While setting up a fully functional online store/ eCommerce website, you have to make sure that the online store enables online payments from your customers.

Selecting the right type of payment method is essential and a critical task for eCommerce.

There are different types of payment methods and they vary from business to business. You have to figure out which payment method will suit the nature of your business and at the same time appeal to your customers.

Long gone are the days where only cash was used for accepting payments. Thanks to technology, there are various instant payment methods available. Also with new players like UPI, mobile payments, mobile wallets, etc. payment space is shifting more towards the digital side.

No doubt, it is important to choose a payment method that is suitable for your business, but you also have to consider other affecting factors. One of which is customer interaction.

People nowadays are using more that one online payment method. They are trying to tailor the application and method as per their convenience.

And that’s the main reason, an eCommerce site should provide more than one payment method. By enabling different payment methods, your online store can enhance the opportunities of conversion.

Here is the list of some payment methods for your e-commerce business.

Types of Payment Methods for ECommerce

Credit/Debit card payments:

As a global payment solution, by enabling payment acceptance via cards merchants can reach out to an international market.

Credit cards are simple to use and secure. The customer just has to enter the card number, expiry date, and CVV, which has been introduced as a precautionary measure. The CVV helps detect fraud by comparing customer details and the CVV number.

Debit cards are considered the best payment method for e-commerce transactions.

Debit cards are usually preferred by customers who shop online within their financial limits. The main difference between credit and debit card is with a debit card one can only pay with the money that is already in the bank account, whereas in the case of a credit card, the spent amount is billed, and payments are made at the end of the billing period.

Prepaid card payments:

They usually come in different stored values and the customer has to choose from them. Prepaid cards have virtual currency stored in them. Though the adoption rate of prepaid cards is low, they are gradually becoming popular for certain niche categories.

Bank transfers:

Though not popular nowadays but still bank transfer is considered as an essential payment method for eCommerce.

It is considered as ‘if all else fails’ kind of payment method. Some of the eCommerce stores are also keen on using bank transfer payment options.

It is a simple way of paying for online purchases and does not require the customer to have a card for payment purposes

E-Wallets:

E-wallet is one of the upcoming trends which gives a new shopping experience altogether. The use of e-wallets is becoming popular at an alarming rate.

E-Wallets require a sign up from merchants as well as customers. After creating an e-wallet account and linking it to the bank account they can withdraw or deposit funds.

The whole procedure with an e-wallet is easy and fast. Considered as an advanced and instant digital payment method, e-wallets can be integrated with mobile wallets using advanced functionalities like NFC.

Prepaid e-wallet accounts store customer information and multiple credit/ debit cards and bank accounts. It needs one-time registration and eliminates the need for re-entering information every time while making payments.

Cash:

Let’s face it, in India cash is the king. For eCommerce, it comes in the form of the cash-on-delivery option.

Cash is often used for physical goods and cash-on-delivery transactions. It does come with several risks, such as no guarantee of an actual sale during delivery, and theft. Though nowadays, cash on delivery does not necessarily mean customers pay with cash (they can use cards, mobile payments as payment terminals are often available with delivery agents), missing out on this is a strict NO.

Mobile payments:

Payment acceptance was no exception for mobile penetration.

This digital payment solution offers a quick solution for customers. To set up a mobile payment method, the customer just has to download software and link it to the credit card.

As eCommerce is becoming mobile mainstreamed, customers are finding it more convenient to use mobile payment options.

Lyra, Accompanying You to Offer Secure Online Payments

21/06/2021Secure Online Payments Accepting online payments is becoming a requisite for businesses thanks to the pandemic. These unavoidable circumstances...

Cryptocurrencies:

Though not popular yet, cryptocurrencies are rapidly but surely gaining a spot as a favorable payment method, particularly with genZ.

Ecommerce payment gateway:

What is an eCommerce payment gateway?

An eCommerce payment gateway is an essential tool for processing the online payment. They process payment information for different websites integrated with them. The payment gateway generates a link between the customer and the bank.

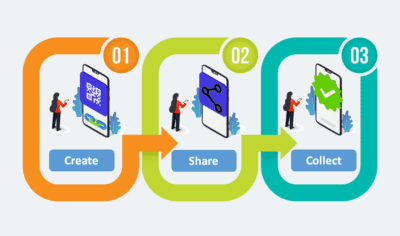

Use of eCommerce payment gateway:

The quick and hassle-free checkout: One of the issues for an e-commerce business is cart abandonment, which often happens at checkout.

According to a survey, more than 70% of customers abandon the cart without making the purchase. A good payment gateway makes the process simple to capture most of the sales.

E-commerce payment gateway makes the checkout process easy for customers. An eCommerce payment gateway must make the checkout experience convenient and provide necessary payment methods for customers to choose from.

What is Payment Gateway and How does it Work

What is Payment Gateway? A payment gateway is an online payments service that, when integrated with the e-commerce platform, is devised as the...

Offers secure online payments:

Payment gateway processes financial data and has encryption and security features to keep the customer’s data safe.

Why Propose Multiple Online Payment Methods?

As discussed, the cart abandonment issue is one of the problems in the eCommerce business. And one of the reasons is the lack of a preferred payment method.

Customers prefer a payment method that suits their needs. If that digital payment method is unavailable, they can and will abandon the cart and look for an alternative option.

Enabling different payment methods makes a better customer experience and if one of the options failed customers would not feel stuck. It gives the customer the freedom to explore other options and get the best deal. Multiple payment methods provide a more seamless experience and increase online purchase orders.

Guide to Choose the Best Online Payment Solution for Your Business

Every business has different long and short-term needs. Choosing the right online payment solution that supports those unique needs can be...

If you can’t collect an online payment in today’s day and age, then what’s the use of your eCommerce site?

Though your customers may not have similar preferences when it comes to choosing the payment method, you have to offer them alternatives to boost your sales.

Most of the payment methods are simple to integrate d simple to use. Customers prefer dia digital experience throughout the shopping and offering digital payment methods will without a doubt increase your conversion rate. The more options you have more will be the profit.

There is a wide range of online payment methods to choose from. But before choosing you to have to understand business needs, how each option works, and how it would be beneficial for you.