Online payments and small business

How can small businesses receive payments online? The question remains popular despite the launching/ introduction of all sorts of new apps and solutions which can accept digital payments.

Demonetization and increasing customers’ demand gave a much-needed push to the escalation of digital transactions.

Though there still are doubts, it is time for businesses to consider accepting digital payment modes more seriously because digital payment is here to stay.

The year 2020 has barely started and the government is on the fast track to making businesses go digital by,

- Introducing waived off MDR

- Introducing a fine for not accepting digital payments

The government is constantly trying to introduce new ways to scale up digital penetration. By planning on offering retailers subsidies to digitize operations and considering a framework to finance POS machines the government is trying to help small retailers to go digital.

Still, small retailers are hesitant to adopt to POS systems as these card swiping machines, as banks charge both customers and owners some percent when owners already have a small margin (their set up, maintenance cost, etc. are another issues), which makes accepting digital payments a much-needed solution.

What is a digital payment?

Digital payment can be considered as an umbrella term used for different modes(digital instruments) used in different ways to collect payment online (i.e. without cash – cashless) with an electronic medium interface.

Lack of awareness on merchants’ side and fear of being cheated are two of the major reasons why merchants are skeptical about accepting payments online.

So, before starting on how can small businesses receive digital payments in India, let’s start with WHY should small businesses go for digital payment solutions: (so, as a business owner, if you are still hesitant on going digital, these points will definitely make you think otherwise.)

Online Payment Processing Problems for Businesses

Demand for online payment processing is increasing and so are the problems because ‘Online Shopping’ is here to stay! And it is not related...

Why digital payments?

Digital payments have a positive impact on all small businesses. It is a convenient tool for accepting payment which is secure, fast, lowers the cost to the company and increases company revenue.

- More customers: More and more customers are preferring shopping online and making online payment via mobile wallets, credit/ debit cards is becoming the norm for them.

- Online presence: Online presence is becoming a dominant factor for businesses to increase their customer base and revenue. Customer experience is an essential part of online businesses, hence online businesses are trying to focus on the best way to receive payments online in addition to making active and reliable websites and supply chains.

- Mobile payments: As per a report, there are over a billion mobile phones and 330 million internet users in India and mobile-based transactions are expected to grow by 50% in the coming year.

- Global reach: Most of the small businesses do business locally, but thanks to the internet they are able to expand their reach more than that. Accepting payments digitally is the best option as payments can be collected anytime, anywhere.

- Customer satisfaction: The more seamless is the checkout experience, the more satisfied is the customer. In addition to seamlessness, online payment collection is more secure, safe and fast.

- reduce overhead costs: Accepting digital payments can reduce overhead costs like set up, maintenance, bank charges, etc. for physical payment acceptance devices, for physical devices.

- Save time and efforts: Collaborating with e-commerce and automating certain processes like processing invoices saves time and effort. online payment services reduce manual interference and increase productivity.

- Recurring Billing: There are many businesses, where customers need to pay in installments on the monthly, quarterly, etc. basis. Many digital payment acceptance modes enable recurring billing option which is not only convenient for customers but also can guarantee on-time payment collection.

Guide to Choose the Best Online Payment Solution for Your Business

Every business has different long and short-term needs. Choosing the right online payment solution that supports those unique needs can be...

How can small businesses receive Digital payment?

Receiving payments online is one of the important keys to grow business and profits. There are multiple online payment methods to accept payments digitally.

List of digital payment methods:

Payment gateways:

Integrating the business websites with payment gateway allows businesses to collect payments online via processing credit/ debit cards and net banking. Payment gateways use platforms like VISA, MasterCard, etc. There are two options to do this:

-

- Integrating with a third-party payment gateway

- Integrating with the bank’s payment gateway. In addition to these payment modes, Lyra’a payment gateway also offers to process payments digitally through e-wallets, UPI, etc.

E-checks:

E-check is an electronic version of a paper check. It is a form of online payment service where the money is passed through the ACH (Automated Clearing House) network and then electronically transferred from the customer’s account to the merchant’s account. This payment method saves both papers as well as time.

E-Wallets:

It is a popular mode of online payment which is similar to a pre-paid account where a user can store his/her money for any future online transaction.

The app is linked with customers’ credit/debit cards and requires a registered mobile number and a verification process.

NEFT, RTGS or IMPS:

These are online fund transfer modes for mobile or net banking.

Payment links:

Many small businesses or startups don’t have a website. For such a scenario, payment links are the easiest, most secure, and instant way to collect online payments. They have advantages like split payments, tracking payments, bulk payments, sharing payment links via social channels, etc.

Best Epos App for 2020

If you are looking for an alternative to a bulky POS, Lyra EPOS app is a great fit for you. Many small businesses are worried about the cost and...

UPI:

Unified Payment Interface is a real-time bank to bank fund transfer application developed by NPCI, India. With a 2FA it provides a hassle-free online payment transaction.

Want to use a more creative way to accept digital payments and attract more customers:

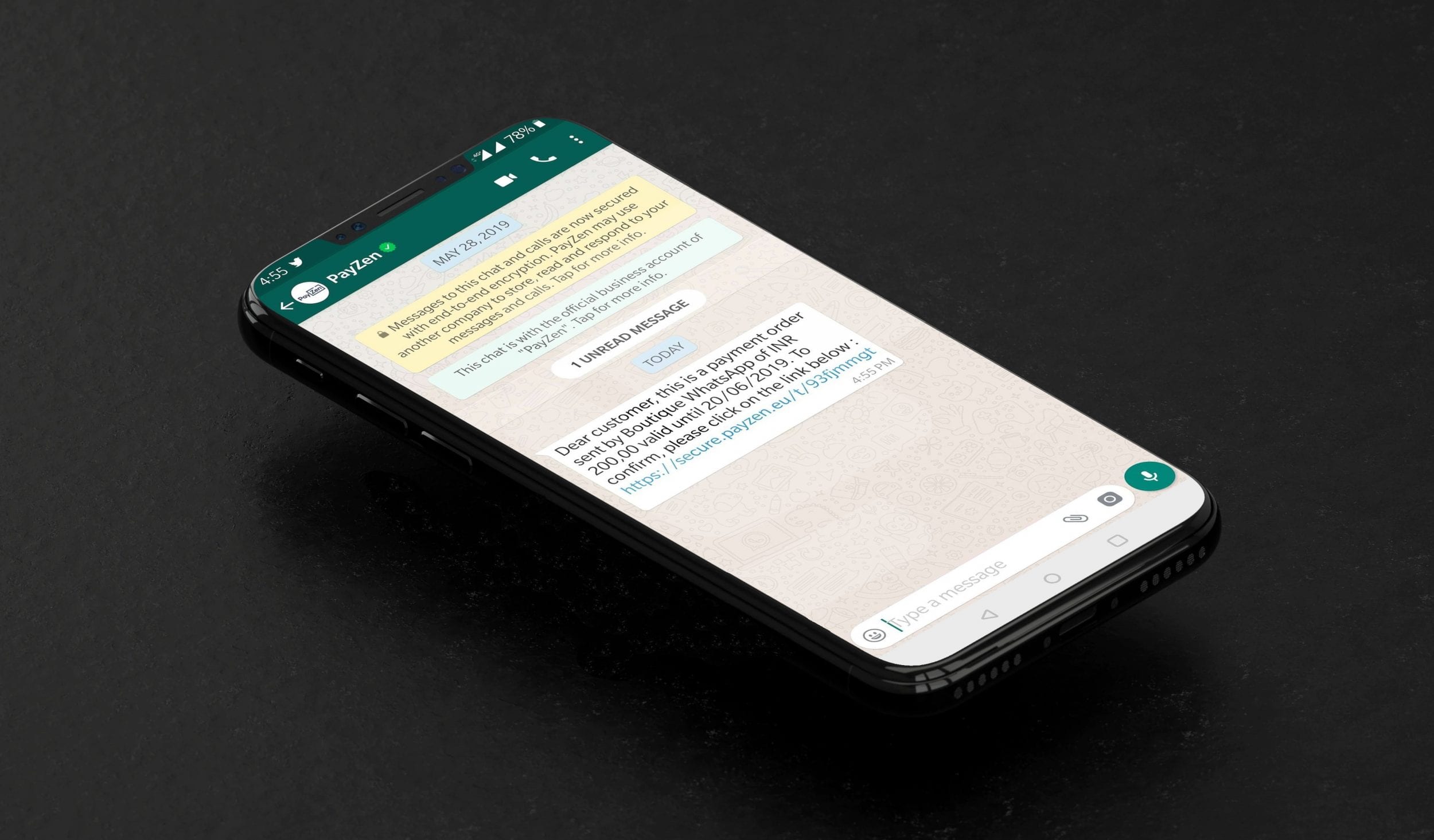

WhatsApp Payment Solution:

This is a secure payment collection solution that does not require a customer to share any type of bank or personal information.

In this link-sharing-based solution, all transactions happen in real-time and on the spot.

A merchant can create and share the payment link via Lyra’s WhatsApp payment solution and also can customize the payment messages (which can help build customer relations).

What is Whatsapp Payments & its top 9 features

For the first time in India Lyra has introduced an extremely convenient and on-the-spot online payment collection solution – Lyra WhatsApp Payment...

Need a Digital Payment Solution for your Business?