What is IP Payment Terminals

As a merchant, you are most definitely aware of the term ‘POS’. POS or Point Of Sale is a terminal POS or Point Of Sale is a terminal where customers make payments and merchants accept these payments.

Often find at the checkout counter, it can be a cash register, a computer-based system, or even a simple mobile application.

IP payment terminals transfer data over a wired or wireless connection, it can be a telephone line or internet connection.

Based on the communication protocol, IP payment terminals are distinguished into the following types.

GPRS POS – GPRS POS accepts payments through the GPRS device. This type of POS does not require a telephone line, it uses a sim card for data transfer.

PSTN POS – This POS terminal uses a telephone line to accept transactions. The main disadvantage of this POS terminal is, it continuously needs electricity.

IP POS – IP Payment terminals(IP POS) work with Internet Protocols and can be connected to other cloud-based devices.

The most widely acknowledged and used technology for POS is IP. Internet Protocol can be seamlessly integrated into the back end system and faster than GPRS and PSTN POS, as a result, it is extensively used by all types of merchants.

IP-based terminals accepting transactions occurring over a secured Internet connection rather than over a traditional telephone connection.

Advantages of using IP based POS –

Cost – One of the significant points for any merchant before investing in anything is ‘cost’. With IP, merchants can save on communication and telephone expenses that they spent on phone lines.

IP uses broadband connection and methods like VPN eliminating the need for dedicated extensions making it cost-efficient.

Using IP also reduces IT and network management expenses.

Speed – One of the main disadvantages of using telephone lines to transfer payment transaction data is their speed and the introduction of sluggishness in the transmission.

The time taken by the line networks to authorize and authenticate transactions is can be tenfold that of the IP-based transfer.

IP-based transmissions save checkout delay times improving customer loyalty.

Security – Line networks are vulnerable to hacking. Hackers can easily tap into these lines and the data can be compromised. On the other hand, IP encryption technology can be used to safeguard the data. Nowadays most of the devices come with PCI DSS compliance making the transactions safer and more secure.

Benefits of using IP for POS –

- less authorization time

- Faster checkout for customers

- Cost reduction on dedicated telephone lines.

- seamless integration with Payment Gateway

- seamless integration with other back-end devices and applications.

- IP based POS offer a single integration node for multiple processors

Lyra’s IP based POS solution

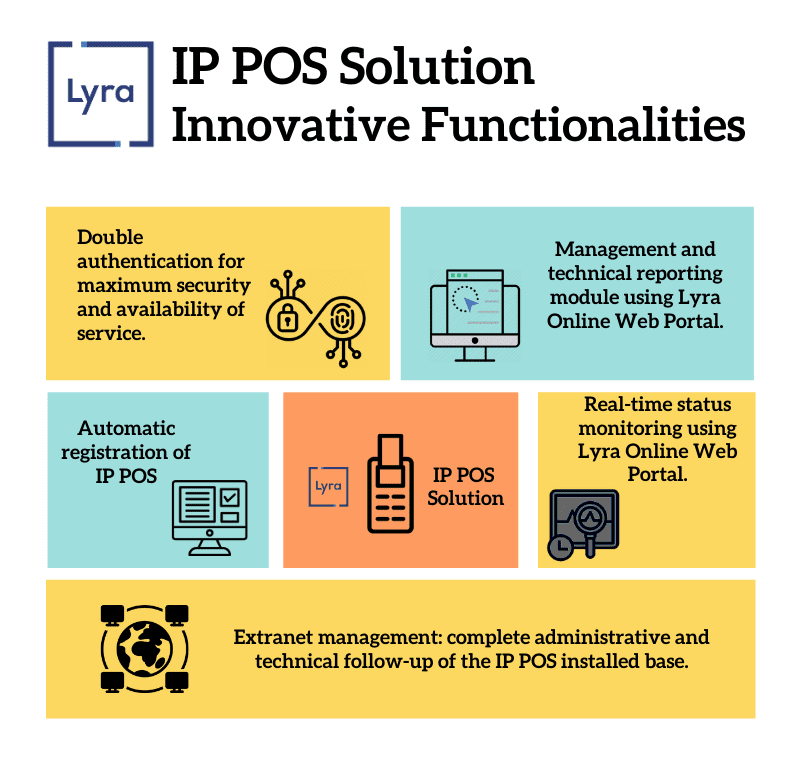

Lyra Network has implemented a double authentication protocol for SSL that enhances the overall security mechanisms and presents multiple advantages such as real-time management and control of all the transactions calls and terminals, an update of a white list of terminals, online monitoring, accurate reporting, and flexible billing structures.

Lyra IP POS – Transaction Flow

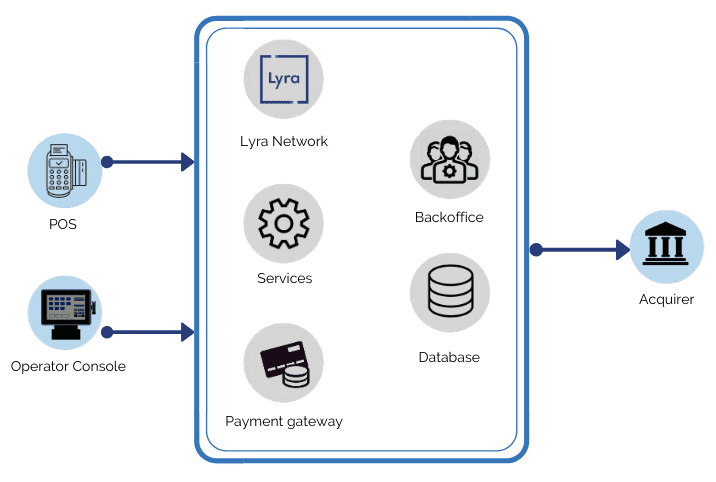

When the IP POS terminal needs to perform its first transaction, it needs to first enroll itself in the Lyra Network Server.

- Enrolled IP POS terminal will send a transaction request to the Lyra Network server with the pre-shared unique client certificate.

- It will then validate both client certificates and authenticate the POS serial number.

- After approval of both validation and authentication, the transaction request is forwarded to the remote bank host.

- If the client certificate is declined or the POS serial number is rejected then the transaction request is discarded.

Benefits of Lyra IP POS System

Security: Lyra network manages security around accessing and acquiring servers, SSL connections, and certificate policies. Lyra acts as a security buffer between the internet and the bank’s network. So, in case of any cyberattack, only IP POS service will be affected and not the rest of the service. Hence, by providing double authentication, Lyra reduces the probability of potential attacks and their extensive impacts on the rest of the service. Lyra also provides a dynamic white list with immediate filtering features to protect the entire system against attacks.

Lyra’s double authentication automatically filters incoming calls from unauthorized terminals making attacks virtually impossible.

Management of POS Terminals: Lyra provides an easy management portal for POS terminals that offers services like,

- suspension connection on the gateway,

- to add or delete IP POS terminals easily.

The portal service allows identification of IP POS that connects to the Gateway and then to the

acquiring server, preventing anyone from connecting to the acquiring server without proper identification and clearance.

The ability to prevent a connection directly on the gateway makes it more preferable and reliable.

Internet reliability: Lyra provides and manages redundant and reliable internet connection services to POS terminals.

White list management: One of the most important benefits of using the Lyra IP POS solution is a dynamically managed white list. It has double authentication and it eliminates the need for manual updating of the white list.

Traceability, control, and billing: Lyra IP POS solution offers the ability to recognize and authorize each POS terminal giving an advantage over traceability and control point of view. It traces every single transaction done by every POS terminal making it easier for monitoring, reporting, and maintenance. The solution offers detailed network diagnostics allowing drastic cost reductions in operation and support by reducing unnecessary site interventions whilst performing remote maintenance. It also offers individual reporting where billing can be done per terminal activity rather than per transaction.

Innovative Functionalities