How to Collect Payments in Travel and Tourism Business

Collecting payments was never so easy

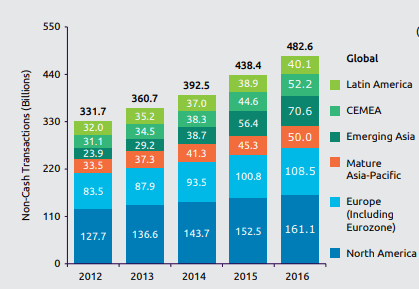

Mobile devices are an essential part of the travel journey today.

Integrated perfectly in travel and tourism experience, travellers use mobile devices from arranging a ride to the airport to paying tickets.

So, it’s inevitable that number of service providers are implementing mobile payment options. But this makes acquiring payments a hectic job for travel and tourism service owners as many of these require physical hardware or a third party application and some of them are a little difficult to operate and understand.

Businesses want payment collections to happen on the spot and more conveniently.

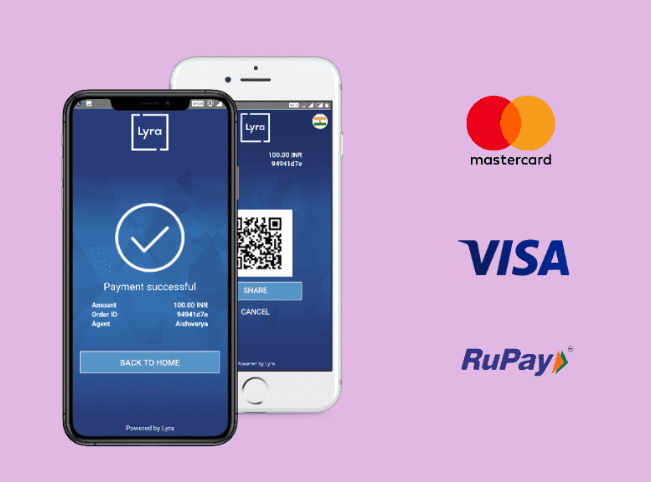

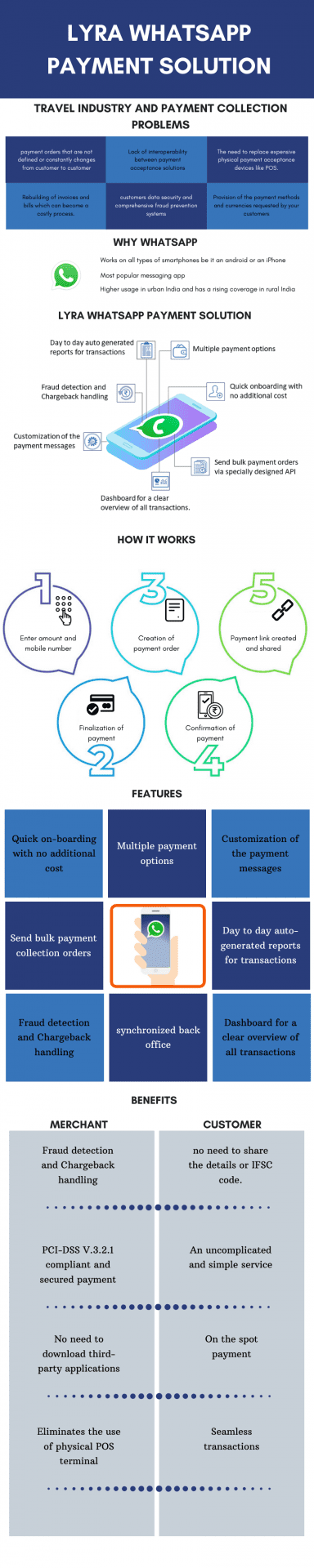

So, with this simple goal, Lyra network has introduced a convenient, on the spot payment solution – as convenient as sending a text message, a service for collecting digital payments through WhatsApp.

What is Whatsapp Payments & its top 9 features

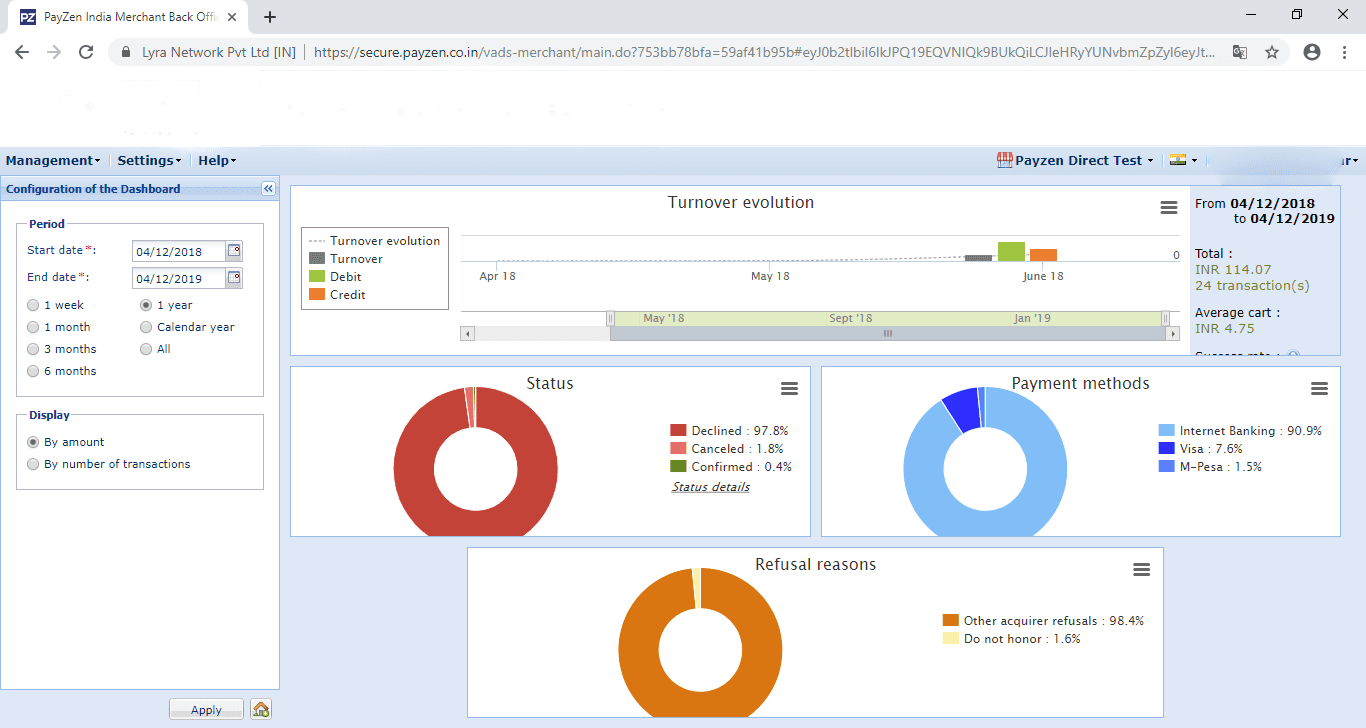

For the first time in India Lyra has introduced an extremely convenient and on-the-spot online payment collection solution – Lyra WhatsApp Payment...

WhatsApp Payment Solution – Payment collection made easy

WhatsApp Payment Solution aligns perfectly with the travel and tourism industry as it supports and enables mobility.

This service allows Travel & Tourism providers to remain in contact with travelers throughout their journey, creating the opportunity to build customer engagement and successfully scaling the business.

Lyra’s WhatsApp Payment collection option provides an integral, standalone business solution where merchants can connect with an individual as well as a group of customers, promote company and travel packages information, assess customer experience, create a follow-up and collect online payments driving business growth to higher levels and overcome online payments acceptance challenges.

Best Epos App for 2020

If you are looking for an alternative to a bulky POS, Lyra EPOS app is a great fit for you. Many small businesses are worried about the cost and...