The pandemic has seen a rise and fall in cashless payment systems. On one hand, temporary or permanent closing of many sectors that used to carry cashless payments majorly became the reason the digital payments took a fall and on the other hand, new businesses like online storefronts, utility bills, etc. gave a helping hand to bring the digital payments back on track.

All in all, it is safe to say that though hit hard by the pandemic, India’s journey towards a cashless economy is slowly but surely getting back on track.

For tier 1 or metro cities and tier 2 cities using digital payments is becoming normal.

Due to the government’s initiative and forced to use contactless methods due to the social distancing norm, digital payments are becoming quite popular and consumers are getting comfortable with them.

The increasing need for customers to shop and pay from anywhere at any time and businesses making revenue by showcasing, marketing, and selling on digital platforms is giving an essential boost to digital payments.

But, amidst all this, India can not become a cashless economy unless and until rural India is onboard with digital payments.

A large population of India resides in rural areas. According to a survey, only 20.26% of the rural Indian population has direct access to the internet.

And among that population, not all of them are using digital payments due to various difficulties.

So, why is it difficult to enable last-mile users under digital platforms?

Digital illiteracy and lack of awareness is the common points, customers and merchants both on some level are confused by the complexity of applications interface and the number of digital payment options available.

For consumers, there is a lack of convenience and trust. As for the merchants, increasing cost for online payment processing and lack of knowledge about systems as simple as POS is becoming a hurdle for digital payment penetration.

In order to advance rural India towards becoming cashless, the government has to make sure that the credit facilities should be made easily accessible to rural borrowers.

In addition to giving rural India access to mobile phones, the internet, and bank accounts, there is a need for advanced digital infrastructure and a strong ecosystem that ensures that the last milers are integrated into the central economy.

The government should also concentrate on the regulations, guidelines about the last mile digital connectivity and transactions, and spread awareness about the same.

Last-mile digital payment is like an untapped source for service providers, as first-time users can play a significant role in increasing the volume of digital transactions.

With the help of advertising and marketing campaigns, it is necessary to recast the mindset of rural customers and merchants.

It is also necessary to analyze merchant and customer behavior and find appropriate hooks for them so that they can adapt to digital payments.

In conclusion, India’s journey to digitization and becoming a cashless economy will not be completed without onboarding rural India.

Lyra’s Last mile connectivity project – ‘Lyra Connect’

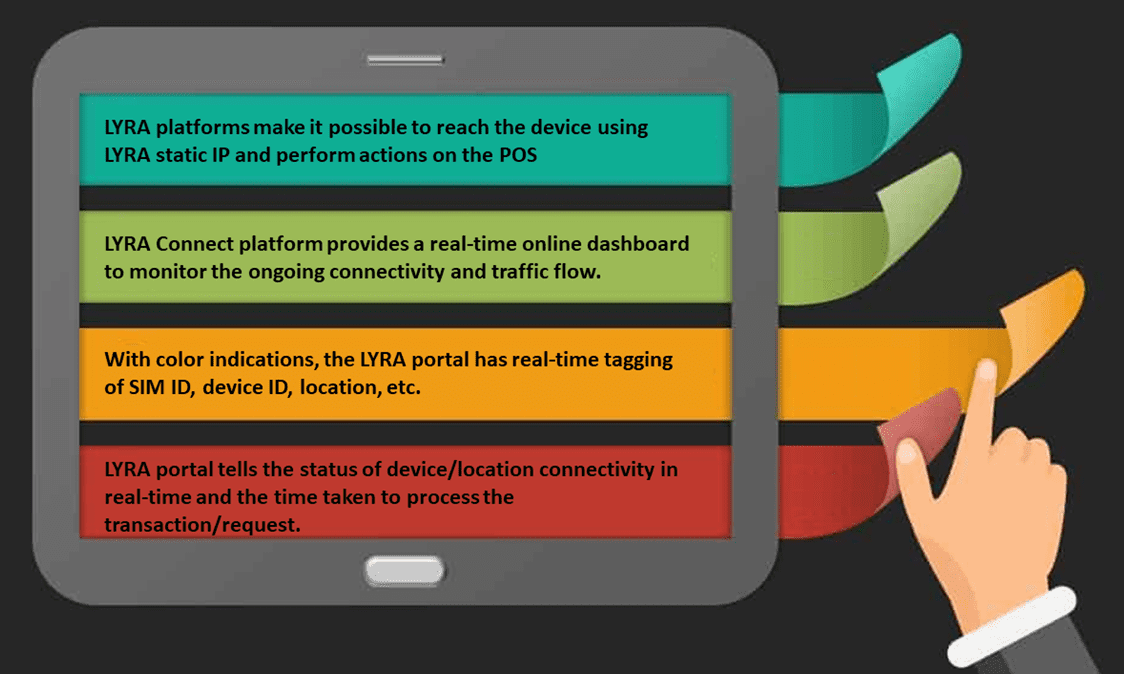

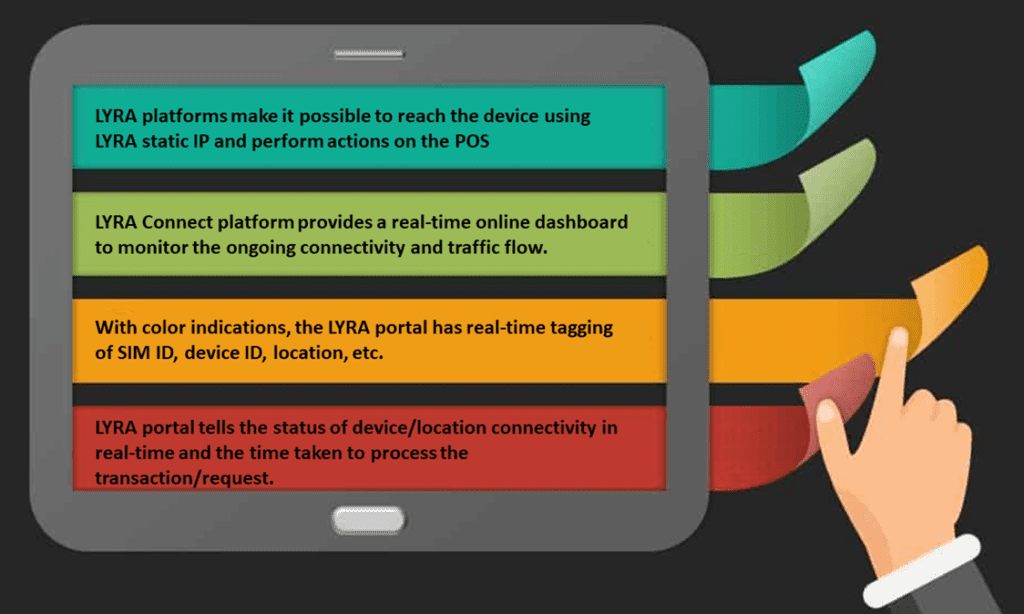

Lyra Network, India, is playing a significant role to solve the connectivity problems pan India and enabling each and every part of India to connect to banking, citizen services, and government services.

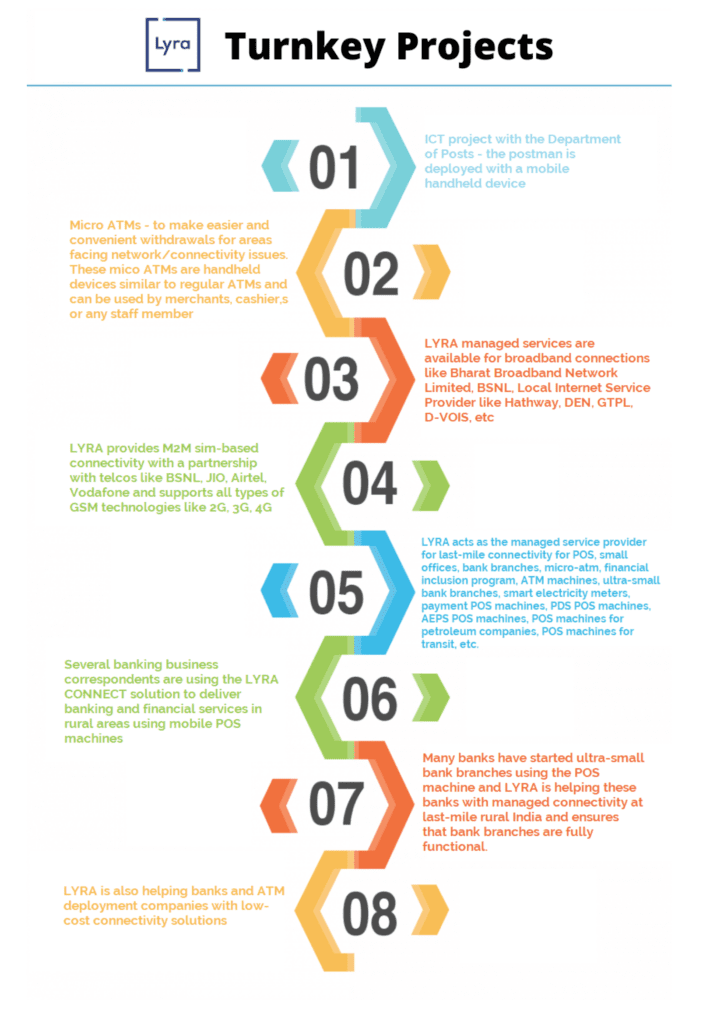

‘Lyra Connect’ is a solution and a platform developed by Lyra, to connect rural India using multiple technologies, wired and wireless. Here are the turnkey projects by Lyra,