Payment Processing software – a term merchants are well acquainted with and one that is deemed critical for businesses of all types.

Therefore As the world is quite comfortable and even encouraging online payments, nearly all businesses are opting for online payment acceptance and a payment processing solution, a comprehensive entity to accept and process all types of online payments serves as a connection between the customer and the merchant.

It accepts and processes online transactions made by the customers (customer’s bank) and merchant (merchant website).

A typical payment processing software consists of three entities,

- A payment gateway, to accept online payments from the customer. The payment gateway connects your online store and website to the payment processor.

- A payment processor, to handle the transfer of the payment information between the merchant’s bank and customer’s bank and all other related processes.

- A merchant account is a business account for the business where funds get deposited initially after the online transaction is done.

Similarly, Payment processing software simplifies the online payment acceptance process and offers advantages like customer management, fraud protection, setting up recurring billing, etc.

How to select payment processing software – a checklist

For a merchant, you want what is the best benefit for your business. Here are the criteria to choose the payment processing software best suited for your business,

- Flexibility – When it comes to accepting online payments, customers tend to use different methods. like net banking, card payments, or the most popular method nowadays, UPI. You have to make sure that the payment processing software processes all these types of payments without complex add ons or without doing additional setups.

- Integration – Every business has a unique model and framework. A payment processing software should integrate with that framework effortlessly and should be flexible enough to adapt itself to changes in the framework. It should also easily integrate with other software you are using like your website, accounting software, etc.

- User Interface – The UI should be easy to follow with clear instructions. In other words, There should not be any redirections, pop-ups, or other distracting options. It should be optimized to do maximum with minimum input.

- Value for money – you have to check if the payment processing software tool comes with any additional fees or charges. Like maintenance, update, or upgrade. The pricing should be transparent and without any hidden prices from the start. And so as the charging mechanism, i.e you have to check how the software charges you, per month or per transaction!

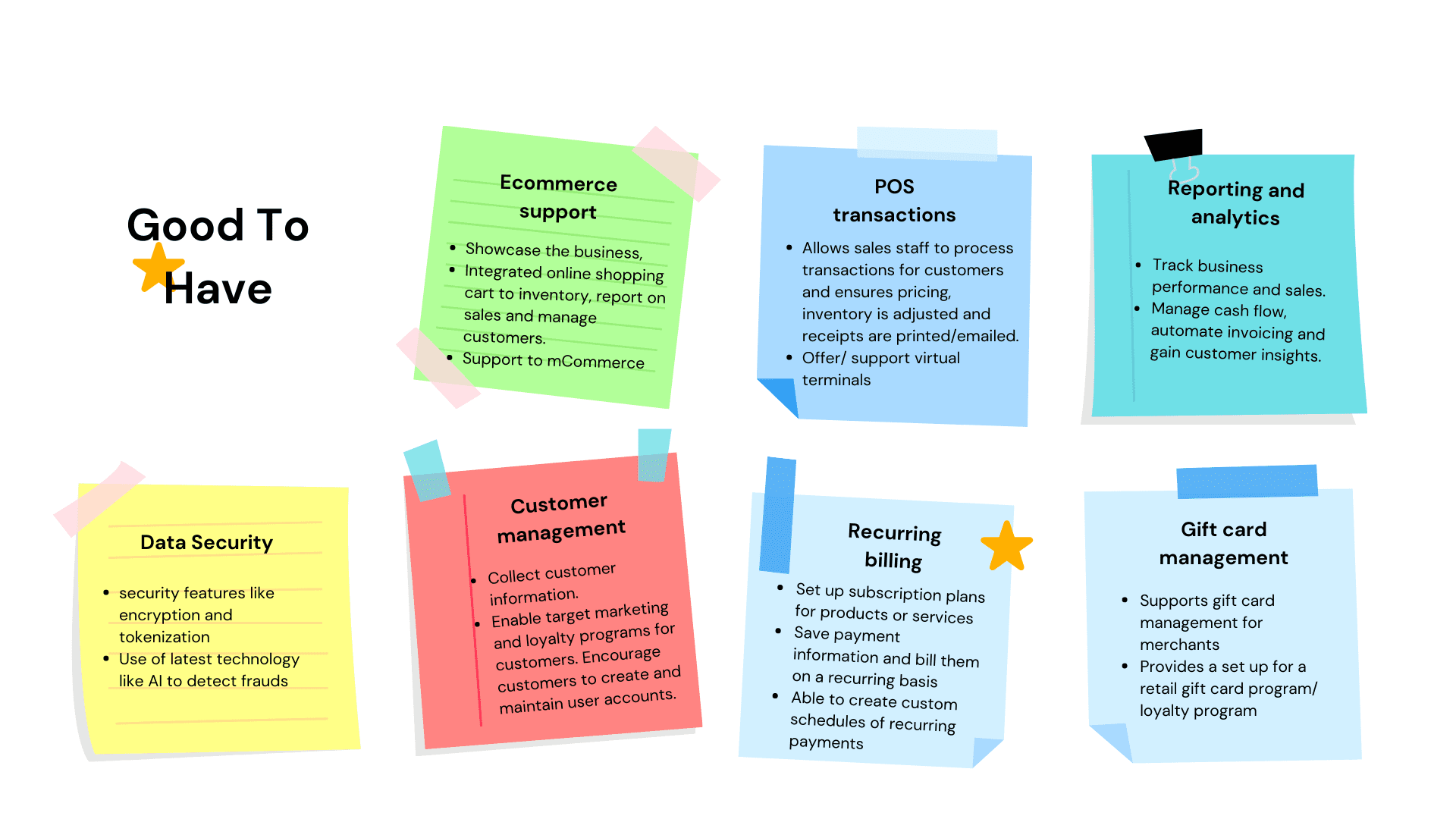

In addition to these pointers, here are some good to have capability criteria,

In addition, Now, that you are familiar with the key capabilities of payment processing software, you have to decide to opt for a particular one depending on your business, or you can skip all the hassle, contact Lyra India and just sit back and relax! Lyra is here to offer you the perfect payment processing software that fulfills all your business requirements. A tailor-made solution for your business that is secure, easy to integrate, and offers a seamless online payment experience!

A PPS can help businesses to establish and expand their online presence.

It makes online payments easier and faster for both customers and merchants. So if you want PPS that is,

- Secure

- Easy to integrate

- Offers frictionless transactions with additional benefits like,

- Zero Setup Fee

- Quickest onboarding

- 100+ payment methods

- Powerful back-office system

- Assures you the lowest quote