Why a POS System is a Must-Have for any Restaurant?

What is a POS machine/terminal and what does it do?

A POS machine is a device that authenticates the customer by sending the cardholder’s details to the bank where his/her account is open.

It then receives the authentication status and, if the details are valid, it connects with the acquirer’s (merchant’s) bank to deposit the said amount of money in its account.

Hence, the main role of the POS system at a brick-and-mortar outlet is to assure and secure transactions for the merchant.

Benefits of a POS system

Having mentioned the major role of a POS system, which is to authenticate the customers for the merchant, it also brings several benefits along with itself. The main other benefits are the existence of one device for-

- Impeccable Administration

- Stock Control

- Inventory Management

- Monitoring Buyers’ behavior and Buying trends (This can assist with marketing campaigns)

- Instant Cash-less Payments

Hence, all the different roles are under one device and there is no need for separate machines/devices. This helps in completing a lot of tasks with a single device, which also makes it cost-effective for the owner.

Simultaneously, the POS machine/POS system is a robust and technically sound device for carrying out numerous transactions.

How is having a POS terminal helpful for a restaurant?

Coming to how a POS terminal helps a restaurant be financially more stable and successful, there are strong factors of POS, which have helped the business of restaurants profoundly over a period.

One of the major aid to restaurant owners is the elimination of storage of cash (if payments happen in cash) on an everyday basis. Eliminating cash payments makes the restaurant’s earnings safe, quick, and with no hassle of accumulating wads of cash.

Secondly, the POS terminal advances the connection from it being not only between a merchant and the end-user but also between the merchant and the supplier of raw material to the merchant. This significantly helps the restaurant to cut down the efforts and to channel the payment securely.

Thirdly, if POS terminal partners with such a payment service provider, which offers robust services, it adds to the secure flow. Since a restaurant happens to witness countless transactions, it needs a mediator to facilitate the secure, quick, and convenient movement of transactions.

A robust platform can bear the weight of multiple payments and flow the same smoothly into the restaurant’s bank account.

Fourthly, as mentioned above, a POS machine comes with all the benefits in one device that facilitate a restaurant’s multi-tasking effectively.

It implies that the efficiency of the restaurant multiplies in this way. So, a POS machine lets a restaurant take control of the administration, stock control, inventory management, and routine customer behavior.

Fifthly, With the knowledge of frequent customers to the restaurant, it can send offers and discounts to that lot of people. Such offers and discounts further the marketing of the restaurant and helps spread the word of mouth significantly.

Consequently, a restaurant without a POS machine means more operational cost, a disorganized setup, and less efficiency.

Besides, as India is swarmed with start-ups in all the fields, it is also the hospitality sector, that has seen a tremendous boost.

Many more eateries, modern resto-bars, and fine dining restaurants have captured the Indian hospitality space. All these eateries have successfully adopted POS machines as an integral part of their everyday operations.

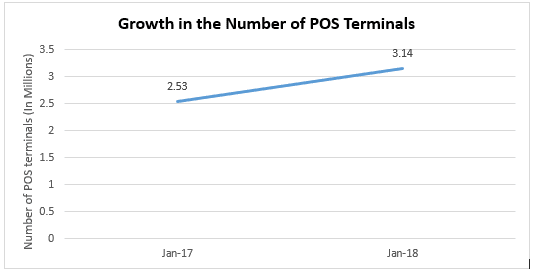

According to data published by RBI, the number of point of sale (POS) terminals grew up to 3.14 million in January 2018, up 24% from 2.53 million in January last year. However, India is anticipating even higher growth of POS terminals in India.

About Lyra’s NAC service to Facilitate Secure Transaction Flow:

Lyra Network provides the POS services a channel for the amount to flow from cardholder/customer’s bank account to the acquirer/merchant’s bank account.

As this flow needs to be secure and not vulnerable to any fraud, Lyra has a service called NAC (Network Access Control). Lyra NAC facilitates payments to move through a safe channel.

- For initiating payment from merchant’s end, the customer needs to swipe the card and type in PIN.

- Following this, a communication between cardholder’s bank and the acquirer’s bank happens with the help of NAC.

- It works by initiating with Lyra public IP configured on the POS over the available internet connectivity at the merchant’s end.

- This request will first land at the merchant’s internet service providing network, and post that using internet connectivity it reaches LYRA’s public IP and port configured on LYRA DMZ firewall.

- Once a request lands on LYRA public IP, LYRA will identify that it needs to be routed to the host bank (cardholder’s bank).

- LYRA then forwards transparently the same data to the bank’s host using existing available connectivity.

- Once LYRA NAC receives the response from the host, NAC will transparently forward this reply to POS over the internet.

- After this, the status of authentication becomes clear and, if the details are authenticated, the flow of payment takes place and the amount flows to the merchant’s bank account.

An important point is that there is security with the POS machine using the Terminal Line Encryption (TLE).

This is required so that the details leave IP-POS with encrypted data and lead to decryption only with the host bank (cardholder/customer’s bank).

Henceforth, a POS system is an all-in-one device for major tasks in a restaurant, which not only manages a secure and hassle-free payment flow but also helps expand the business.

This implies that, for a restaurant business, possessing a POS machine is assistance in disguise.