Best mobile payment app for small businesses.

There are mobile applications available for almost everything.

They are majorly defining everything for us, the way we eat, the way we spend our free time, the way we live, and the way we make payments.

Using apps for online payment transactions is an easier, safer, and most convenient solution for business owners as well as for customers.

India is a country with a growing number of businesses, many of them don’t have a registered website, but for any kind of business, small or big, getting on the spot and real-time payments is an essential requirement.

There are all types of businesses, retail stores, home-based businesses, social media-based businesses, private tuition’s, catering, etc. All these small businesses may not have the funding to invest in physical payment acceptance devices like POS, so what is the best payment application to receive payments for such businesses? The answer may contain the word ‘mobile’.

What are the payment collection problems for businesses?

Every business has it’s own set of problems when it comes to accepting payments. These problems are majorly based on the business modules. Some of the businesses require to accept payments in installments, some of them are required to accept some percent of payments in advance, some of them even don’t have a website or online store but still need to accept online payments(maybe due to transportation problem), etc.

Here are some of the challenges faced by small businesses:

- Payment collection orders are always changing and so are the invoices and receipts.

- There is a lack of compatibility between payment acceptance solutions.

- Many businesses need an external physical device or a third party application to accept money/payment online.

- Growing security and fraud concerns about transferring /transacting online.

- Provision of the payment methods requested by customers.

How can small businesses receive Digital payments

Online payments and small business How can small businesses receive payments online? The question remains popular despite the launching/...

What Can a Mobile Payment App Accomplish?

Everyone and anyone has a mobile, it is one of the ‘basic needs’ nowadays. So accepting payments via a mobile application that caters all the business needs is the solution. It is easy for merchants and customers will surely enjoy the convenience!

Advantages of mobile payments:

Online Mobile Payments offer multi-channel payment methods. Customers can choose any payment method like card, wallet, etc. to pay online via mobile.

Most of the mobile payment apps are easily downloadable, have a simple user interface and supports most of mobile devices.

WhatsApp is the most preferred choice for communication in urban India and it has been gaining rising coverage in rural India.

Mobile payment is not limited to transferring money, merchants can do much more than that. Merchants can manage their transactions, raise invoices, create digital receipts, etc.

Mobile app developers are coming up with all types of advanced techniques. For example, many mobile applications are integrated with card readers or many mobile payment applications support contactless payment methods (like NFC)

Another interesting development in the mobile payment industry is, merchants can create online stores, manage inventories and link their businesses with social media platforms.

Mobile Payment application is becoming all in one solution for small businesses.

Reasons Retail Businesses should use EPOS App

Reasons Retail Businesses should use EPOS App Having a retail business means, you consider keeping your business up to date so as to keep up with...

Best mobile payment app for your small business

Lyra Epos

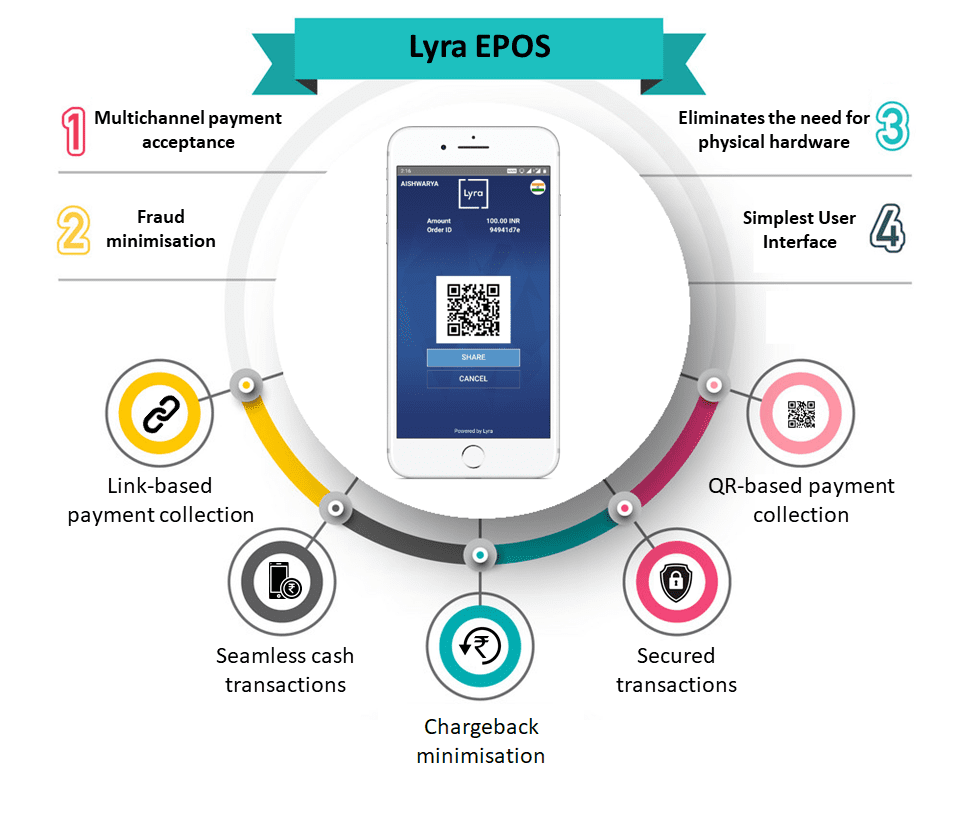

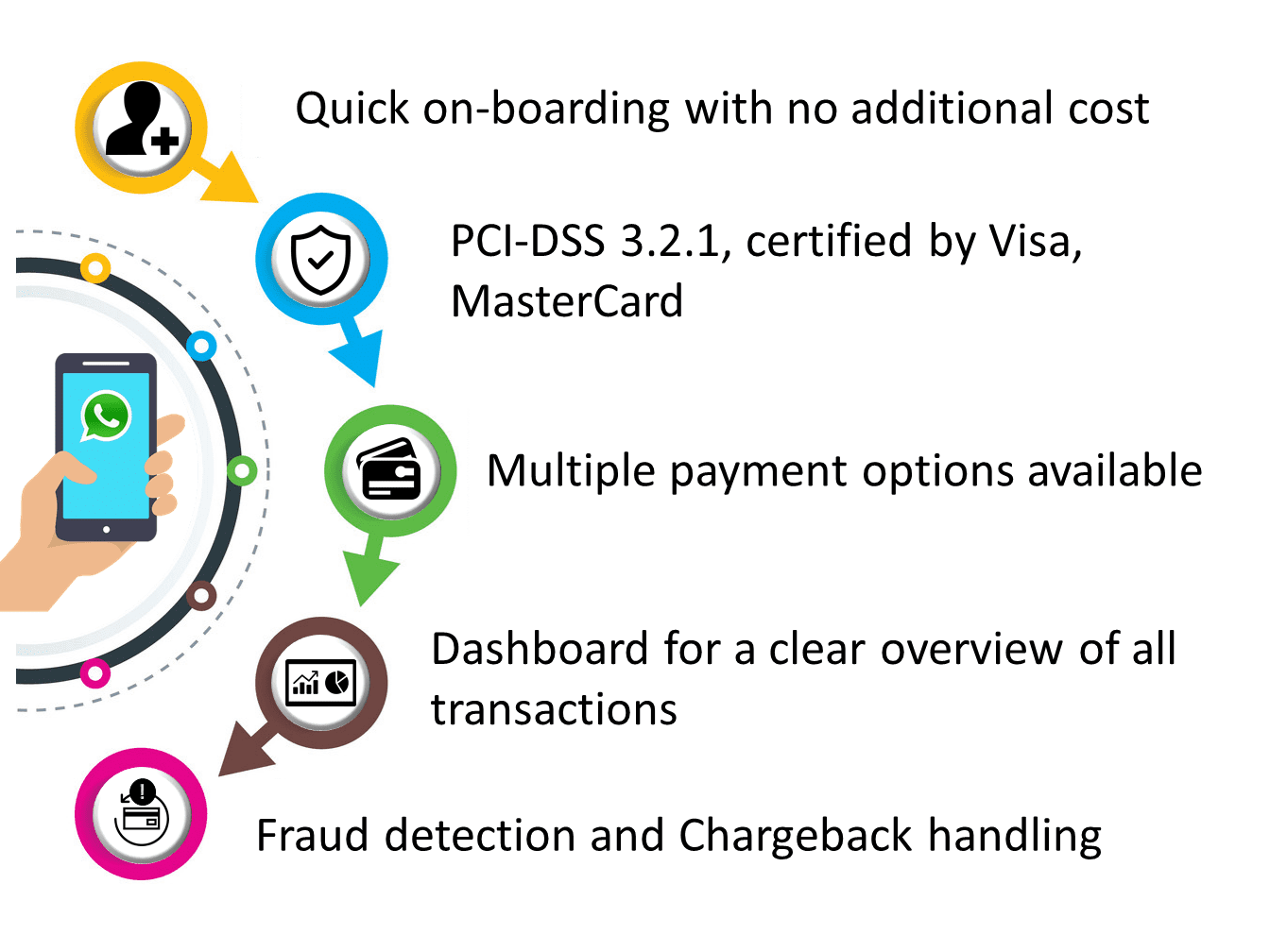

Lyra’s EPOS(Electronic Point Of Sale) sits right inside the merchant’s mobile and eliminates any need for bulky and expensive physical hardware for accepting payments.

Lyra’s EPOS can be considered as the best mobile payment app. Here’s why!!

Why small businesses should use Lyra EPOS:

Best Epos App for 2020

If you are looking for an alternative to a bulky POS, Lyra EPOS app is a great fit for you. Many small businesses are worried about the cost and...

Lyra WhatsApp Payment Solution:

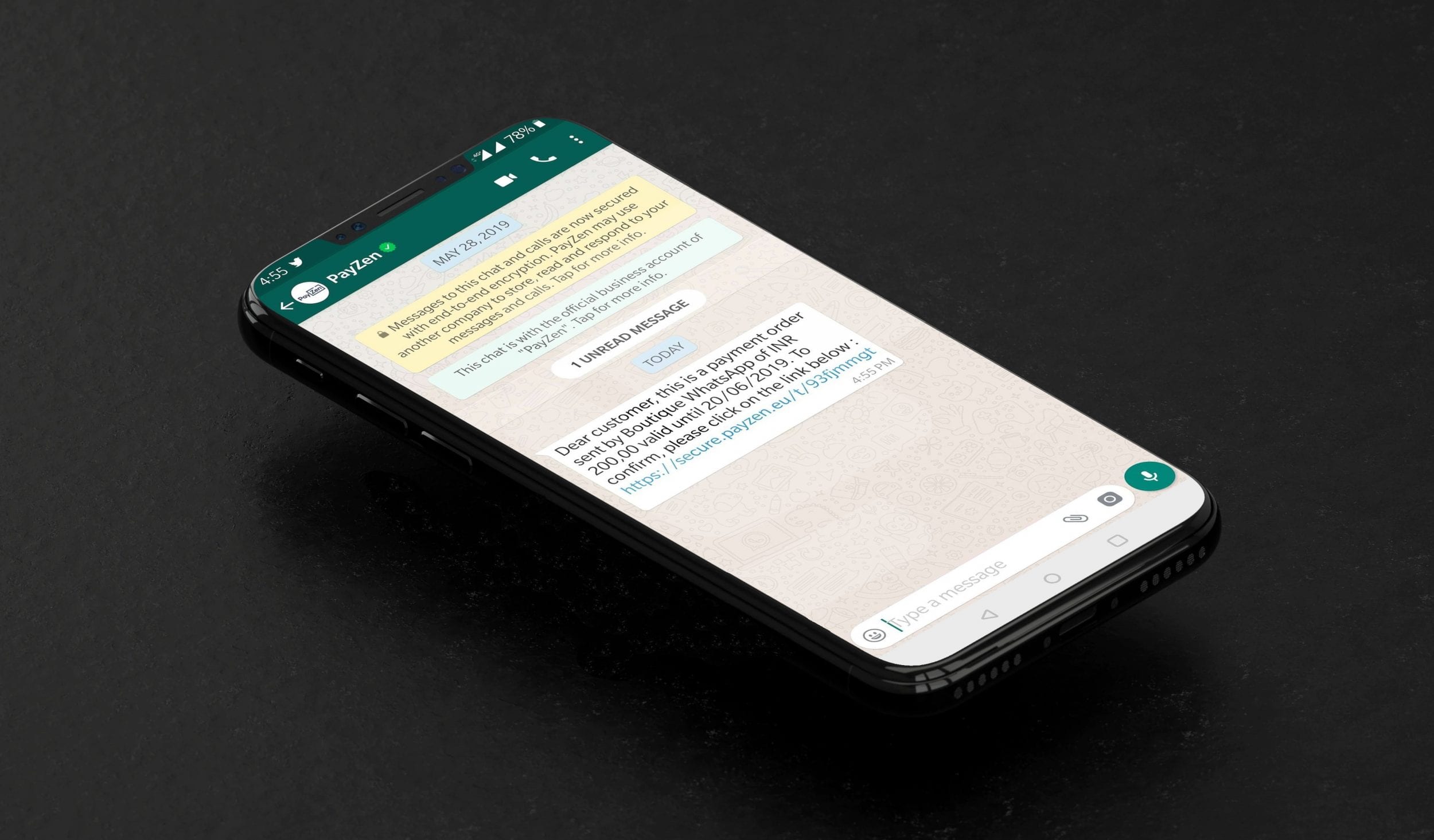

For the first time in India Lyra is offering payment collection via WhatsApp.

Many small businesses use WhatsApp to expand the customer base and to engage with customers. It is considered to be a great messaging application. So, wouldn’t it be beneficial if as a business owner you can start accepting payments via Whatsapp? Just imagine how convenient it would be for you as well as for your customers!

With a direct partnership for payments with WhatsApp, It is Lyra’s objective to help small businesses achieve smooth and seamless online payments

Should small businesses use WhatsApp payment solutions to accept digital payments? The answer is undoubted YES, and here is why!

Online mobile payment acceptance via WhatsApp provides a standalone business solution where merchants can connect with their customers, promote products, accept online payments along with, customer experience assessment, creating a follow-up driving their business growth to higher levels, and overcome online payments acceptance challenges.

Here are the features of WhatsApp payment Solution

What is Whatsapp Payments & its top 9 features

For the first time in India Lyra has introduced an extremely convenient and on-the-spot online payment collection solution – Lyra WhatsApp Payment...

Want us to guide you to chose the best mobile payment solution for your business

Read here about fintech news and updates