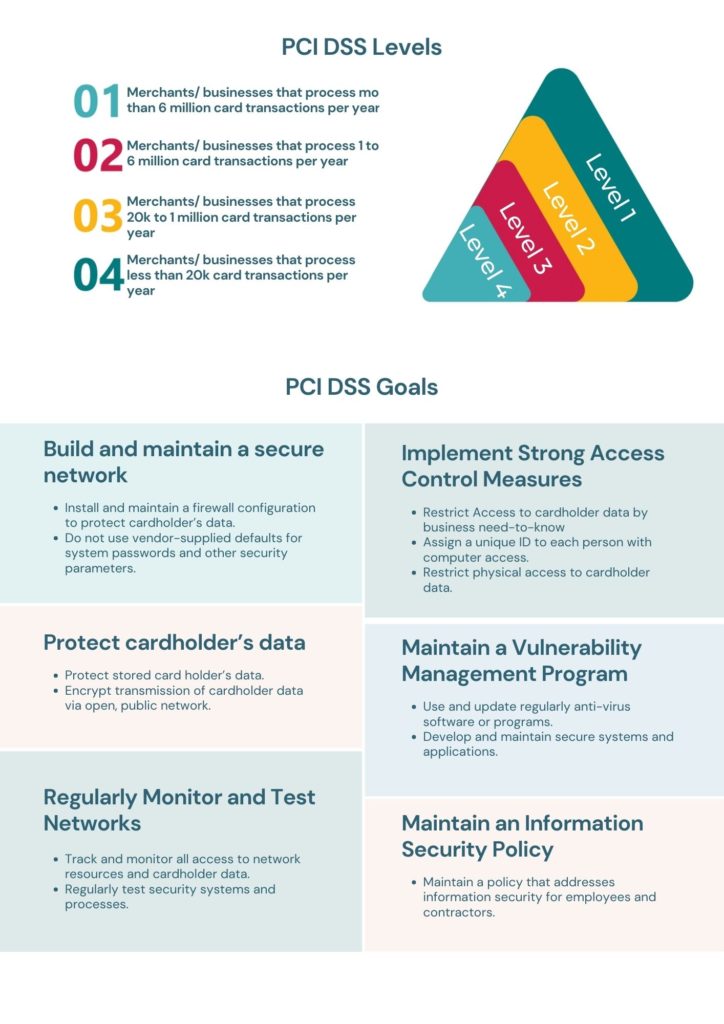

PCI DSS or Payment Card Industry Data Security Standards is a set of rules and regulations for managing cardholder data for online payment systems.

Also, PCI DSS has 4 levels and operates to maintain 6 goals.

3DS protocol –

3DS or 3 Domain Secure is an XML-based protocol that adds an additional layer of security for online card transactions.

As the name refers the protocol interacts with three domains, viz. merchant/acquirer domain and the issuer domain, and the interoperability domain.

Similarly, When the customer initiates the transaction, the Payment Gateway contacts the directory server to get an authentication status on the card.

PG redirects customers to a 3DS page for authentication by entering OTP.

3DS then forwards the authentication response to PG, based on the status, the customer gets notified of transaction success/ failure.

Two-factor authentication

Just like 3DS, 2FA also adds an extra layer of security for online transactions.

It is a two-step verification authentication process for the customer. The protocol has been mandated by RBI.

It uses a combination of what the customer knows and what the customer and only the customer knows, like username, password, and card details with OTP, biometrics, etc.

India’s direction on digital payment security control –

Along with the key developments like,

Setting up of the Regulations Review Authority

Relaxed KYC norms for video-based processes

Centralized Payment Systems to be opened up for non-bank entities

New Master Directions On Prepaid Payment Instruments and many more,

On 18th Feb 2021, RBI published the master director for a digital payment security control that discusses,

- Necessary security controls to protect and secure the confidentiality and integrity of the customer data and processes

- Availability of the infrastructure

- An appropriate review system

- The capacity of building and expanding with scalability

- Minimum disruption of customer service with increased availability of the system’s channels;

- Efficient and effective customer grievance resolution

- The efficient and effective dispute resolution system

But why care about online payment processing and security when Lyra is here to help you out?

All of Lyra’s solutions are SSL certified, EMV 3D2.0 secured and PCI DSS V 3.2.1 compliant, and are backed up with Lyra payment gateway – one of the most secured payment gateway in India!!

In conclusion, By offering a stable, robust one-stop-shop for banks, customers, e-commerce platforms, and all types of businesses, Lyra’s unique technology reduces transaction time and enables cost saving for its users, ensuring complete data security to acquirers and acts as a single gateway to handle multiple connections and multiple protocols.

So opt for Lyra today and leave your payment processing security concerns to us.

Follow Lyra India for more updates