Fintech – A game-changer driving recovery for India.

The world is experiencing a period of rapid fintech technology change and induced digital transformation due to COVID-19.

New technologies are fundamentally changing every aspect of life and with emerging new innovations like blockchain, AI, IoT Financial technology is becoming one of the fastest-growing sectors in India.

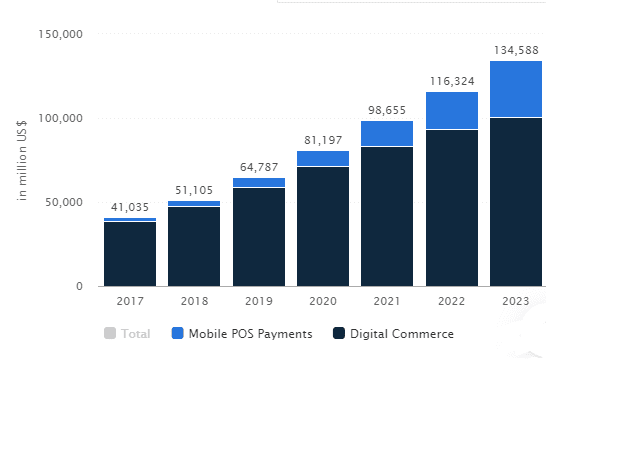

Today, India’s Financial technology market is considered to be the fastest-growing market around the world. It is currently valued at 31 billion US dollars and is expected to grow to 84 billion US dollars.

Despite the pandemic, India’s Financial technology sector remains active and has seen a 60% increase in fintech investments.

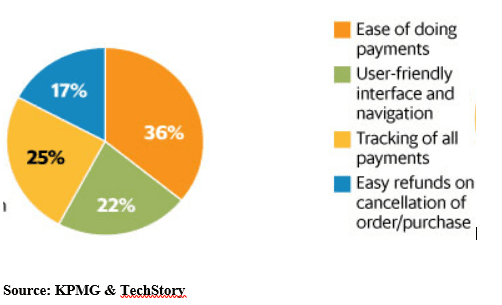

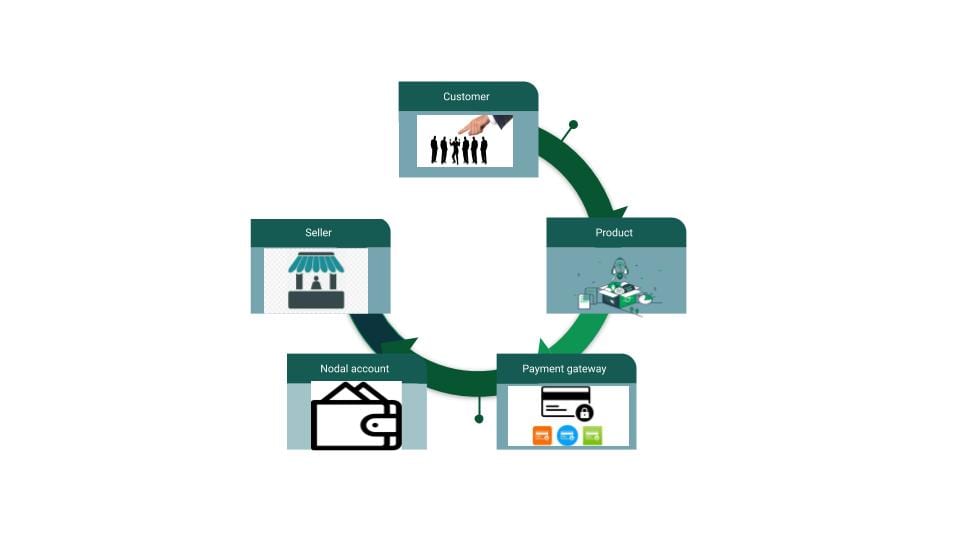

Indian Fintech includes various sub-sectors like payments, insurance technology, wealth technology, regulation technology.

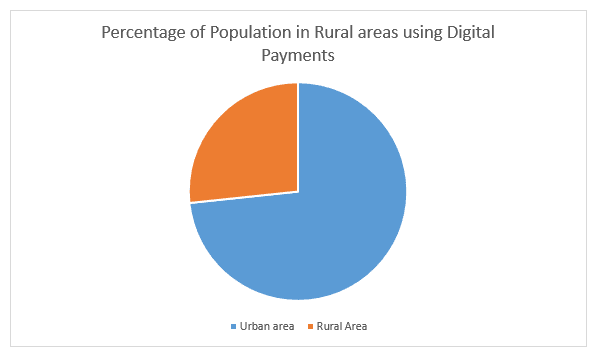

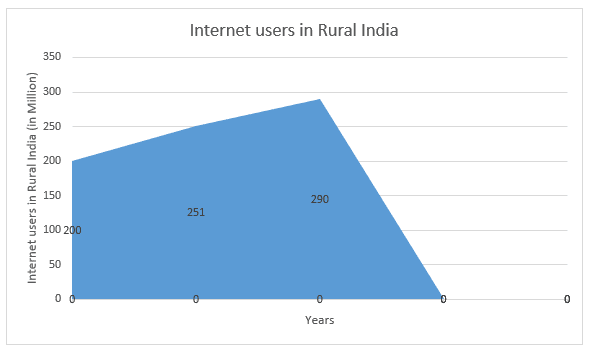

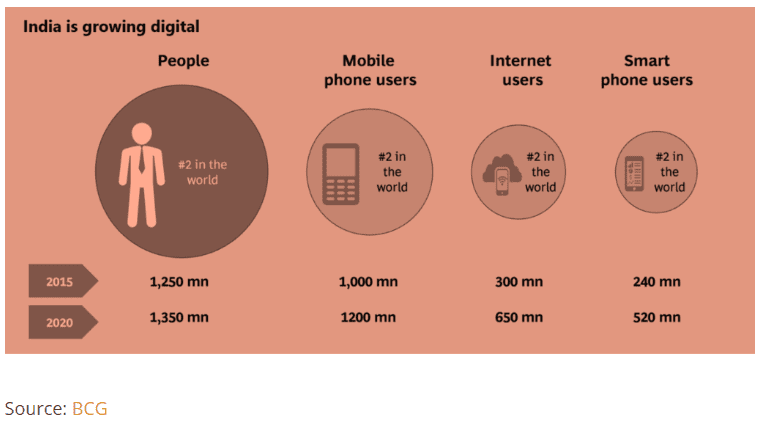

lending, broking, etc. With the Government’s initiative, regulatory support, robust ecosystem, smartphone penetration, and backing policies India’s Financial technology sector is attracting tremendous attention as an extremely promising market.

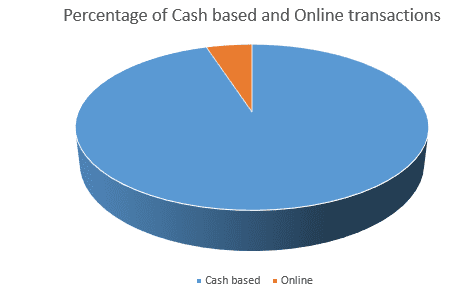

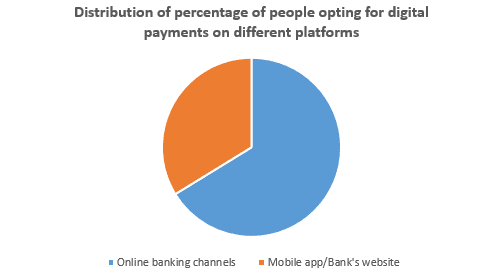

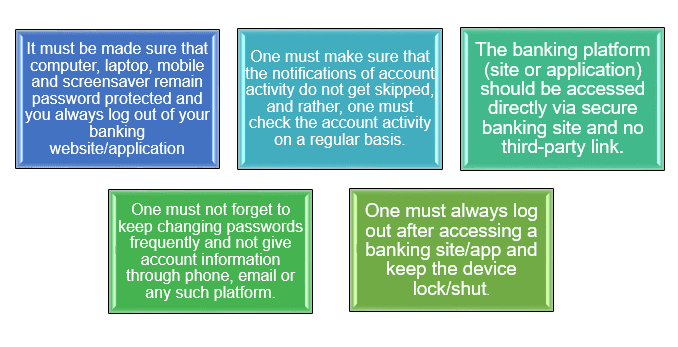

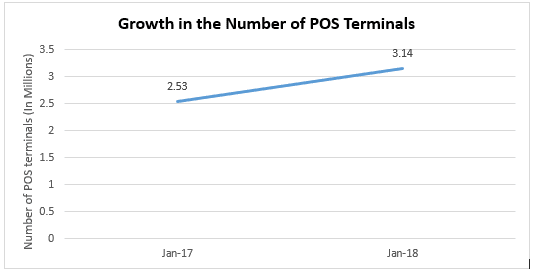

Amid COVID19, the government’s imposed restrictions on social distancing and a push towards less physical transactions has contributed to the increased requirement of accommodating digital financial services.

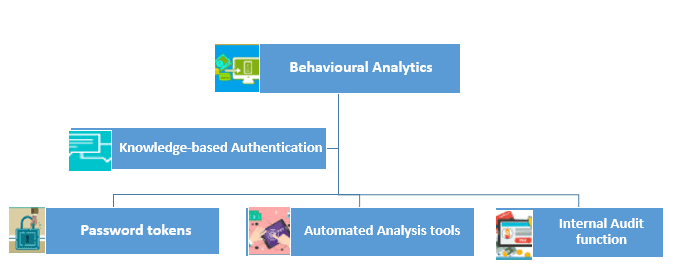

With new trends like digital banking, biometric verification (Aadhar), Jan Dhan Aadhaar, neo banking, open banking, autonomous finance, etc. and various initiatives by the government like setting up a new regulation review authority, updated and upgraded KYC norms, setting up a centralized payment system, new umbrella entity, etc. startups, and fintech have already started to steer the financial movement to reach the goal of financial inclusion.

Source: https://www.india-briefing.com/news/indias-fintech-market-growth-outlook-and-investment-opportunities-22764.html/

Read more about news, stories, and fintech updates here.