Mistakes To Avoid While Choosing A Payment Gateway

The world is becoming digital and India is not an exception!

Merchants have realized the importance of digital payments as a result of the remarkable evolution and growth of the eCommerce marketplace.

As the industry is advancing, merchants are taking into account the significance of integrating a payment gateway with the shop site.

If you want to run an online store or want to accept online payments, one of the most important things you have to get is a ‘payment gateway’.

Choosing a payment gateway that suits your business requirements and at the same time gives you the best deals is somewhat a crucial task.

Here is Lyra’s guide on how to choose a payment gateway.

As you know, there are various aspects when it comes to choosing a payment gateway. And it is only natural that sometimes some things may slip your mind.

So, here are some mistakes that you can avoid while choosing a payment gateway.

Payment options – The importance of payment options can not be stressed enough. The more payment options you have, the more will be the flow of customers.

But too many of the payment options and customers may become confused and decide to go another way.

So, the question is how much is too much? Well, there is no specific answer to this question.

This is a common mistake to include not enough or more than enough payment options. You have to consider carefully from the point of view of customers.

What are the payment options customers often use while shopping at your store? What is the popular payment option, what payment option can not be replaced, etc?

after the research is thoroughly done you can choose handpicked payment options to integrate into your online store.

security concerns –

Now that we have come across the question ‘how much is too much, the concerns for security also come in this category.

Cyber theft and fraud are no joke. It is one of the serious problems faced by many. So, it is obvious that you want to build customers’ trust and protect your as well as customers’ information.

Being cautious about online payment security is good, being over cautious is not. When you are choosing a payment gateway you have to make sure that the solution is compliant with the government’s rules and regulations e.g. PCI DSS certified, 3DS, etc. But at the same time, you should not be overly concerned about the certificates.

As long as the solution follows all the rules and regulations stated by the government, you are in the right hands.

Setup and support –

Nowadays, the integration of payment gateway has become much easier, and even a shop owner can do it by himself/herself.

So many of the merchants don’t take the option where the solution is set up by the solution provider.

So, even if you have enough knowledge of all the technicalities, it is a good thing to accept the solution provider’s offer and get the solution set up, or you can choose a solution that can be easy to integrate.

Another important thing to consider while choosing a payment gateway is to look for a solution provider that can offer 24/7 support.

You have a business to run, you don’t want to waste your time on these problems.

Yes, it is good to have knowledge but, sometimes the problem may need specialized assistance and it is good to let experts carry out their work.

Less means more –

Well not for everything! Many merchants have a habit of choosing a payment gateway based on the fees.

They think low pricing will benefit their business budget. At such times you have to have a closer look.

Sure, low prices catch the eyes fast, but it is important to look for what other benefits you can gain from that solution provider.

Can it be adequate?

Does it fit into your business model? Are there any other features?

These are the questions you have to ask yourself before going for the low-cost payment gateway.

Multi-Currency support –

The internet has brought the world closer to evolving from local businesses into global ones.

So, a payment gateway supporting only local currency can limit eCommerce opportunities. A payment gateway should support global payments and offer multi-currency support.

Subscriptions! Subscriptions! – Customers are using subscription-based services now more than ever, making recurring payments one of the most preferred options.

Subscription-based payments enable merchants to set automated billing cycles for customers.

This seamless method is a must to collect funds regularly from your customers!

Mobile payments –

If you think integrating a payment gateway with your shop website is enough to collect online payments, think again!

With the increasing usage of mobile devices, mobile payments are soon to replace credit card buying.

So, a payment gateway must support mobile payments enabling your customers to make payments using their mobile devices.

While considering all these options, a merchant can easily forget one of the most important things, and that is the infrastructure of the business!

Every business has its own unique framework. So, you have to choose a payment gateway that is scalable and seamlessly integrates with the framework.

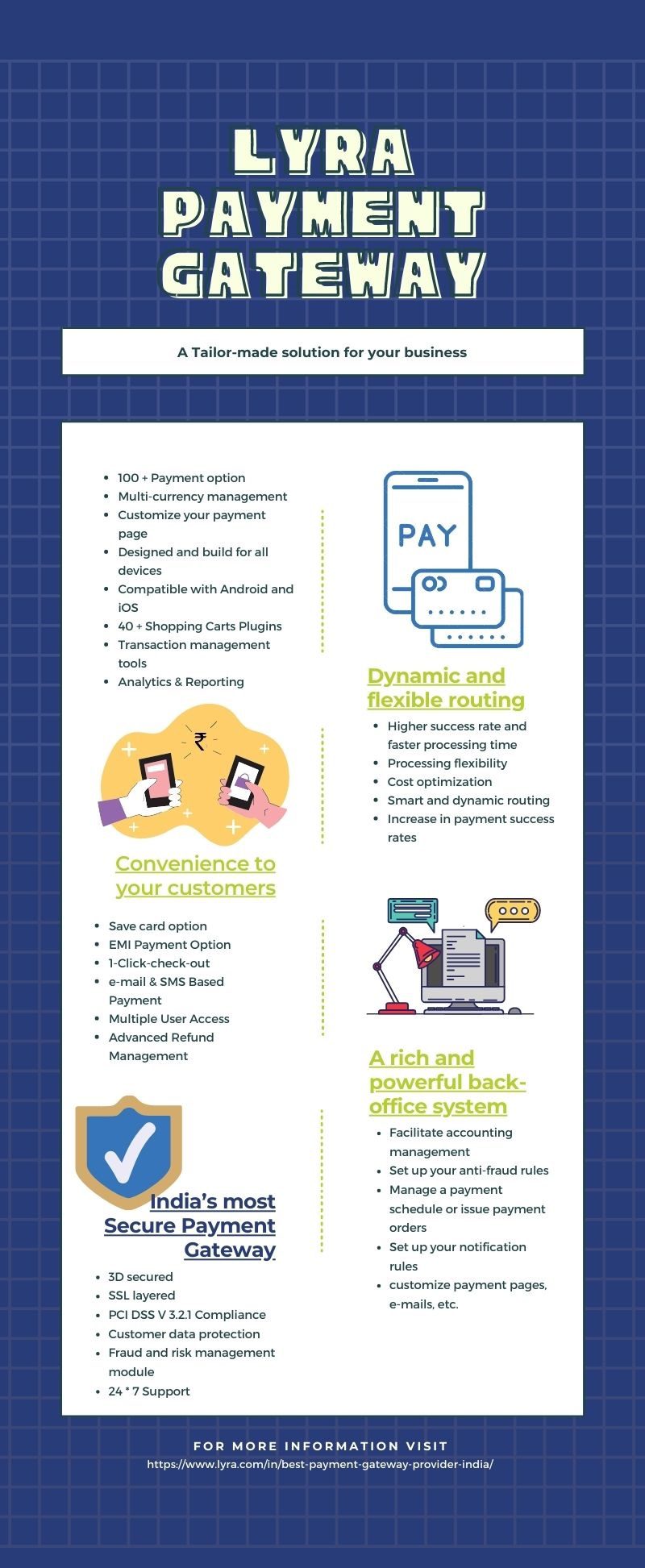

Well, you don’t have to worry anymore! Lyra is here to take care of all your requirements and offer you a tailor-made payment gateway solution!