What is Transaction Success Rate (TSR)? & Does it really matters?

Does the transaction success rate really matter?

The short answer is YES, as for why, let’s see,

Transaction failures have become far more frequent in India’s digital payments ecosystem becoming one of the important reasons for the loss of sales.

Though India is bristling with digital payment activity, the transaction failure rate is something no business would like to witness.

Simply put, it refers to when a customer makes a payment but it does not reach another end, i.e. merchant, resulting in failure of transaction and in turn purchase failure.

The most common reasons for transaction failures are technical issues or inability to handle the surge in payment volume, server issues at the bank, checkout flaws, etc.

But in any case, it is in no way favorable for business. And so, understanding the whole transaction success rate metric is extremely necessary for any business owner.

let’s dig a little deeper.

What is the transaction success rate?

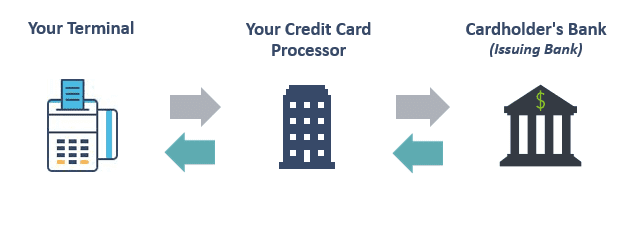

Transaction Success Rate or TSR is the ratio of successful payment transactions over a given time period. It is a result when the number of successful transactions is divided by the number of total attempted transactions.

For example, if there are 100 attempted transactions out of which 40 became successful, the TSR is 40%

Now imagine a scenario where your webshop received 100 orders from which payment for only 80 orders is approved.

So, by the formula stated above, TSR is 80% But there is more to this. Every integrated payment solution has a ‘retry’ option to improve the success rate.

If the retry mechanism retried to process payment for all 20 failed transactions and succeeded for 5 of them, then it takes TSR to 85 successful transactions divided by 120 total transactions i.e. 70.83% And you can see how drastically it had reduced.

The increased failure rate can frustrate customers and can result in cart abandonment, loss of sales, and in the worst-case loss of customer loyalty.

So, TSR matters because it can impact your business and customer experience.

The importance of TSR varies according to the industry. For example, for eCommerce, as stated above, if the customer fails to complete the transaction, it may lead to cart abandonment.

Same with the hotel, the travel industry, and ordering online transportation, food, or other services. Failure in transactions may direct customers to switch to another platform.

TSR also varies from platform to platform, for example, website shopping, app, office stores, etc.

What can you as a business do?

Businesses can take these measures to improve TSR,

The checkout should be as smooth as possible without any distractions and redirections. The payment page should require as little information as possible.

A long checkout process and entering irrelevant and lengthy information may take more time resulting in canceling the payment.

It is good practice for a business to ensure that the customers need not spend a lot of their time on the payment page filling in too many details.

Auto filling information like state and PIn may help save some time.

The saved payment information option can do wonders! No customer likes to enter long credit card numbers or UPI IDs again and again.

Saving payment information makes the whole ordeal much easier on customers and customers can concentrate more on the actual product or service.

The whole payment procedure should be as smooth and flexible as possible. Businesses should offer multiple payment modes and methods.

So, if one method fails, the customer may try to re-do the payment via another method.

Many payment solutions offer dynamic and smart routing.

Opting for dynamic routing can be a blessing as it can get the job done if there are issues with one provider.

Dynamic routing maximizes TSR. Read more on dynamic routing link – payment switch

And last but not the least, opt for Lyra’s payment processing solutions.

Lyra’s payment solutions help with the recovery of failed payments.

Lyra offers 100+ payment options, 40+ shopping cart plug-ins, and multi-currency management.

Lyra owns its entire framework and doesn’t have any third-party dependencies resulting in fewer hops and high TSR With PCI DSS compliance Lyra is one of the most secured payment gateway providers in India.

Along with Payment Gateway, Lyra also offers a robust and secure platform for authorizing and switching, Lyra’s Payment Switch.

Lyra’s Payment Switch enables a higher success rate and faster processing time with high-end ISO switch infra and in-house hosting.

Curious about the payment switch? Read more or contact our sales team!