Challenges faced while using an online payment system in 2020 and Chargeback guide

In today’s era of digital technology, online businesses, e, and e-commerce customers, and merchants both expect a swift and secure digital experience.

In the customer’s case, it will be surfing, shopping, and paying online. In the merchant’s case showcasing, marketing, and processing payments digitally.

The innovations and modern technologies have already simplified the b2b and c2b experience.

But as the online marketing and selling experience is reaching more and more customers, user demands are also increasing with it.

Though it is proved to be a wonderful opportunity, as they say with new opportunities comes an even greater challenge. Well, in this case, challenges.

Accepting online payments and online payment processing poses some unique challenges. Let’s see what these challenges are and some tips to overcome them.

The first and one of the most important challenges faced by all the merchants is online fraud.

Usually, transactions involved in online payments are ‘card not present type transactions. This means the cardholder is absent physically at the time transaction is processed.

This makes online transactions vulnerable to fraud and cyber-attacks.

E-commerce and m-commerce are ever-expanding and so are the fraudulent attacks making it a serious security challenge for all the merchants.

Want to know how to detect and prevent fraud? Here you go – https://www.lyra.com/in/ecommerce-fraud/

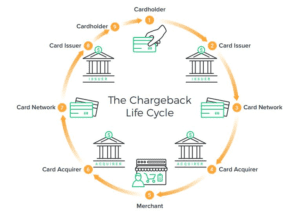

Chargeback – along with the fraud comes chargeback. Here is your chargeback guide. These disputed charges and transactions can result in decreased authorization and in turn bad business.

While, payment processors play a part in resolving chargebacks, more the chargebacks less the credit of the merchant.

Chargebacks can implicate heavy damage to business and merchant reputation and credit scores. It can lead to closing merchant accounts killing the business.

Be it a lack of knowledge or a lack of proper plan to handle frauds and chargebacks, online businesses are vulnerable to frauds and chargebacks.

Don’t be ignorant anymore, here is your chargeback guide – https://www.lyra.com/in/base/chargeback-guide/

To overcome this, merchants have to make sure to go for the online payment processor that provides chargeback management that is compliant with security guidelines issued by RBI, like PCI-DSS, and in addition should integrate some security features like 2FA, technologies like EMV in the whole online process.

choosing a payment gateway – When it comes to accepting online payments, dealing with the payment gateway becomes inevitable. If the business deals in an online store or e-commerce it is absolutely necessary to have a payment gateway integrated with your store’s website. A payment gateway securely processes online transactions from your website to your bank. While integrating payment gateway is an obvious task, choosing the payment gateway can be somewhat difficult and challenging.

What are the key factors you should consider while choosing a payment gateway?

Selecting a payment gateway that will fit your business model and customer needs can be rather hectic.

Along with these points, a merchant should carefully consider other business as well as payment gateway aspects before choosing a particular payment gateway.

They can be, security, compliance, integration, scalability of the payment gateway, payment gateway fees, technical support, etc.

Want to choose a tailor-made payment gateway for your business?

Global transactions – The Internet has bought the world relatively closer. As a merchant, it is always beneficial for the business to spread out across and outside the residing country. And with this comes the challenge of cross-border transactions.

Compare to local transactions, cross-border transactions sometimes can be slow, expensive, and can create difficulties in terms of the language barrier, banking norms, currency exchange, security, and general norms and guidelines.

A hassle-free and simple solution for this will be pairing up with an international payment gateway.

User experience – Upcoming technologies are constantly changing customers’ expectations about what a company should offer.

It is a mixture of payment options, payment rewards, offers, seamless online shopping experience, personalized shopping, accessibility, etc.

These demands are ever-growing and it is absolutely necessary to keep your customers satisfied (well, for obvious reasons).

In this constant race among your competitors, you have to stand out by offering a little extra.

So, you have to consider building a smart interface by using existing digital features and techniques.

The main points to focus on should be convenience, simplicity, and choice of customers. The interface should be error-free, seamless, and simple.

It should be scalable and accessible in order to modify it with upcoming technologies.

The entire cycle from showcasing to shopping to payment and to delivery should be as simple and hassle-free as possible and should give customers a unique and personalized experience.

Along with these points, there are many challenges like payment solution integration, 24/7 help desk, payment options, and methods, but while overcoming all these challenges, it is important to keep three thighs in mind, your business model, customer analysis, and customer and business convenience