Why PCI DSS compliance is utmost necessary for your business.

Accepting online payments is the necessity for any business whether it is an online business or a physical one.

In this digital era, customers are getting quite comfortable with shopping and paying online for goods and services.

And with the pandemic altering our lifestyle, many of them are actually preferring online payments over traditional ones.

But when it comes to online payments, there is still not that much awareness among people.

Be it a lack of knowledge or plain ignorance, people are often afraid to use online payments. One of the main reasons is ‘security’.

Every business that deals with online payment acceptance need a payment solution provider.

Now, there are a lot of points and features to consider while getting a payment processing solution for your business.

Here are the guidelines to choose a payment processing solution that will suit your business.

And one of the most important features to consider comes in the form of – you guessed it ‘security’.

With increasing online fraud and cybercrime, it is evident that customers may get afraid of using online payments, it deals with their financial and personal information after all.

And when it comes to personal and financial details no one will try to use the payment method that he/she feels will compromise with their personal details.

The government and RBI have come together to create and maintain the security guidelines for the payment solution providers.

These guidelines and rules mainly concerned about data privacy and safety. One such compliance is PCI DSS.

What is PCI DSS?

PCI DSS stands for ‘Payment Card Industry Data Security Standard’. It is a set of security guidelines standards for credit and debit card transactions against data theft and fraud.

Formed in 2004, Visa, MasterCard, Discover Financial Services, JCB International, and American Express are the main players to participate in the formation of this standard.

PCI DSS is governed by the Payment Card Industry Security Standards Council (PCI SSC). It is considered to be the best way to secure and protect card sensitive data which in turn can help the business to build long-lasting and trusting customer relations.

Why do my business needs PCI DSS compliance?

PCI DSS compliance assures the customer’s safety about their card data and that the business (in compliance with PCI-DSS) is safe to transact with.

A little more about PCI DSS

PCI DSS compliance has 4 levels. These levels are based on the card transactions business processes per year. The levels are as follows,

Level 4 – Merchants or businesses that transact (card transactions) less than 20k transactions per year are eligible for the level 4 PCI DSS compliance.

Level 3 – Level 3 PCI DSS compliance applies to the businesses/ merchants that process 20 k to 1 million card transactions per year.

Level 2 – Merchants or businesses that process 1 to 6 million card transactions annually are eligible for level 2 compliance.

Level 1 – Merchants/ business that processes more than 6 million cards (credit/debit) transactions per year are eligible for level 1 PCI DSS compliance.

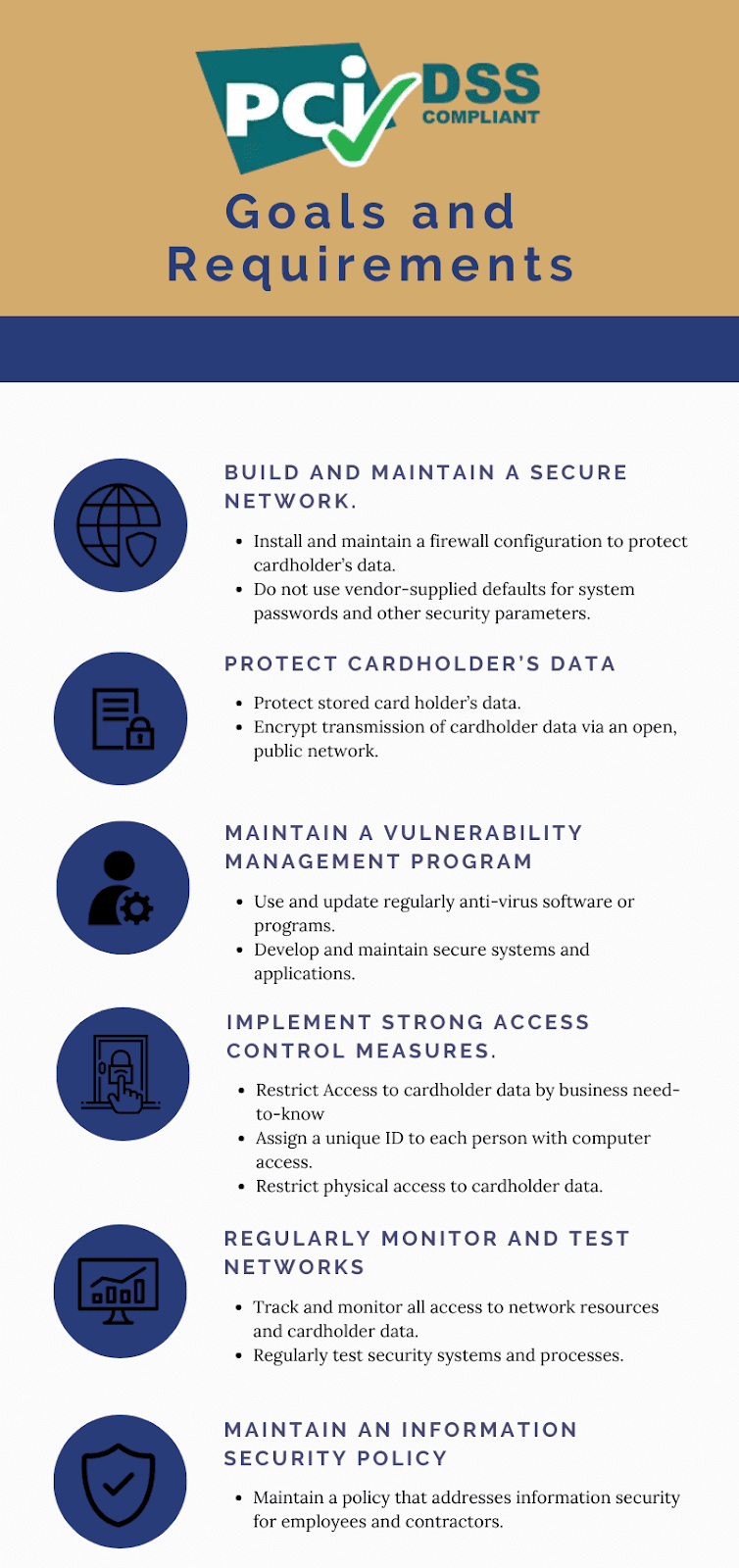

Here are some requirements mentioned under PCI DSS that a merchant has to follow –

If the business is not PCI DSS compliant, it cannot avoid the data breaches that can lead to heavy damage to the brand reputation.

The main goal of the standard is to protect the sensitive card information. Knowing the merchant is PCI DSS compliant gives customers the satisfaction that their data and privacy is safe and protected.

But, getting PCI DSS compliance is not an easy task. It can be quite a lengthy process and can take weeks to complete.

Merchants don’t want their customers to wait for that log (and obviously it will be bad for business).

So the simple solution for merchants is to get a payment processor or provider that offers PCI DSS compliant solution.

Want a PCI-DSS compliant payment solution for your business?