What are Mobile Payment ? What are the different types of Mobile Payments? What is the future of Mobile Payments?

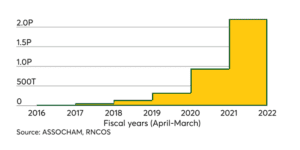

Demonetization led by the digital India campaign and the government’s support for digitization leads to an immense increase in digital and mobile payments.

As mobile is becoming an inseparable part of our lives, online payments through mobile fit perfectly with the lifestyle and are becoming more popular.

Indian economy is on the verge of becoming cashless and merchants play a big role in this. Considering the trend of online payments and the internet, shopping is never been so easy.

Merchants are providing a complete, customized, and unique shopping experience, from browsing to payment via mobile.

This article is all about mobile payments, trends, advantages, and their future.

What are Mobile Payments?

If we go by the authentic definition, mobile payments are transactions done through mobile devices. So, instead of using cash, you can use mobile applications for online payment of any goods or services. It allows you to transfer funds digitally.

Why use Mobile Payments?

The statistics show clearly the rapid increase in mobile payments and as we are moving forward to the digital world this trend is here to stay.

With mobile payments, merchants can track customer trends and at the same time keep a check on the inventory. By tracking the orders and analyzing the behavioral pattern of customers merchants can understand what the market requires and accordingly can boost marketing strategies.

Mobile payments are indeed very convenient for customers. They make it easy for customers to pay. Instead of using physical cash, or making efforts to pull out a credit card, customers can easily pay for goods and services comfortably with just a mobile device.

Mobile payments give merchants an opportunity to connect with customers more personally, understanding their requirements. Merchants can engage with their customers throughout the shopping journey. This can without a doubt increase conversions and brand loyalty.

Mobile payments can reduce the overhead costs for purchasing and maintaining bulky physical devices like POS systems. In the form of online invoicing and online billing, it also saves paper.

Mobile payments offer an extra layer of security. They eliminate the need to carry physical cash, cards, etc. Mobile payments use biometric authentication and along with the mobile phone’s security like pattern or pin or fingerprint authentication, it provides an extra layer of security.

Generally, mobile payments use tokenization replacing sensitive cardholder information with tokens that are hard to hack providing security measurements for customers as well as merchants.

Last but not the least, mobile payments are fast. There is no need to search for cash, exact change, credit cards or to wait till the card authentication. With a user-friendly interface and seamless experience, mobile payments can be done with just a few clicks.

How do mobile payments work?

Mobile payment is a general term. There are usually many different types of mobile payments that can be categorized based on the technology used in the type of payment.

Contactless payments also known as in-store payments are the type of mobile payment that uses devices like M-Pos or scanner receiver machines for NFC payments.

Merchants can also use their mobile devices to accept card-based payments. M-commerce an evolved form of e-commerce offers customers the to make a purchase online through m-commerce applications and pay via mobile phone.

Types of mobile payment

SMS-based payments – These types of mobile payments used text messages or SMS to pay for goods or services. Generally, SMS-based payments are used for micropayments. SMS-based payments are simple and convenient. They can cover a large base of customers. A customer just has to send an SMS to get access to a premium account and order goods or services. Charges for this are handled by the mobile carrier and the cost is deducted from a prepaid balance or billed monthly according to the carrier plan. So, customers do not necessarily need a credit card or bank account for such payments. One of the disadvantages of SMS payments is unreliability, as messages can get lost. SMS payments can be slow and setting up this method can cost merchants some overhead amount.

Direct billing – Direct mobile billing is an option that can be used by a customer during checkout. To make a payment, the customer’s mobile account is charged. This method is equipped with a 2FA i.e. 2-factor authentication which generally includes PIN and OTP. Direct billing via mobile is a fast, easy, and convenient method of mobile payment.

Mobile web payments – Merchants provide customers with a web store (web page) or applications installed in the mobile device to make payments. Mobile web payments use wireless application protocol technology. This is an instant mobile payment method and convenient for customers as it involves online web pages for making a payment.

QR Payments – This type of mobile payment method uses square bar codes also known as QR codes for making a payment. QR codes can either be presented by the merchant or the QR code displayed on the mobile screen of customers can be scanned by the merchant. QR code payment is easy to implement with little to no overhead cost. They are reliable, secure, and very easy to use.

Know what is QR Code Payment and How does it Work?

NFC payments – Near Field Communication technology is used for such types of payments. NFC is integrated with most the mobiles nowadays. By placing the device over the NFC reader module these payments can be done. NFC payments are convenient and can be used for all types of payments. These types of mobile payments use PINs and hence can be considered more secure.

Link-based mobile payments – Link-based mobile payments are easy and secure. The merchant sends a payment link to the customer via any messaging or social media application. The customer just has to click on the link and then can initiate an online payment

Know more about payment links

What’s the future of mobile payment?

Mobile payments have revolutionized the payment scenario with their security and convenience. Nearly all sectors are adapting to mobile payments and payment solution providers are trying to implement faster and more convenient ways to make transactions via a mobile device. Fast-growing countries and the rise of m-commerce can play a vital role in the development of mobile payments

Boost Your Business

Use Mobile Payment Solutions by Lyra