All About the Transaction Approval Rate and How to Increase It

What is the one hidden challenge for online stores? higher payment decline rates!!

That’s right if your online store is generating a good amount of revenue but still but at the same time, your business may be missing out on a very fair amount of money due to declined transactions.

What’s more, is transaction decline rate not only hurts merchant reputation but can also affect the overall health of business very deeply.

As online payment methods are becoming an essential part of our new lifestyle, merchants need to manage transaction declines efficiently.

Here is all you need to know about the transaction approval rate and how to increase it

What is a transaction approval rate and why does it matter?

Simply put, the transaction approval rate is the result of dividing a total number of approved transactions by the total number of attempted transactions over a fixed time period.

The transaction rate actually tells you how much you are losing because of declined transactions.

When you are spending a decent amount of funds to attract the customer to your shop, it is only discouraging and aggravating when customers change their minds if the transaction gets declined.

Customers may not know the reason behind the decline, but it can harm your business just as much.

Now tracking the decline transactions may actually improve your sales numbers.

By doing detailed research and basic root problems for the decline, you can save your business from getting charged with more merchant fees for declined transactions.

Types of declines

There are typically two types of declines –

Soft declines – When issuing bank approves the transaction, but the transaction fails middle ways, it is identified as a soft transaction.

For example, If there are not enough funds in the customer’s bank account, the payment processor declines the transaction.

This is known as a soft decline.

Some more reasons for a soft decline –

expired card

unusual purchase

declined by the processor

Mismatching of IP address and billing address

Suspicious cross border transactions

With soft declines, the failure is temporary, while the card is still valid, and something in the middle goes awry, the transaction can be still resubmitted.

Hard declines – In case if the issuing bank declines the transaction, the decline identifies as a hard decline.

These declines call actions from the cardholder being the permanent authorization failures. Some of the reasons for hard declines are –

Stolen card

Invalid card

Closed account

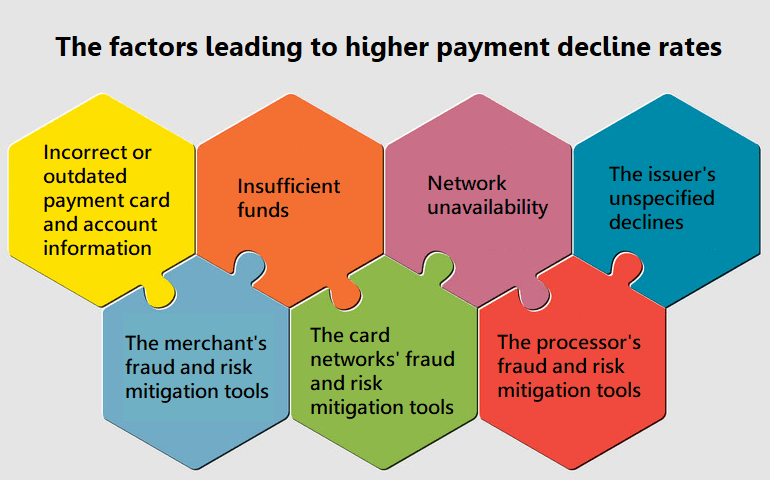

Some typical decline reasons –

Card Type Rejected

Cardholder’s data mismatch

“Do Not Honor” Declines

Expired cards

Fraud/Risk Mitigation Tools

High-risk industry or transaction categories

Out-of-region payments

Customer account changes

Outdated technology

Large Ticket Orders

Incorrect Account Information

Insufficient funds

International Charges or Currency Does Not Match

Technical Issues

Poor fraud screening

How to drive transaction approval rates high

- Data-informed services

Many payment processing service providers offer data-informed and driven services. These payment processing solution providers have access to a large set of data and applying data to authorization attempts improves approval authorization which eventually can help to achieve better approval rates for your business.

- Automatic card updating process

By using an automatic card updating process, approval rates can be improved. This significantly boosts the approval rate by allowing merchants to submit the transactions using original information obtained from cardholder while the processor uses this information for authorization.

- Get big data insights

Data is everything when it comes to approval rate, by using big data analysis, you can measure how efficient your payment processing is and how your payment processing is performing. Big data insights can also help you to identify other problem areas and develop proper solutions.

- Choosing a payment solution provider

Your payment solution provider should enable you to identify the causes for decline rates and should offer a reliable solution to them.

If the payment solution provider itself is causing the problems or holding you back causing losses, it’s time you have to search for the replacement.

The payment solution provider should follow all the regulatory standards and should offer a powerful fraud prevention tool. A payment service provider should be PCI DSS compliant and should provide tight security for transactions

- Your customer base

If your business deals with international clients, you have to optimize your online payment processing for international business.

Thorough research of your customer base and checking if the declined transactions tend to originate from overseas, you have to consider changing the functionality of your payment processing solution.

Your business would need an efficient payment solution provider that can capture transactions from where your customer base belongs. In conclusion, if your business is accepting online payments, you have to make sure that the online transaction process is smooth, effortless, and as frictionless as possible.

You can decrease the decline rates by using effective solutions. Increasing transaction approval rates means increasing your online revenue.

Want a payment service provider that offers a strong fraud and risk management tool? Get started by contacting us!