Hosted Payment Page

If you own an eCommerce business, you must know that one of the key points that affect customer loyalty and cart abandonment is the checkout experience.

And with checkout experience, inevitably comes the payment page. When it comes to online payment processing, businesses want to build a payment page that allows customers a safe, secure, and easy way to make online payments.

One such feature is a hosted payment page, one of the most common ways to accept online payments.

A hosted payment page is a feature also known as external or a third party checkout.

What is a payment page( hosted )?

In simple terms, a hosted payment page is a third-party web page set up by the payment gateway that a customer gets redirected to for the checkout.

The external checkout page enables customers to enter the payment information and proceed securely to the online payment.

Payment facilitator/ solution provider designs develop, maintains, and hosts the payment page

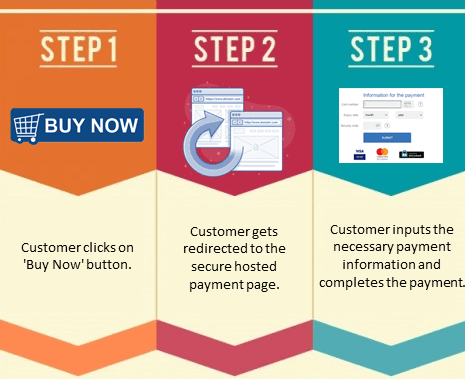

How payment page (hosted) works?

When a customer clicks on the buy now button, he gets redirected to a secure payment page, i.e. hosted payment page to continue checkout and payment by entering necessary payment information.

Things to consider when choosing a payment page –

A hosted payment page is considered to be one of the most preferred ways to accept payments.

However, it is also one of the key points which are responsible for cart abandonment. So choosing a payment page can be proved as all or nothing for the business.

Here are some pointers you have to consider while choosing a hosted payment page.

Integration – as aforementioned using a payment page saves your time, money, and effort, as it is a ready-made service from a third party.

So, it is pivotal, that the payment page is easy to integrate and requires minimum to no effort from your side.

Payment methods – Today, payment using credit or debit cards is not the only option. Customers are getting comfortable with the various alternative payment options and are preferring to use them.

They find these alternative online payment methods like digital wallets, UPI, etc. more secure and convenient.

So, choosing a payment page that can give you an option to integrate these alternative online payment methods will be a major plus for the business.

International presence – If your business deals with clients globally, you have to opt for a hosted payment page that allows online payment acceptance worldwide, the one that supports multiple languages, multiple currencies, and different card brands and payment methods used in different countries.

Security – You are thinking of integrating a payment page which means, you are going to accept online payments.

And if you are accepting online payments you have to make sure that all the online transactions are secure.

The payment page you get from the payment provider should be in compliance with the government’s security standards.

User Interface – A payment page is where the customer will get redirected for making a payment, so, it is crucial that the page should be user-friendly, easy to understand, and well organized.

It should be simple, clean, and with clear indications for customers about how to proceed with the checkout.

Providers offer a variety of different modes or types of predefined payment pages, some can design as per the merchant’s requirements.

While choosing a payment page you have to make sure that the page is mobile responsive as mobile shopping and payments are becoming popular.

All in all, you have to consider what your business module and infrastructure needs and choose a payment page accordingly.

Lyra’s hosted Payment Page –

- Different payment modes – eg. immediate payment, deferred payment, installment payment

- 3DS2 authenticated

- Risk analysis

- PCI-DSS compliance

- International payment options

- seamless integration

- multiple payment methods

- Customizable

Read about latest trends, news and fintech updates here