Higher Success Rate, Faster Processing

Higher transaction rates! – One of the most important things for any digital business?

Today we are living in the digital era, rapid digitization along with the social distancing norm has forced many businesses to go digital. This is proving to be good considering the numerous advantages of digitization. With the digitization of businesses, many of them started accepting online payments and for such types of businesses, high transaction accepting rates are all that matters. Anyone can get frustrated if online transactions don’t go through for one reason or another. The more the thwarted transactions the more is the cart abandonment risk and hence the risk of losing customers and brand loyalty.

Though many online payment processing solutions are available to choose from, merchants need to consider more than a handful of factors that play an important role along with the business infrastructure and a business-suitable payment solution. One such factor (often neglected due to lack of awareness) is routing. Considered one of the most crucial factors while considering a payment solution, routing directly affects your approval and thus conversion rates.

Let’s start from the basics. What is payment routing?

When customers make an online purchase and wish to pay for it online for the online transaction to go through, all components of the payment system must be in sync. The whole transaction process is not as simple as it seems. The complex process consists of several components and complex connections.

What are these components?

- Merchant bank

- Acquirer

- Issuing bank

- Online payment processing solution, etc.

The payment processing solution has to see that the transaction goes through without any glitches and as seamlessly as possible. Many times PSPs and fintech face multiple outages. They may face technical difficulties, malfunctioning software or hardware, connectivity issues, may it be for any reason, and outages can cost businesses financial losses. Many businesses opt for several payment processing solutions, making the transaction process more complex and vulnerable.

- If you work with a single payment solution provider, the glitch or downtime can directly affect your business.

- If you go with multiple payment providers, well both options have their own fair share of pros and cons, but managing multiple payment providers can be a difficult task.

This is where routing comes into the picture. When there are outages or connectivity issues, routing the transactions can result in a higher payment acceptance rate and in turn accelerate revenue growth.

When the customer initiates the transaction, the payment routing system routes the transaction to the best-acquiring bank using the optimized set of rules. If in case the transaction fails, it is routed through another acquirer in real-time making it successful.

Lyra’s Payment Switch

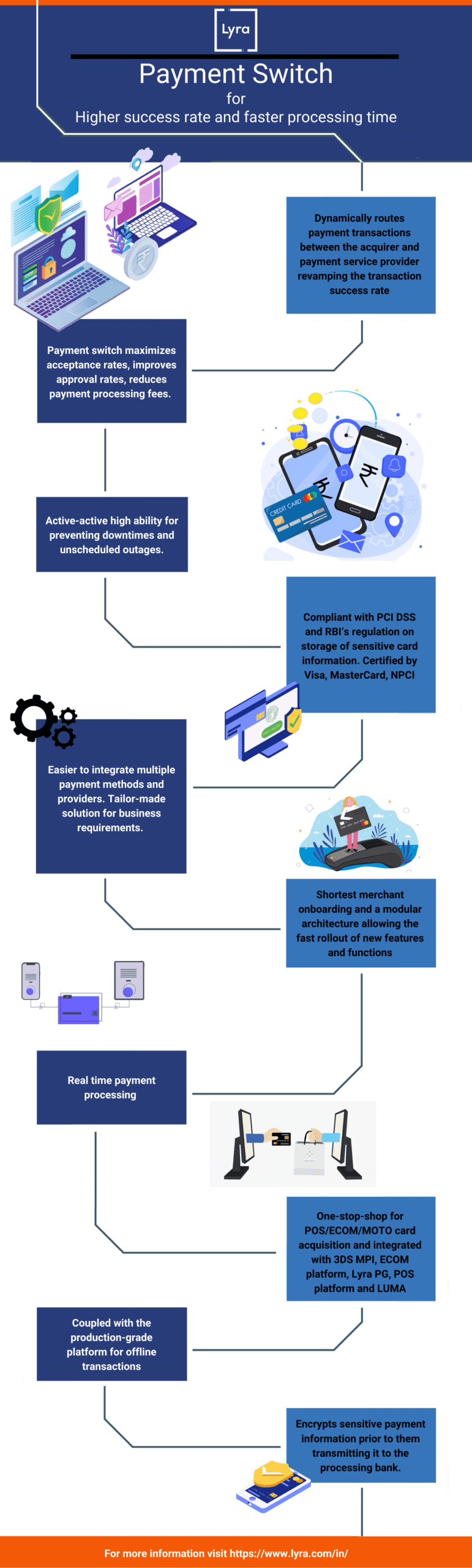

The routing happens between multiple endpoints including acquirers, PSPs, etc. Once the transaction is initiated, the payment switch accepts the payment request formats and sends the message to the suitable provider, gets a response, and sends the response back to the caller.

It is also a merchant-driven rules-based authorization and switching solution.

Lyra’s payment switch has a high-end ISO infrastructure. It saves merchants from connectivity and security issues while avoiding downtime and outages. Sitting at the centre of the payment process, Payment Switch dynamically routes payment transactions between multiple acquirers and PSPs. It basically acquires, routes, switches, authenticates, authorizes, clears, and settles transactions. The routing takes place according to the set rules. These rules include BIN, day and time, processing amount, declined transactions, etc. So, if the transaction is declined by one of the acquirers in case of an outage, the merchant can retry the same transaction by routing it to other acquirers.

In addition to the dynamic routing and switching, the payment switch also manages direct integrations and merchant configurations with the payment providers. It manages 3DS MPIs and facilitates real-time payment processing. With the direct connectivity with card schemes Coming with default connectivity platform to connect 3G, 4G, LAN, WiFi, PSTN, IP, devices, Lyra’s payment switch also supports a wide variety of traditional as well as modern services like POS, ECOM, SMS, DMS, MPOS, etc.

Lyra Payment Switch not only securely acquires, processes, clears and settles credit and debit card transactions in real-time, but it also offers High-end ISO switch infrastructure for online authorization/reversal and improves reliability with the real-time transaction process. To know more about this flexible connectivity platform contact our sales team today!