Your key to secure eCommerce transactions

Today India is buzzing with eCommerce activities due to the challenges created by the pandemic.

Digital payments are at their all-time high and merchants are learning the importance of online transactions.

The pandemic imposed social distancing has boosted the use of contactless payments and pushed India further on the highway to become a cashless economy.

An ideal eCommerce platform must have its own shopping platform that offers, a wide range of products, easy navigation, quick checkout, flexible accessibility, and instant payments.

But to fulfill the need for a seamless shopping experience, you had to have an efficient and secured payment gateway!

As an eCommerce merchant, understanding how payment gateway works is a crucial part.

But not everyone has a technical background, the concept of online payment processing can be a little tricky to understand and one can get lost in all the technicalities.

To explain in the easiest way, payment processing generally comprises three essential elements,

first is the Payment Gateway, the payment gateway acts as a link between your shop website and the customers.

It allows the website to accept online payments. Second is the payment processor, the entity that collects the information from the payment gateway, authorizes and authenticates it, and transfers the funds from the customer’s bank to the merchant account.

And lastly, the merchant account, the account that holds onto the funds during the process and once the settlement is done, transfers it to the business account.

How does this work?

Though the whole process takes less than a minute to transfer funds from the customer’s bank to the merchant, a whole lot happens behind the scenes.

Let’s see how payment processors, payment gateway, and merchant accounts work together for an eCommerce business.

The transaction initiates when a customer clicks on ‘buy now or the equivalent button.

The payment gateway then secures this data and transfers it to the payment processor.

The payment processor checks with the card networks and ensures the authenticity of the transactions.

It sends the information to the issuer’s bank(customer’s bank). The issuing bank then checks the information and either accepts or declines the transaction and sends this status to the payment processor.

Based on the accepted/ declined status, the payment processor sends the result through the payment gateway.

And the payment gateway sends this message to the customer. If the transaction is successful, the bank settles the payment with the payment gateway and the payment gateway settles the funds with the merchant, notifying the customer that the transaction is successfully completed.

Want to know how payment gateway works more in-depth? Read here

Now that you know the basics, how would you choose a payment gateway?

Here are some basic checks,

- Transition fees associated with a payment gateway

- Sign up process for payment gateway

- Multi-currency support

- PCI DSS compliance

- How it handles sensitive payment information

- Terms and conditions of payment gateway on what type of services it supports for selling.

- Check for accepted payment modes, cards, wallets, etc.

- Check if payment gateway requires customers to fill in lengthy and useless information

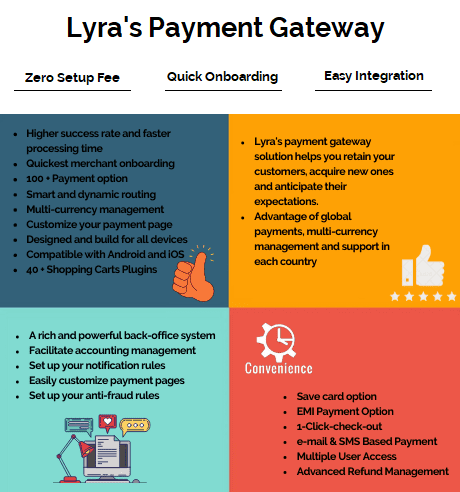

Or, you can go for Lyra’s Payment Gateway, a payment gateway that is tailor-made for your business.

Every business has its own requirements, keeping this in mind, Lyra offers a payment gateway that is unique and tailor-made for your business!

Your key to secure eCommerce transactions

Customers are rather afraid of online transactions as they doubt the security of sensitive payment information.

That’s why it’s important to understand the quality of your eCommerce payment gateways and how it offers real-time, secure encryption.

Lyra’s payment gateway is 3D secured, SSL layered and is in compliance with PCI DSS V3.2.1.

In addition to the compliance with the RBI and the government-imposed conditions on data security, Lyra also offers a fraud and risk management module and 24/7 support.

Here is a glimpse at Lyra’s Payment Gateway – your key to secure and seamless eCommerce transactions,