Digital payments have spread – But have the Rural areas got covered?

Ever since digital payments have got a nudge in India post demonetization, there has been a steep rise in the acceptance of the same.

Be it the end-users or online businesses, both the sections are enjoying the benefits of an extremely secure, convenient, and quick payment method.

This method of transacting is the new obsession among the masses and is vital for the growth of the economy as a whole.

Rural India, being the sector with 83.3 crore Indians residing in it, makes up for the majority of the country’s population.

This is the reason for needing to provide push the digital payments in rural areas considerably.

Hence, the emphasis is not only on making digital payments a prominent aspect of rural areas in India but is also on increasing financial inclusion.

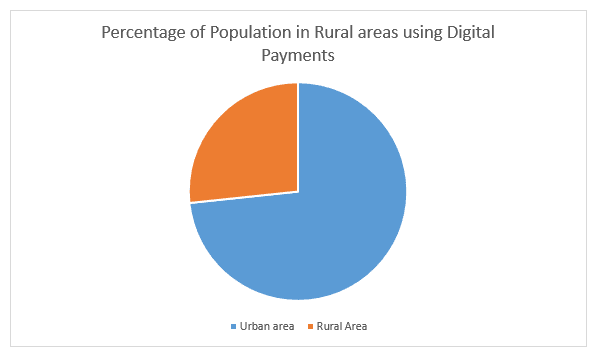

The pie chart above shows that 16% of people in Rural areas have adopted digital payments against 44% of the population in Urban areas having completely accepted the same.

Even though it is only 16% of the population has adopted digital payments, it will be a further push to the entire economy once Payment gateways are available across the sector.

Factors that favour Payment Gateways for Rural India

Here is the list of factors that favor Payment Gateways for Rural India, since rural sectors have advanced significantly:

- Internet Penetration in Rural India is making a way for Payment gateways’ Penetration

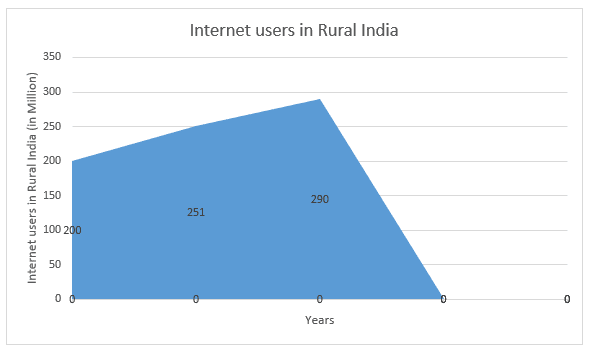

According to a report by livemint, India’s internet base had crossed the 500 million mark in December 2018, which signifies that there has been a considerable rise in internet usage by the rural population.

In the entire population, it turned out that 200 million are active users of internet facilities in rural areas.

In addition, recently, it was found in a report that the digital adoption is going ahead further and internet users in rural areas have gone up by 35%.

Hence, according to the estimation, there are around 251 million internet users in rural India now. This is also expected to go up to 290 million by the end of 2019.

The graph above shows how gradually internet users in Rural India have gone up, from 200 million in the early survey (2018) to 251 million in December 2018 and are expected to rise up to 290 million by end of the year 2019.

This is a clear indication of advancement in rural India, and thus, payment gateways’ penetration is only expected to serve as a much-needed inclusion.

- Small Businesses in the Rural sector

One major factor supporting Payment gateways’ inclusion in rural areas is the existence of small businesses in these areas.

With Digital wallets as well as government-initiated apps like UPI (Unified Payments Interface) solution, demand for payment gateway in rural areas has gone up considerably.

The businesses in these areas strive to find an apt means to collect payments for them.

Different payment options that payment gateway provides can help small businesses receive payments from their customers.

Besides, a small online business in the rural sector can receive payments from across the globe with a payment gateway.

Such ambitious business owners need to be encouraged by equipping them well with payment instruments, which in turn, will only help India grow.

By providing access to these businesses, payment gateways can make the functioning of the same much better.

Besides, the level of transparency, as well as security, are much higher with a payment gateway. Small businesses can grow leaps and bounds with a facility that has become an everyday routine for people residing in urban areas.

- Unbanked have become banked lately

Very recently, in a survey by the government in February 2019, it was found that 34.3 crore accounts have been opened under the Pradhan Mantri Jan Dhan Yojna (PMJDY).

Contradicting the earlier survey results in 2014 and later, this was an extreme level up for India.

In rural areas, as more people opened their bank accounts, it is more feasible for them to utilize payments method.

Furthermore, according to money & banking, banks provided 230 million debit cards to facilitate electronic payments to the masses.

- A need for pushing the economy toward being paperless

The inclusion of a payment gateway goes beyond making transactions simpler, quicker, and more convenient.

Apart from making businesses in rural areas equipped with the services that payment gateway offers, it is also crucial to make the economy more eco-friendly.

Being paperless also makes the processing of bills and other tasks more convenient as well as quick.

Scope of Payment Gateway in Rural India

Since the rural area was lagging behind, the government made efforts, which is visible in the initiative to make one-lakh villages Digital villages over the next five years with Common Service Centres (CSCs). It, being a public-private initiative, is aimed at offering excellent digital services to the villagers.

According to the Ministry of electronics and information technology, the Digital Villages initiative will initially cost over Rs420 crore ($62 million) and, along with basic internet access, will provide avenues for interactive telemedicine and educational sessions.

“The project is a public-private partnership and will be driven through the common service centers (CSCs).

With applications introduced by the government like BHIM UPI, UPI, IPPB, M-payments & NFC payments in Rural India, the scope is quite expansive. Post-demonetisation, efforts have been made not only for urban India but also for the rural part of it.

Rural India, being really an integral part of the economy, has witnessed several efforts to be included in the digital wave.

It is quite evident from the internet penetration in rural India, that mobile phones have become a success, and banking in the unbanked that the Rural sector is going to grow further successfully.

Also read,

Contribution to Digital Villages – Advancing Bharat

Contribution to Digital Villages – Advancing Bharat The digital sector is known to evolve with the advancing technology to get better with time...