With the change in time and advancement in technology, the developed nations across the world are successfully synchronising with the digitisation of systems and operations on a daily basis.

Ever since government took initiative to promote businesses in India, youth in the country has become tremendously motivated to become self-employed, even more than before.

Along with the emergence of the trend of Make in India (self-employment), another booming industry is that of Digital payments.

With the digitisation of payments, government is adamant on sorting various issues relating to cash payments and is successfully doing so.

Now Digital India and Make in India are both going hand in hand since youth, not only prefers to be self-employed but also prefers a fast life which, daily transactions is a crucial part of.

Further, both the campaigns together constantly support women entrepreneurs in the country at varied parameters.

With the incentives and facilities in both spheres, women are being encouraged to successfully take ahead their businesses without getting into any hassle of receiving or making payments.

According to an article in Economic Times, PM Shri Narendra Modi said, “Today India is making tremendous progress in the field of digital infrastructure.

Broadband connectivity is reaching villages, over 100 crore mobile phones are active in India. 1 GB data is cheaper than the smallest bottle of cold drink. This data is becoming the tool for service delivery”.

Making it evident that Digital India is progressing and making the country savour and experience the flavour of online shopping even much more than before, government is actively promoting digital payments.

PM Modi also mentioned in the article by Economic Times about Make in India by saying, “We’re manufacturing quality products not only for India but for the world.

India is becoming a global hub, especially in field of electronics and automobile manufacturing. We’re rapidly moving towards being no. 1 in mobile phones manufacturing.”

For promoting digital payments in the country, various online start-ups, apart from digitizing physical stores/businesses, are imperative.

Whereas, for the online start-ups to be successful, secure, quick and convenient digital payments’ platform is necessary.

Indian digital payments’ sector has succeeded drastically from the time when failure rate of online payments would be recorded as 40% and it would take 60-80 seconds to process a transaction.

Contrastingly, now, the advantages of digital payments have surpassed the drawbacks and majority of the earlier glitches have been successfully resolved to make online transactions a success in the country.

Hence, with the advancement in technology, for processing each transaction, the record says it takes less than 10-15 seconds in today’s time.

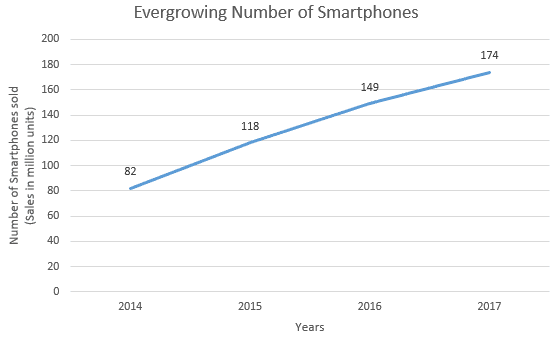

With the smartphones and broadband connectivity reaching every nook and corner, there has been a steep rise in the number of transactions done via smartphones.

The graph above shows the number of smartphones sold from 2014 to 2017.

With the penetration of more number of smartphones in the country, online transactions have gone from $86 million in 2011 to $1.15 billion in 2016.

Source: Economic Times

With the surge in online transaction across the country, it is but obvious that the demand for online purchasing has also gone up drastically.

With the demand for online purchasing, the supply of online shopping portals has gone up as the youth inclined toward being self-employed prefers to start an online business nowadays.

The advantages of digital payments are many for both owner of the business and its customers.

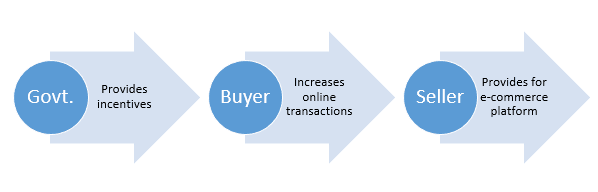

With various incentives provided by government sector for promoting digital payments, customers prefer buying online.

These incentives serve as the added advantage with other advantages of shopping online for the customers, like time saving approach, more convenient than handling cash transactions, safer, and helps to pay exact amount without any hassle.

Government provides for the incentives and promotes online transactions because it helps it keep tabs on each transaction.

This further prevents tax evasion and keeps illegal transactions at bay.

This has led to the provision of e-commerce platforms from many of the existing business owners and from the new entrants/start-ups.

Follow Lyra India for more updates or Contact us for more information