What is Payment Gateway?

A payment gateway is an online payments service that, when integrated with the e-commerce platform, is devised as the channel to make and receive payments.

The procedure to receive payments includes the customer requiring to fill in some details, like credit/debit card number, expiry date, and CVV.

Post this, the customer proceeds to make a payment, which then, gets transferred from the buyer’s account to the seller’s (merchant’s) account.

What is the Role of a Payment Gateway

The main role of an online payment gateway is to approve the transaction process between merchant and customer.

It plays a vital role in the online transaction process and authorizes transactions between merchants and customers.

It helps the e-commerce platform aggravate its existence with ease of payments to offer to its customers.

Besides, it also leads to the e-commerce platform gaining rapport for leading to not only quick and secure payments but also convenience and success with the same every time.

A payment gateway service can be provided by banks directly or a payment service provider authorized by a bank.

How Does Payment Gateway Work?

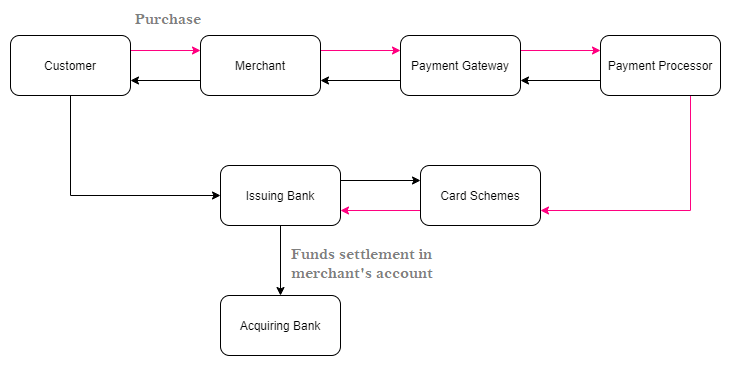

Straight away coming to the functioning of an online payment gateway, it follows a procedure for settling the payment every time.

This happens when a customer places an order for a service/product from a payment gateway-enabled merchant.

From filling in the card details to payment finally flowing into the merchant’s account and settling, the payment gateway passes through a variety of steps-

STEP 1: After the customer places the order online and proceeds to make payment for the same, he/she needs to enter credit/debit card details.

STEP 2: The card details are encrypted in a secure way with Secure Socket Layer (SSL) encryption to be sent between the browser and the merchant’s web server.

A payment gateway eliminates the merchant’s Payment Card Industry Data Security Standard (PCI DSS) compliance obligations without redirecting customers away from the website.

STEP 3: After this, the merchant forwards transaction details to their payment gateway, which is also an SSL encrypted connection to the payment server hosted by the payment gateway.

STEP 4: The payment gateway converts the message from XML to ISO 8583 or a variant message format (format understood by EFT Switches) and then forwards the transaction information to the payment processor used by the merchant’s acquiring bank.

STEP 5: The payment processor forwards the transaction information to the card association (I.e.: Visa/MasterCard/American Express).

STEP 6: Next, the credit card issuing bank receives the authorization request, verifies the credit or debit available, and then sends a response back to the processor (via the process same as for the authorization) with a response code (i.e., approved or denied).

The response code also helps to communicate the reason for the case of a failed transaction, for example, insufficient funds, and so on.

STEP 7: The processor then forwards the authorization response to the payment gateway, and the payment gateway receives the response and forwards it onto the interface used to process the payment.

This process is termed Authorization or “Auth”. This entirely takes around 2-3 seconds in general.

STEP 8: The merchant then fulfills the order and the above process can be repeated but this time to “Clear” the authorization by consummating the transaction.

Typically, the “Clear” is initiated only after the merchant has fulfilled the transaction (I.e. shipped the order).

This results in the issuing bank ‘clearing’ the ‘auth’ (I.e. moves auth-hold to a debit) and prepares them to settle with the merchant acquiring bank.

STEP 9: The merchant submits all their approved authorizations, in a “batch” (end of the day), to their acquiring bank for settlement via its processor.

This typically reduces or “Clears” the corresponding “Auth” if it has not been explicitly “Cleared.”

STEP 10: The acquiring bank makes the batch settlement request of the credit card issuer.

STEP 11: The credit card issuer makes a settlement payment to the acquiring bank (the next day in most cases).

STEP 12: The acquiring bank subsequently deposits the total of the approved funds into the merchant’s nominated account (the same day or the next day).

This could be an account with the acquiring bank if the merchant does their banking with the same bank or an account with another bank.

Ten Payment Gateway Terms Entrepreneurs Must Know

Ever since demonetization struck the economy, digital payments have become the most preferred... Ten Payment Gateway Terms Entrepreneurs Must Know

28/05/2019

Payment Gateway Architecture

What to look for in a Payment Gateway? – How To Pick The Right Payment Gateway For Your Ecommerce Website

Any business that collects online payments or accepts credit/ debit card payments, needs an online Payment Gateway.

It’s important to research and find the correct payment gateway provider that fits your unique needs.

A payment gateway should offer numerous benefits, namely, quick settlement of payments, the hassle-free flow of transactions, and a superb overall experience every time.

So, what more is there to look for in a Payment Gateway?

- Security: A secure transaction is a first and foremost need for any business that collects payments online. Customers must trust in the transaction and that their personal and financial information will be safe while online transacting. It should ensure the security of the information a customer put in. Such a service should be compliant with PCI standards.

- Customer experience: A payment gateway should provide unique and swift payment processing and payment customization. It should be mobile optimized, secure and convenient which will provide customers with a seamless shopping experience.

- Worldwide Payment Acceptance: We live and work in a global market. A payment gateway should support multi-currency transactions

- Merchant Onboarding: A payment gateway should provide the quickest merchant onboarding, as online transactions are a primary need in today’s world. The processing and setup fees and rates should fit in the merchant’s budget.

- Payment Options: Last but definitely not least, a payment gateway should offer multiple payment options. A customer should be able to choose a payment method he/she is most comfortable with, be it Credit/Debit Cards, Netbanking, Mobile Wallets, UPI or any other.

Think you need a Payment Gateway – Talk to our Experts

Here are some ways with which a payment gateway keeps information secure

Security for merchants and security for customers:

A payment gateway ensures the security of the information you put in. Here is a list of things that an online Payment Gateway does to keep your data safe:

- The standard security protocol used in online transactions is SSL(Standard Security Layer) It protects sensitive card information and authenticates the customer’s identity. A payment gateway with SSL can be identified by checking the ‘https’ at the beginning of the web address.

- To authenticate customers and merchants an additional layer of security can be implemented under the 3ds(Three-Domain Secure) protocol. This is a messaging protocol developed by EMVCo.

- Data encryption is one of the most important security measures in the payment gateway, where the data appears scrambled and illegible to anyone but you.

- Another unique way for a secure transaction via payment gateway is tokenization, where sensitive card details are replaced by a string of encrypted characters

Read More: What is 3DS (3 Domain Secure) Payment Gateway?

Benefits of payment gateway

Gone are the days when, a Payment Gateway was used to be a tool for transferring money, now a Payment Gateway can do a lot more than that, want to know? Here is a glimpse:

-

White label

-

Fraud and risk management

-

PCI DSS Wallet

-

API tools for easy integration

What are Payment Gateway Charges

Charges for payment gateway generally depend on many elements like,

-

Business model

-

Features and services merchants require from a payment gateway

-

Set up fee

-

Software fee

-

Maintenance fee

-

Transaction discount rate according to the payment mode

With zero setup fee and the quickest merchant onboarding, opt for Lyra’s Payment Gateway.

Accept payments online for your business globally with 100+ payment options.

Keep your digital transactions safe and your customers happy

Read about the latest fintech updates and news at Lyra Linked In Page

Want to set up a payment gateway for your business? Contact us