Financial inclusion has stirred up many sectors’ evolution and the banking sector is not an exception. The growth in the digital banking sector has given customers better choices providing them with convenience and seamlessness.

These days there is a variety of new applications, and new trends emerging and neo banking is one of them. Neo banking in India is taking over fintech considerably fast on national and on global levels.

Neo banks have changed the banking landscape and keeping in mind customer loyalty and revenue growth, many fintech services are rethinking the way they do business.

So what is this neo banking, and how is it changing the financial scenario?

What is Neobank?

Neo bank is a virtual bank. A bank without any branches. A bank that is entirely online rather than being physical. Neo banking provides a complete digital banking experience through mobile applications.

With the main goal of providing a seamless customer experience, neo banks provide solutions in ways traditional banks can not.

Neo banks are cheaper, and faster and they can integrate the entire financial portfolio in one single platform.

Neo banks offer financial services including:

- Opening accounts

- Payment and money transfer

- Loans

- Other services, including budgeting, etc

Along with the explosion of mobile technology and financial inclusion, there is a massive drift in the financial industry. Indian customers are embracing digital means moving away from physical cash.

The number of digital solutions is increasing rapidly as customers are making themselves comfortable transacting digitally.

The integration of technology and banking services has changed the banking industry making transactions more customer-oriented.

At the same time, chatbots and AI are making it possible to analyze customer patterns, credit history, and other data to create realistic data models for recommending financial services based on their lifestyle choices.

In a way, Neobanks are providing a fluidity that traditional banks can’t. It is just convenient and easy to operate a mobile application that is managing their money and helping them with various decisions.

All about the Benefits of Digital Payments

All about the Benefits of Digital Payments India has always been extremely comfortable with the traditional method of making payments, which is...

How does a Neo bank work?

Neo banks are very different from traditional banks in every aspect and their business model is not an exception. A business model on which a neo bank works is altogether different from a traditional bank model.

As aforementioned, neo banks are customer-oriented and provide personalized or more customized services. As they are fully digital, technology plays a vital role in the working model. Neo banks mostly work on the decision-making model which is driven by data-based decisions.

They collect and analyze data, understand the patterns, try to calculate how their customers behave, and then create predictions/results.

How does a Neo bank differ from a traditional bank?

Fundamentally, neo banks are different from traditional banks in every aspect from business models to customer care. Here are some points for Neobank vs. traditional bank

As aforementioned, traditional banks have a physical banking service platform and branches, whereas, neo banks are fully digital mobile applications (with no branches). Traditional banks need additional overhead costs (ongoing costs on rents, electricity, etc) which they collect from customers in the form of services like a bank statements, bank alerts, etc.

Whereas neo banks have few costs and are transparent. Neo banks have either no, partial, or full banking license, whereas for traditional banks a full banking license is a must.

Any approval process (opening account, etc) is lengthy in the case of the traditional bank as it is fully manual. Neo banks make this tedious task automatic and quick.

Neo banks’ customer support relies on a combination of chatbots and AI providing flexible, virtual, online support whereas traditional banks rely on in-person or telephone for customer support.

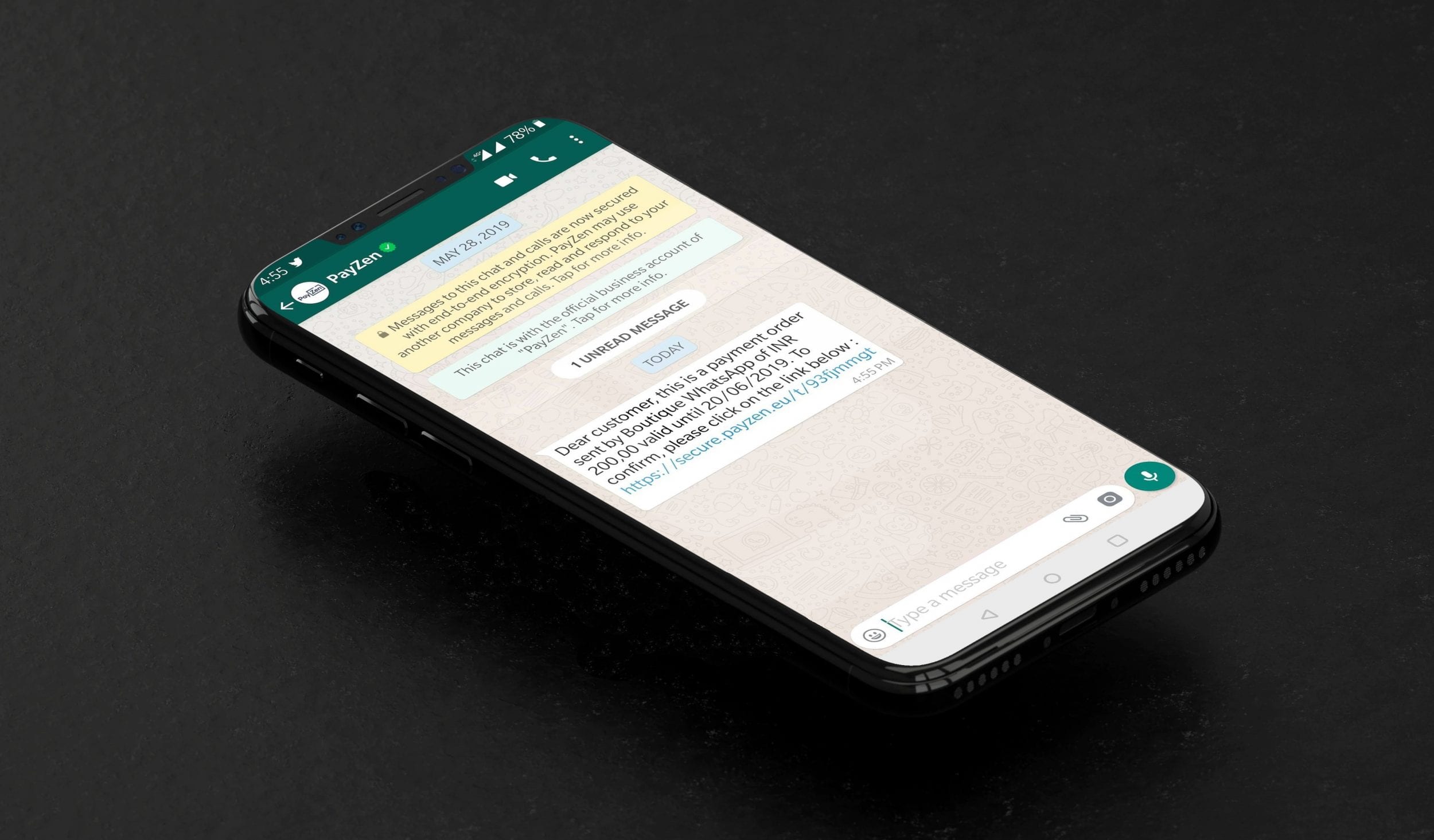

What is Whatsapp Payments & its top 9 features

For the first time in India Lyra has introduced an extremely convenient and on-the-spot online payment collection solution – Lyra WhatsApp Payment...

What are the Advantages of Neo banking?

Since neo banks are completely digital, they open up a wide window of advantages to a customer. Here are some key advantages:

Hassle-free account creation

Everyone knows and has gone through the pain that is creating an account in a traditional bank. Sure, this process had become more simplified, but still, the rigidness is not completely gone. Creating an account with neo banks removes this tediousness completely.

As mentioned, neo bank is a completely digital bank, thus eliminating the possibility of a storefront. So, users can create an account without going anywhere.

Neo bank functions fully on mobile, making this process comfortable and the account gets ready in a very short amount of time.

Seamless international payments

With traditional banks, there is always this line differentiating how we transact nationally and internationally. We may need to upgrade the current debit/credit card or get altogether a new card to transact internationally.

Neo banks overcome this disadvantage and allow transacting nationally and internationally with current exchange rates.

User-friendly interface

As mentioned above, neo banking is all about customer experience. This customer-oriented banking facility provides an extremely user-friendly interface that is easy to understand and operate. Neo banking apps are responsive, crisp, and are well designed according to the need of customers.

Service Speed

Neo bank transactions are real-time and immediate. It provides you a dashboard with an overview of every transaction and up to date balance. It also helps you manage your finances, expenses, and savings and can be customized according to your requirements.

Lower Fees

One of the disadvantages of the traditional bank is its high operating cost which often comes in the form of charge for services like account statements, transaction alerts, etc.

Sometimes, customers end up paying more for charges. Neo banking eliminates this. It operates digitally and makes a wide range of services available for customers with just a few clicks.

There is no physical infrastructure, maintenance for physical branches, and ATMs in the case of Neo bank, which saves additional charges. Neo banks offer their basic services free of cost.

Skipping on all the extra service charges, neo banks make themselves a great and promising alternative.

Value-Added Services

Banking is not only about payment transfer anymore. Neo banks use account information, customer data, patterns, etc. with AI and recommend other financial services for customers as per their needs.

Neo banking application backs up its recommendation with the statistics and insights displayed on the interface.

Neo banks leverage customer profits, recommend services based on demographics, and make it easy for customers to make their own investment decisions.

Advanced Security Features

Security is and always will be the most concerning factor when it comes to digital transactions. Neo bank application implements 2FA (2-factor authorization), Biometric verification, RBAC (Role-Based Access Control), encryption technology along with other security measures to protect customer data.

The applications are built to ensure compliance with anti-money laundering laws, complete privacy of customers, and to prevent malware attacks.

What is Payment Switch - Working, Architecture, Features, and Benefits

What is Payment Switch - Working, Architecture, Features, and Benefits Simply said, Payment Switch is a tool that facilitates communication...

What’s in it for businesses?

Businesses deal with tedious processes involving payments regularly. Neo banks save manual efforts and time at the same time while providing useful business insights and financial statements and analysis.

In short, they are also of great use for businesses.

No more spending hours and hours with some rigid and complex software!

Neobanks are great for businesses, too!

In India, Neo banks are already on the rise and they are disrupting traditional banking models. Becoming the future of banking, their popularity has increased in a relatively short span of time.

Neo banks can play a key role in making India digital and providing customers with a detailed, analysis-oriented all in one kind banking experience.